- In the past week, Keysight Technologies announced that Fortinet selected its BreakingPoint QuickTest solution to validate the security and performance of the FortiGate 700G firewall, and also delivered a 1,000-Qubit Quantum Control System to Japan's National Institute of Advanced Industrial Science and Technology.

- These partnerships not only highlight Keysight's role in advancing cybersecurity solutions and quantum computing infrastructure but also reinforce its reputation for innovation and reliability among global technology leaders.

- We'll explore how Keysight's expanded client engagements, particularly in quantum computing, influence the company's overall investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Keysight Technologies Investment Narrative Recap

To be a Keysight Technologies shareholder, you need confidence that the company's ability to drive demand through innovation in advanced infrastructure, such as AI-driven networks and quantum computing, will outweigh near-term pressures from cyclical slowdowns and margin risks. The latest partnerships in cybersecurity and quantum control reinforce Keysight's reputation but do not fundamentally shift the most important short-term catalysts or the principal risk, execution on margin protection amid tariffs and end-market volatility, at this time.

The Fortinet win stands out as most relevant, highlighting how Keysight’s core expertise in network and security performance testing remains vital for mission-critical deployments. This directly supports the company's value proposition to high-growth customers, yet also means that sustained success depends on maintaining a technological edge as cybersecurity and performance requirements rapidly evolve.

However, despite these growth drivers, investors should also keep in mind that if tariff mitigation efforts fall short or if global supply chain pressures intensify, profit margins may face meaningful headwinds...

Read the full narrative on Keysight Technologies (it's free!)

Keysight Technologies is projected to reach $6.2 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and a $558 million increase in earnings from the current $742 million.

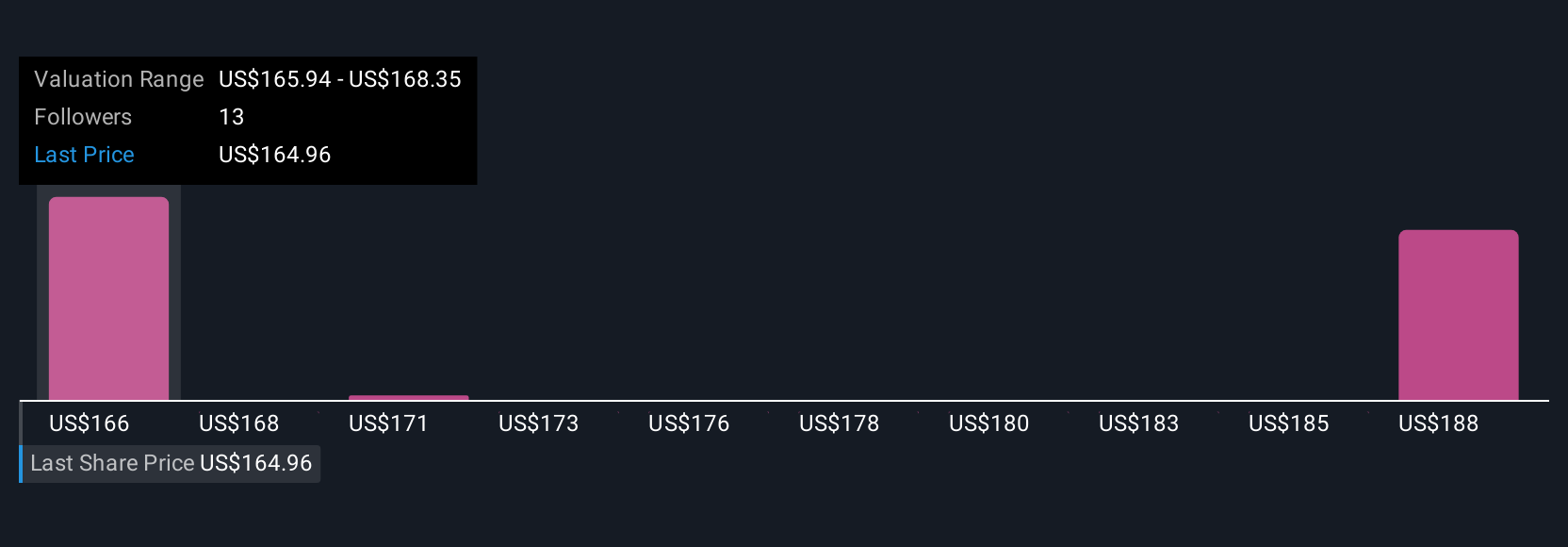

Uncover how Keysight Technologies' forecasts yield a $188.18 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span US$165.86 to US$190.01, reflecting varied outlooks among retail investors. Many remain focused on the challenge that escalating tariffs and execution on cost mitigation could have on margin improvement, inviting you to compare different views and assumptions.

Explore 4 other fair value estimates on Keysight Technologies - why the stock might be worth just $165.86!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com