- Acadia Healthcare Company recently reported its second quarter 2025 results, revealing revenue of US$869.23 million, a 9.2% increase year-over-year, but also a sharp decline in net income and profit margins alongside updated annual guidance and a CFO transition.

- This mix of strong top-line growth, higher expenses impacting earnings, and an executive change highlights persistent growth opportunities but introduces questions around cost control and financial leadership.

- We'll look at how Acadia's strong revenue performance amid leadership changes could shift views on its investment narrative and future growth prospects.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Acadia Healthcare Company Investment Narrative Recap

To be a shareholder in Acadia Healthcare, you need confidence that the company can convert rising demand for behavioral health into consistent revenue growth despite cost pressures and execution risk from rapid facility expansion. The latest updates, showing strong revenue gains but sharply lower net income and a CFO transition, do not materially alter the near-term catalyst of growth through new facility openings, but highlight the rising risk of margin compression if expense management falters.

Among recent developments, the CFO change stands out: Timothy Sides, previously Senior Vice President of Operations Finance, has been appointed interim CFO while a nationwide search for a permanent replacement is conducted. Leadership transitions at the finance level can impact short-term perceptions regarding cost discipline, especially as the company juggles expansion, capital needs, and a challenging profit backdrop.

Yet, behind the headline growth numbers, investors should not overlook the growing pressure from higher expenses and how this could affect...

Read the full narrative on Acadia Healthcare Company (it's free!)

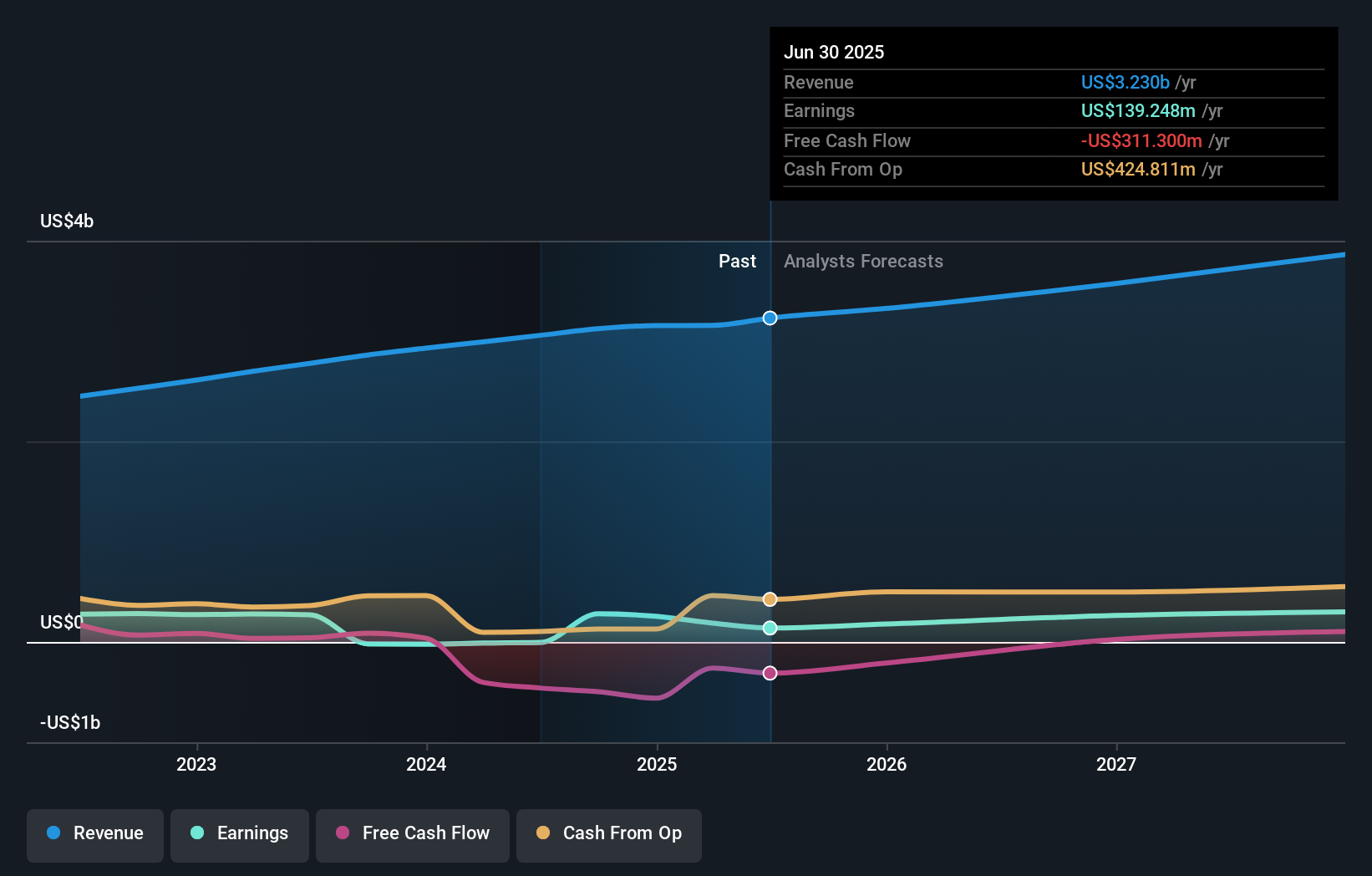

Acadia Healthcare Company's outlook estimates $4.1 billion in revenue and $325.4 million in earnings by 2028. This is based on an annual revenue growth rate of 8.3% and an increase in earnings of $186.2 million from the current $139.2 million.

Uncover how Acadia Healthcare Company's forecasts yield a $33.21 fair value, a 73% upside to its current price.

Exploring Other Perspectives

One fair value estimate from the Simply Wall St Community pegs Acadia Healthcare at US$33.21, well above the recent market price. Still, concerns about expense escalation and declining margins remain top of mind for many, shaping competing views of the company’s outlook.

Explore another fair value estimate on Acadia Healthcare Company - why the stock might be worth as much as 73% more than the current price!

Build Your Own Acadia Healthcare Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadia Healthcare Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Acadia Healthcare Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadia Healthcare Company's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com