- Vulcan Materials recently reported its results for the second quarter and first half of 2025, showing year-over-year increases in sales to US$2.10 billion and net income to US$320.9 million for the quarter.

- Interestingly, the company completed its long-running share buyback program but did not repurchase any shares in the most recent quarter.

- We'll examine how Vulcan's continued growth in sales and earnings impacts its longer-term investment thesis and forecasted profitability.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vulcan Materials Investment Narrative Recap

To own Vulcan Materials, you'd need to believe in a multi-year uptrend in US infrastructure and non-residential construction, providing sustained demand for aggregates. The company’s solid Q2 2025 results reinforce its positive narrative but the recent completion of its share repurchase program, without buying back shares this quarter, does not materially change the most important near-term catalyst, infrastructure spending, or the biggest short-term risk, which remains extreme weather in key Southeast markets.

The latest Q2 2025 earnings announcement, with both sales and net income rising year-over-year, stands out as the most relevant update, reinforcing Vulcan’s exposure to resilient infrastructure and public project activity. While ongoing public funding is buoying contract backlogs, the company’s earnings still face sensitivity to regional weather volatility and project timing, which could affect realized volumes and margin progression in the latter part of the year.

By contrast, investors should be mindful of continuing weather-related disruptions in core markets and how...

Read the full narrative on Vulcan Materials (it's free!)

Vulcan Materials is projected to reach $9.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook reflects an 8.1% annual revenue growth rate and a $541.9 million earnings increase from the current earnings of $958.1 million.

Uncover how Vulcan Materials' forecasts yield a $300.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

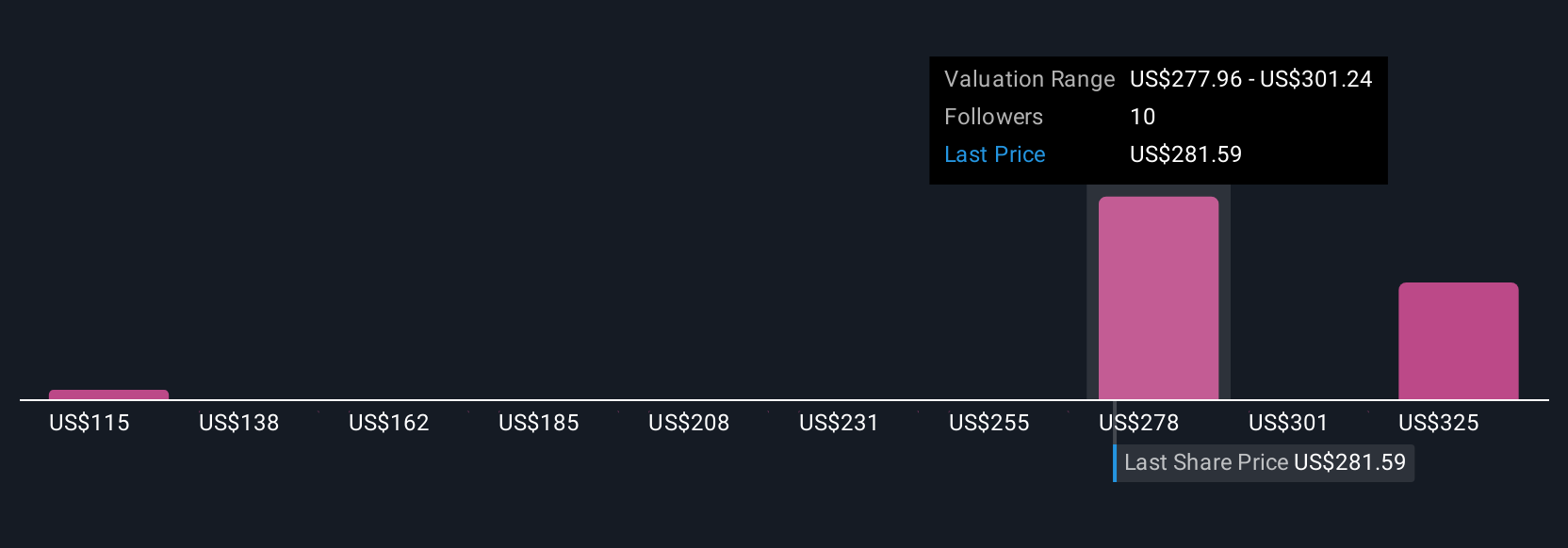

The Simply Wall St Community supplied three fair value estimates for Vulcan Materials, spanning from US$115 to US$344.81 per share. While many see upside in infrastructure-driven sales, some caution that regional weather volatility could limit the company's earnings momentum, making it vital to review a range of independent viewpoints.

Explore 3 other fair value estimates on Vulcan Materials - why the stock might be worth less than half the current price!

Build Your Own Vulcan Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com