- ResMed Inc. recently reported increased quarterly and full-year sales and net income, announced a quarterly cash dividend of US$0.60 per share, updated its share repurchase activity, and disclosed the departure of its chief commercial officer for the residential care software business, Bobby Ghoshal, who left to pursue another executive role in an unrelated industry.

- These developments highlight management's ongoing capital allocation discipline and confidence in long-term financial performance, supported by both reinvestment in the business and direct returns to shareholders.

- We'll examine how ResMed's stronger earnings and higher dividend inform its investment narrative, especially regarding shareholder returns and growth commitments.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ResMed Investment Narrative Recap

To be a ResMed shareholder, you need to believe in the company's ability to expand its leadership in sleep and respiratory health through both hardware and digital solutions, despite risks from price competition and changing healthcare reimbursement. Recent executive changes and ongoing capital returns do not appear to materially affect the looming risk that ongoing or renewed CMS bidding pressures could impact margins, nor do they accelerate the shift toward software-driven services, which remains a key catalyst.

Among the latest updates, ResMed's continued investment in tuck-in acquisitions stands out. Management reaffirmed its commitment to deploying capital on acquiring growth assets during the Q4 call, which is directly connected to the company's need to broaden its digital and home health offering, supporting a catalyst that could offset competitive and regulatory threats.

But beneath ResMed's robust headline numbers, investors should also keep in mind the less visible financial risks if reimbursement rules suddenly tighten...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion revenue and $1.9 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from $1.4 billion today.

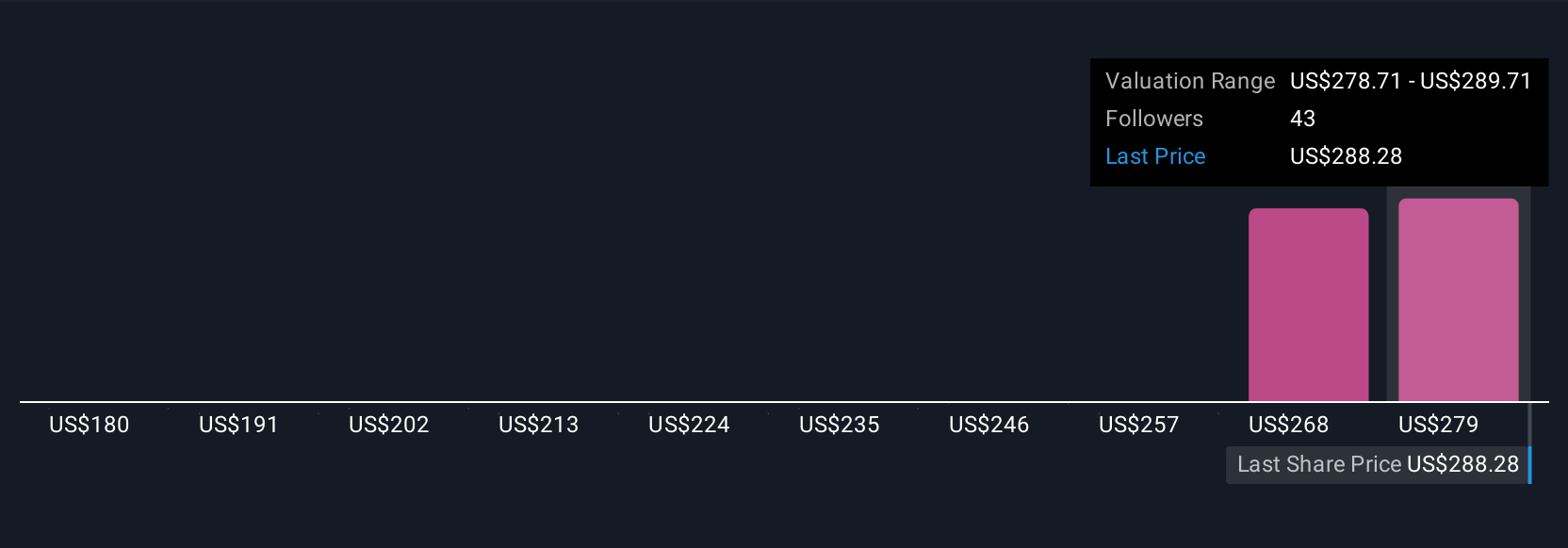

Uncover how ResMed's forecasts yield a $289.71 fair value, in line with its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community have independently estimated ResMed's fair value, ranging from US$179.72 to US$289.71. While opinions vary widely, many are closely watching how possible healthcare cost containment or stricter reimbursement policies could influence future returns and risk profiles, so make sure to consider a broad set of viewpoints.

Explore 7 other fair value estimates on ResMed - why the stock might be worth 37% less than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com