- Zimmer Biomet Holdings, Inc. recently reported second-quarter earnings, with net sales rising to US$2.08 billion and adjusted earnings per share beating analyst expectations, driven by strong performance in hip and knee portfolios and contributions from new product launches and acquisitions.

- An interesting insight is Zimmer Biomet raised its full-year 2025 revenue and profit guidance, citing reduced tariff headwinds, higher demand, and confidence in its innovation pipeline, including advancements in surgical robotics.

- We'll explore how Zimmer Biomet's raised financial guidance and strong hip and knee portfolio growth impact the company's investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Zimmer Biomet Holdings Investment Narrative Recap

To own shares in Zimmer Biomet Holdings, investors need to be confident in the company’s ability to drive growth through innovation in orthopedics, capitalize on strong hip and knee demand, and successfully integrate new acquisitions. The recent raised 2025 outlook and solid sales in core portfolios have sharpened focus on operating efficiency and new product cycles. While reduced tariff headwinds are a positive, muted basic earnings and ongoing integration costs from recent deals remain key risks for near-term profitability.

Zimmer Biomet’s completion of the Paragon 28 acquisition stands out, expanding its S.E.T. (Sports Medicine, Extremities, and Trauma) business into the high-growth foot and ankle market. This move is directly relevant to ongoing sales and margin catalysts, supporting the company’s revised revenue goals and helping offset external cost pressures.

Yet, against these positive signals, investors should not ignore significant headwinds like ongoing integration costs from recent acquisitions, especially as...

Read the full narrative on Zimmer Biomet Holdings (it's free!)

Zimmer Biomet Holdings' projections show revenue reaching $9.1 billion and earnings totaling $1.3 billion by 2028. This outlook is based on an assumed 5.6% annual revenue growth rate and a $386.6 million increase in earnings from the current $913.4 million.

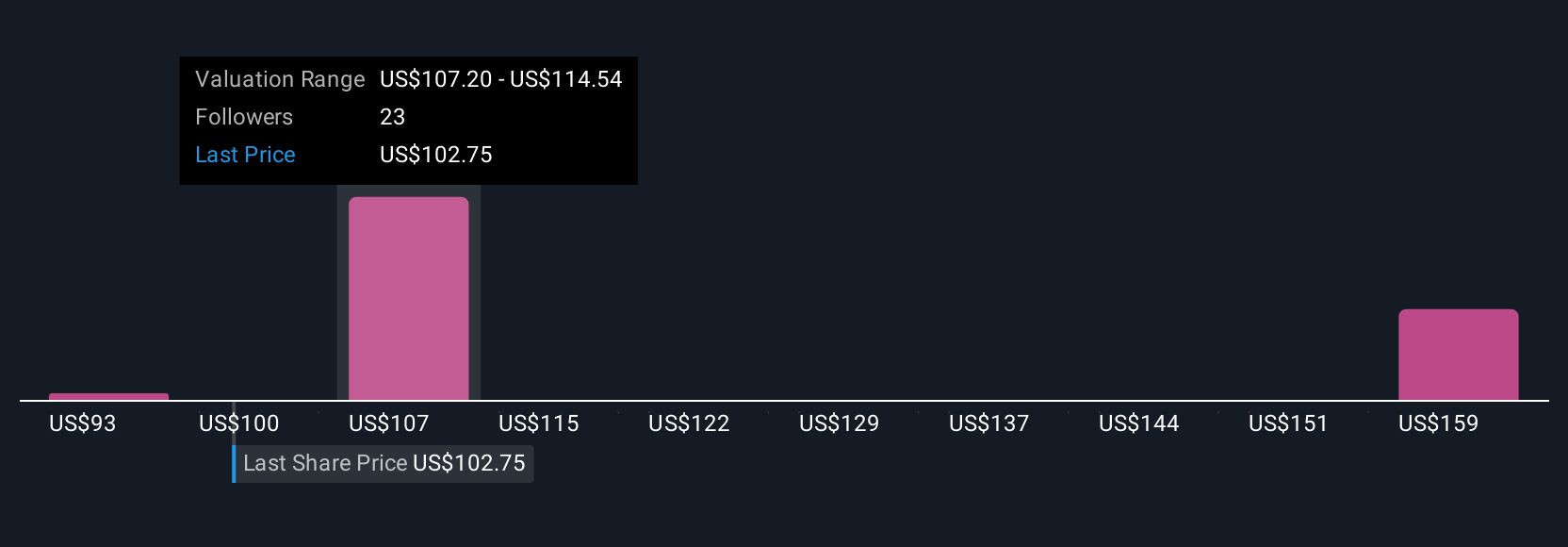

Uncover how Zimmer Biomet Holdings' forecasts yield a $107.79 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community range between US$92.52 and US$165.60. While members see different potential in Zimmer Biomet, risks such as integration costs after acquisitions could weigh on financial flexibility and future returns.

Explore 4 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth 7% less than the current price!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com