- Walker & Dunlop reported its second quarter 2025 earnings in the past week, posting revenue of US$319.24 million and net income of US$33.95 million, both up from a year earlier.

- The company’s increase in earnings per share and continued dividend affirmations suggest a focus on shareholder returns alongside business growth.

- We’ll examine how Walker & Dunlop’s robust quarterly financial performance could influence its previously stated investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Walker & Dunlop Investment Narrative Recap

To invest in Walker & Dunlop, you have to believe in the long-term potential of the multifamily housing market and the firm's ability to leverage opportunities as transaction activity recovers. The recent earnings report, which showed strong revenue and profit growth, signals progress on this front and may help ease concerns about short-term revenue risks from client caution. However, the improvement does not materially reduce the biggest near-term risk: ongoing economic uncertainty and sensitivity to interest rate changes.

Among recent company updates, the new dividend declaration of US$0.67 per share stands out. This move highlights a continued emphasis on returning capital to shareholders despite a market climate where many peers are more guarded, reinforcing the company’s confidence in its stability and income prospects even as transaction volumes remain a central catalyst for future performance.

But while these results are encouraging, investors should also consider the risk that rising long-term interest rates could...

Read the full narrative on Walker & Dunlop (it's free!)

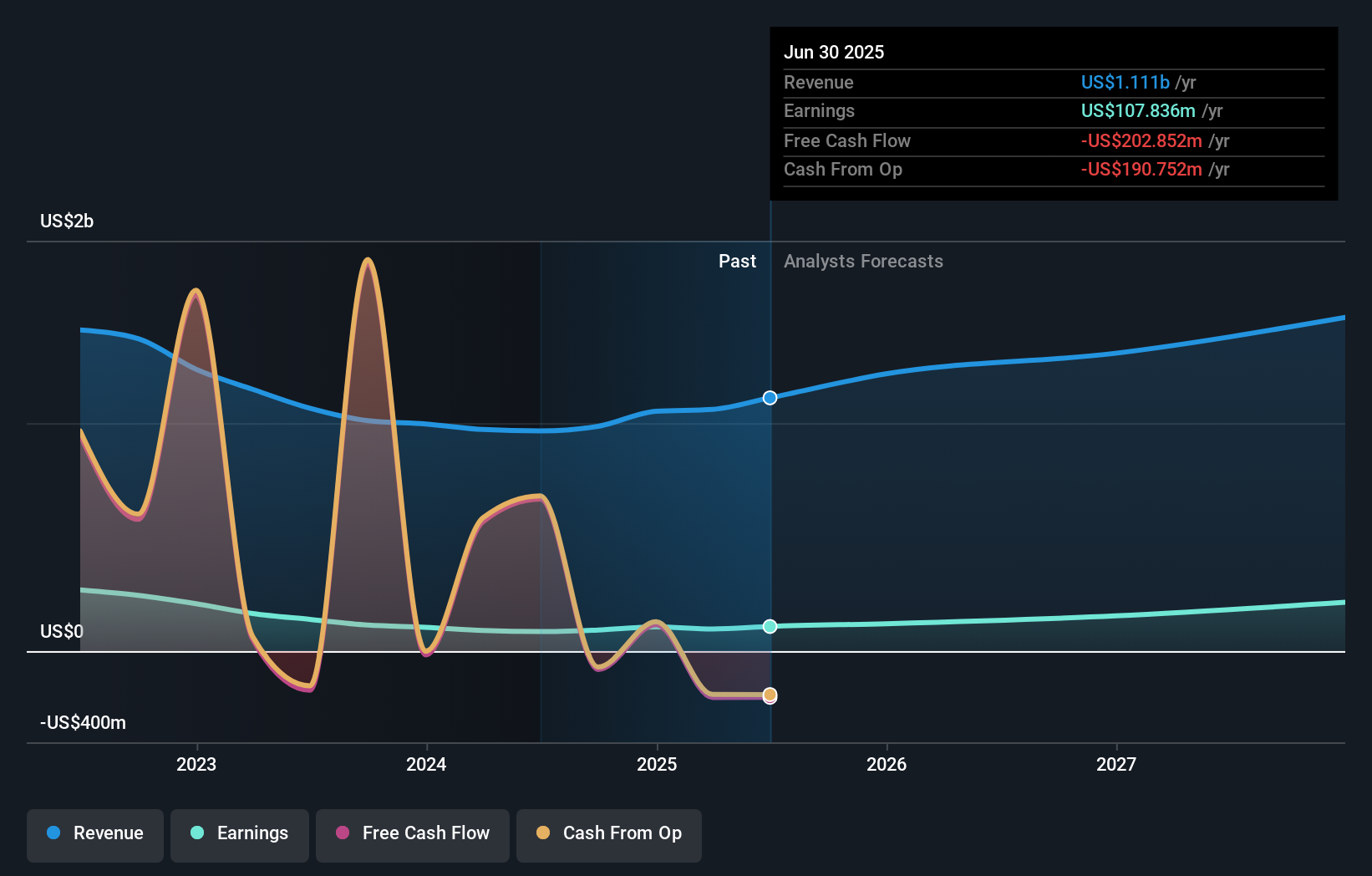

Walker & Dunlop's narrative projects $1.4 billion revenue and $210.7 million earnings by 2028. This requires 10.2% yearly revenue growth and an increase of $113.9 million in earnings from $96.8 million currently.

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Three different views from the Simply Wall St Community put Walker & Dunlop’s fair value anywhere from US$33.50 to US$92.50 per share. Amid this wide range of estimates, the company's recent earnings growth stands out as a potential signal for improved business momentum moving forward, but your take could differ, explore more viewpoints to decide for yourself.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth less than half the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com