- Littelfuse, Inc. recently appointed Dr. Karim Hamed as Senior Vice President and General Manager of its Semiconductor Business, and reported second-quarter sales of US$613.41 million and net income of US$57.34 million, both higher than the prior year. The company also raised its quarterly dividend and confirmed third-quarter sales guidance, underscoring management's confidence in current business trends.

- Dr. Hamed’s extensive semiconductor industry experience signals Littelfuse’s intent to accelerate innovation and operational performance within its fast-growing electronics and semiconductor segments.

- We'll examine how the arrival of Dr. Hamed could influence Littelfuse's trajectory within the evolving semiconductor landscape.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Littelfuse Investment Narrative Recap

To be a Littelfuse shareholder, you need to believe in the company's ability to execute a turnaround in its power semiconductor business while capturing secular growth from electrification trends and new electronics solutions. The recent appointment of Dr. Karim Hamed brings sector expertise that could boost execution, but for now, this change does not materially shift the near-term catalyst, improving semiconductor segment performance, or lessen the key risk of delayed demand recovery and rapid industry shifts.

Among recent corporate news, Littelfuse's confirmation of third-quarter sales guidance between US$610 million and US$630 million stands out. This guidance, issued alongside Dr. Hamed’s appointment, underlines management’s current confidence even as challenges in the semiconductor and power markets remain a central focus for investors tracking momentum in upcoming quarters.

But even with new leadership, investors should be aware that prolonged margin pressure in the electronics segment could...

Read the full narrative on Littelfuse (it's free!)

Littelfuse's narrative projects $2.9 billion revenue and $400.8 million earnings by 2028. This requires 8.6% yearly revenue growth and a $293.6 million earnings increase from $107.2 million today.

Uncover how Littelfuse's forecasts yield a $300.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

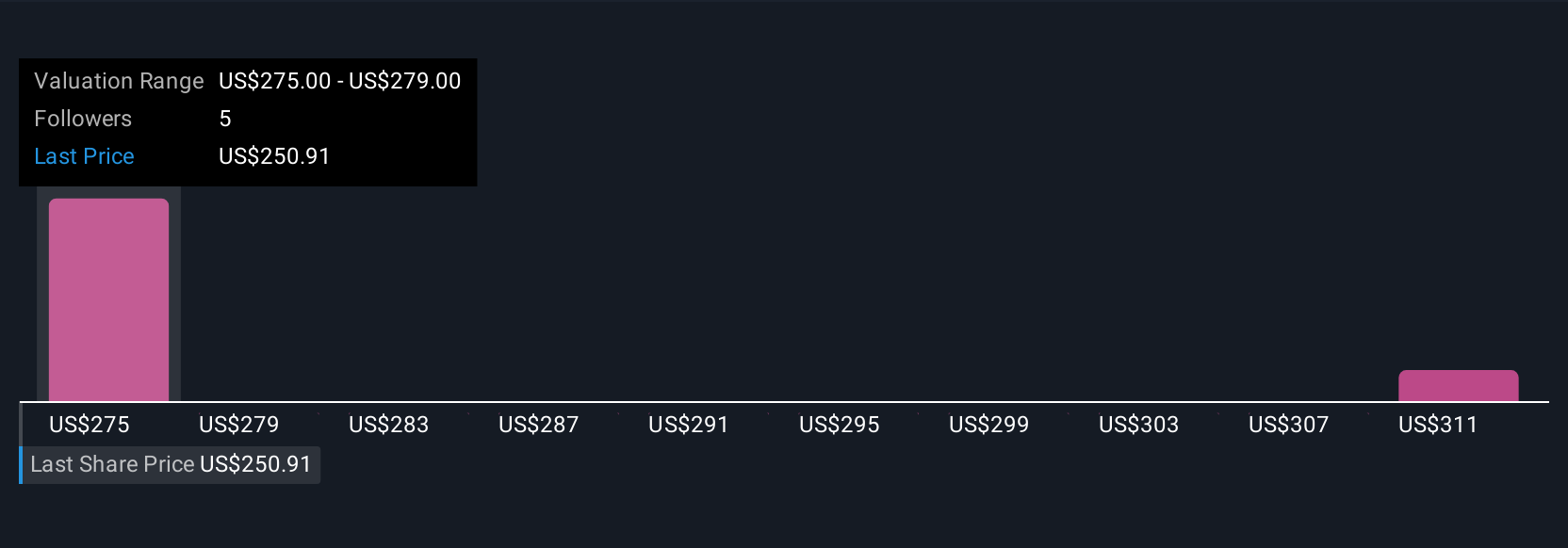

Simply Wall St Community members estimate Littelfuse’s fair value between US$292.78 and US$300, based on two independent forecasts. While earnings are forecast to grow faster than the market, contrasting views highlight how much performance expectations and uncertainty can shape outcomes, consider exploring these diverse viewpoints to inform your own perspective.

Explore 2 other fair value estimates on Littelfuse - why the stock might be worth as much as 20% more than the current price!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com