- Kulicke and Soffa Industries recently reported third quarter results, posting US$148.41 million in sales and a quarterly loss of US$3.29 million, but exceeded consensus expectations on adjusted earnings and revenue performance.

- The company also issued an optimistic revenue outlook for the fourth quarter and revealed it is winding down its Electronics Assembly equipment business to focus on core semiconductor opportunities.

- We’ll explore how management’s confidence in new order momentum and targeted business focus influences Kulicke and Soffa’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Kulicke and Soffa Industries' Investment Narrative?

Kulicke and Soffa Industries’ recent third quarter update signals an important crossroads for the business. On one hand, upbeat revenue guidance for the upcoming quarter suggests management is seeing order momentum at just the right moment as the company winds down non-core operations to sharpen its focus on semiconductors. This pivot aims to address a key short-term catalyst for shareholders: a return to top-line and earnings growth after a period of declining sales and profitability. The Q3 results, which exceeded adjusted analyst forecasts despite sharp year-on-year declines, could help rebuild short-term confidence, but the positive outlook is not without its risks. Ongoing margin pressure, the unpredictable impact of closing the Electronics Assembly business, and continued underperformance versus the broader semiconductor sector may weigh on sentiment. As a result, while the guidance lift is material and could shift expectations, it also raises the stakes if market conditions or execution stumble.

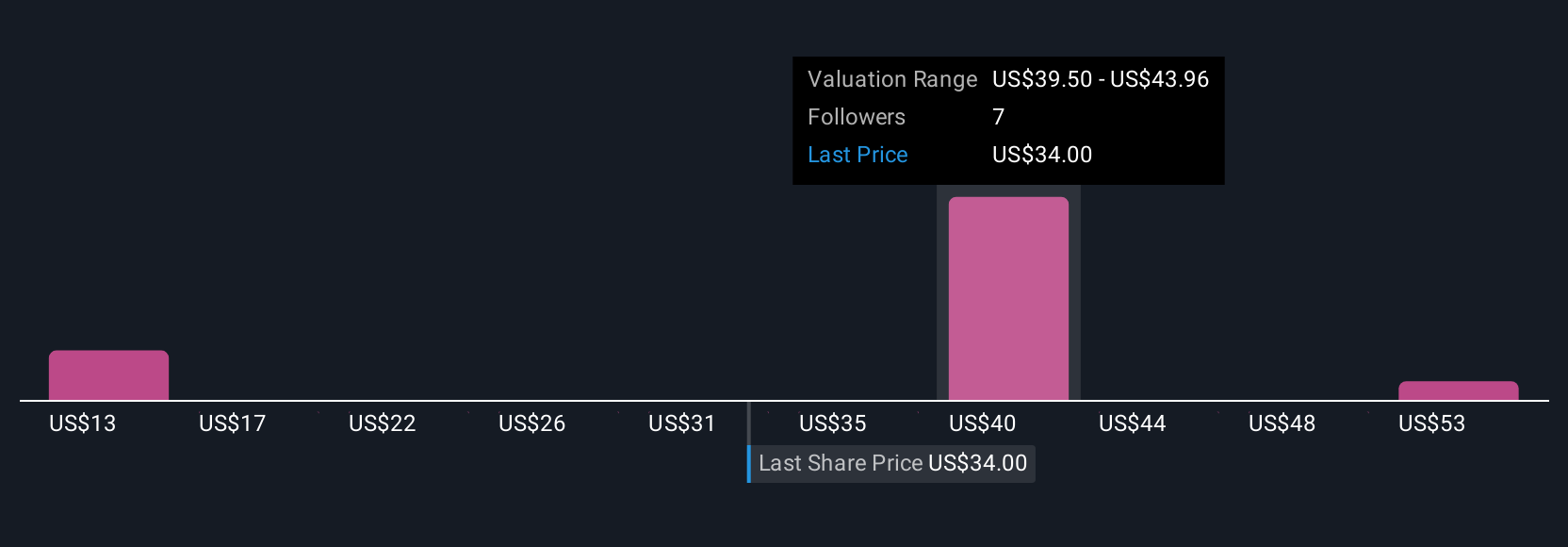

But, profit sustainability in the face of a recent business exit is a risk investors should watch. Kulicke and Soffa Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth as much as 62% more than the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com