- 3M and the Kids In Need Foundation marked the grand opening of KINF’s new national headquarters and expanded Teacher Resource Center in Little Canada, Minnesota, earlier this month, celebrating a 30-year partnership focused on providing free classroom supplies to under-resourced educators and students.

- This initiative highlights 3M’s longstanding commitment to social responsibility, addressing widespread teacher out-of-pocket classroom spending and benefiting more than 1,000 local teachers at launch.

- We’ll explore how 3M’s expanded support for educators reinforces its reputation for corporate responsibility and what this could mean for its broader investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

3M Investment Narrative Recap

To be a shareholder in 3M, you need to believe in its ability to leverage operational efficiency and innovation to drive modest revenue growth and margin improvements, while successfully managing legal liabilities. The expanded partnership with the Kids In Need Foundation bolsters 3M's reputation for corporate responsibility, but it is unlikely to meaningfully shift the immediate outlook for margins or earnings that remain primarily shaped by ongoing legal and macroeconomic risks. This positive community initiative is a reminder of 3M’s stakeholder engagement, though the largest short-term catalyst continues to be cost optimization and legal resolution progress. Among the company’s recent announcements, the July update on successful share buybacks stands out, with over 12.7 million shares repurchased for nearly US$1.85 billion. While these capital returns reflect confidence in long-term value creation, they only partially mitigate investor focus on the pace of growth and execution on operational improvements. However, investors should also pay close attention to the lingering legal risks, especially surrounding PFAS-related claims and the potential for large, unpredictable settlements that...

Read the full narrative on 3M (it's free!)

3M's outlook projects $26.2 billion in revenue and $4.7 billion in earnings by 2028. This is based on an expected 2.1% annual revenue growth rate and a $0.8 billion increase in earnings from the current $3.9 billion.

Uncover how 3M's forecasts yield a $161.15 fair value, a 5% upside to its current price.

Exploring Other Perspectives

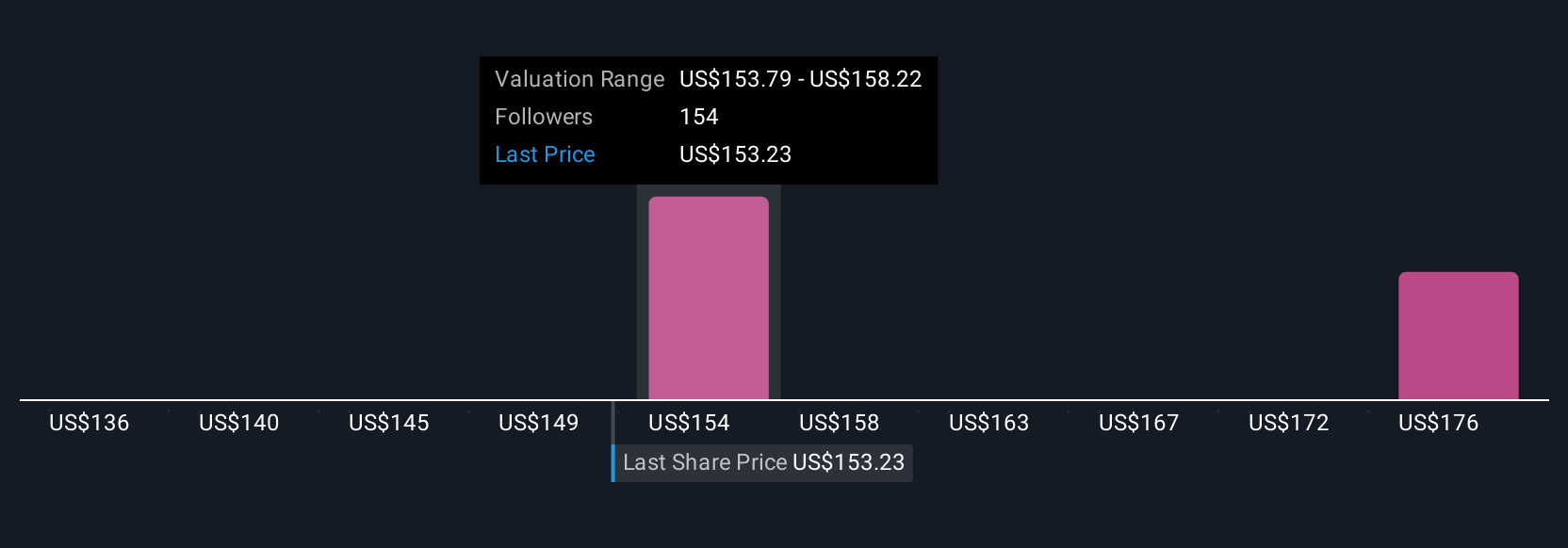

Simply Wall St Community members have set fair value estimates for 3M ranging from US$114.86 to US$167.63, based on 8 independent viewpoints. While opinions differ on upside potential, ongoing legal liability management continues to be a focal point with implications for future cash flow strength.

Explore 8 other fair value estimates on 3M - why the stock might be worth as much as 9% more than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com