- Pure Storage recently reported an 11% revenue increase and a 32% jump in earnings per share over the past year, alongside $941 million in insider holdings indicating leadership alignment with shareholders.

- The company has scheduled its second quarter fiscal 2026 earnings call for August 27, 2025, and will offer further insights at its Product & Technology-Focused Meeting for analysts during Pure//Accelerate NYC in late September, shaping expectations for its future direction.

- We'll examine how Pure Storage's strong earnings growth and leadership's high insider ownership inform the company's investment narrative moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Pure Storage Investment Narrative Recap

Pure Storage appeals to shareholders who believe in its ability to turn strong revenue and earnings growth into sustainable profitability, despite pricing and product cycle risks. While the recent announcement of 11% revenue growth and a 32% jump in earnings per share underscores performance momentum, these results do not appear to fundamentally change the immediate importance of margin pressures linked to fluctuating NAND prices or the critical short-term catalyst of expanding major hyperscaler deployments. Investors should continue to weigh the balance between margin resilience and top-line expansion as central to Pure Storage’s narrative.

The company’s collaboration with SK hynix, aimed at joint QLC flash storage development, stands out in light of these ongoing catalysts. This move addresses demand from data-intensive hyperscaler environments and could support Pure Storage’s efforts to offset margin risk by scaling high-capacity flash storage solutions, which remains a focal point for near-term performance given current industry trends and competitive dynamics. Yet, even as Pure Storage pursues growth in new high-density markets, one looming concern remains...

Read the full narrative on Pure Storage (it's free!)

Pure Storage's narrative projects $4.7 billion revenue and $569.8 million earnings by 2028. This requires 12.7% yearly revenue growth and a $442 million earnings increase from $127.8 million currently.

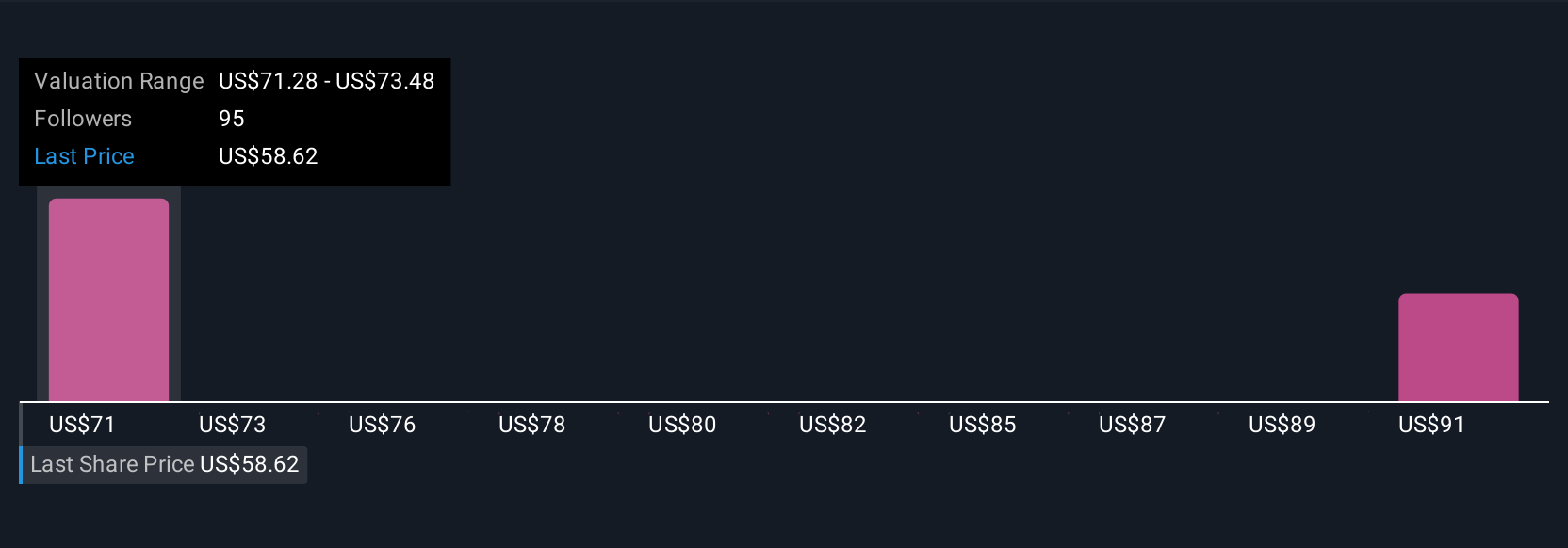

Uncover how Pure Storage's forecasts yield a $71.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members see Pure Storage’s fair value spread across a wide US$71 to US$93.37 range. Product cost pressures, especially around NAND pricing, remain a key watchpoint as you consider these diverse views on future performance.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth just $71.00!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com