- In August 2025, Agilent Technologies introduced three new Dako Omnis instruments, the 110, 165, and 165 Duo, expanding its solutions for pathology labs of all sizes with tailored, scalable staining systems.

- This launch marks a shift from a single-solution approach to a flexible, portfolio-based offering that allows laboratories to customize workflows based on specific volume and diagnostic needs.

- We'll explore how this expanded Dako Omnis product line could shape Agilent Technologies' future market positioning and investment outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Agilent Technologies Investment Narrative Recap

To be a shareholder in Agilent Technologies, you need to believe in the company's ability to innovate and expand its life sciences and diagnostics solutions, while maintaining stable revenue growth amidst a competitive environment. The August 2025 launch of the three new Dako Omnis instruments enhances Agilent's pathology portfolio, allowing for greater workflow customization in labs, but is unlikely to immediately shift the main catalysts, such as digital transformation and margin expansion, or address headwinds like currency fluctuations or exposure to China.

Of Agilent’s recent announcements, the enhancements to the Agilent 8850 Gas Chromatograph in May 2025 stand out as particularly relevant. This underscores Agilent’s broader push towards operational efficiency and product refresh cycles in core instrumentation, aligning with ongoing efforts to drive revenue growth and improve customer retention, though the pace and consistency of product replacement remains a variable for earnings stability.

In contrast, investors should also be conscious of financial risks associated with U.S. federal budget uncertainty, which could...

Read the full narrative on Agilent Technologies (it's free!)

Agilent Technologies is projected to reach $7.8 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.7% and an increase in earnings of $0.5 billion from the current $1.2 billion level.

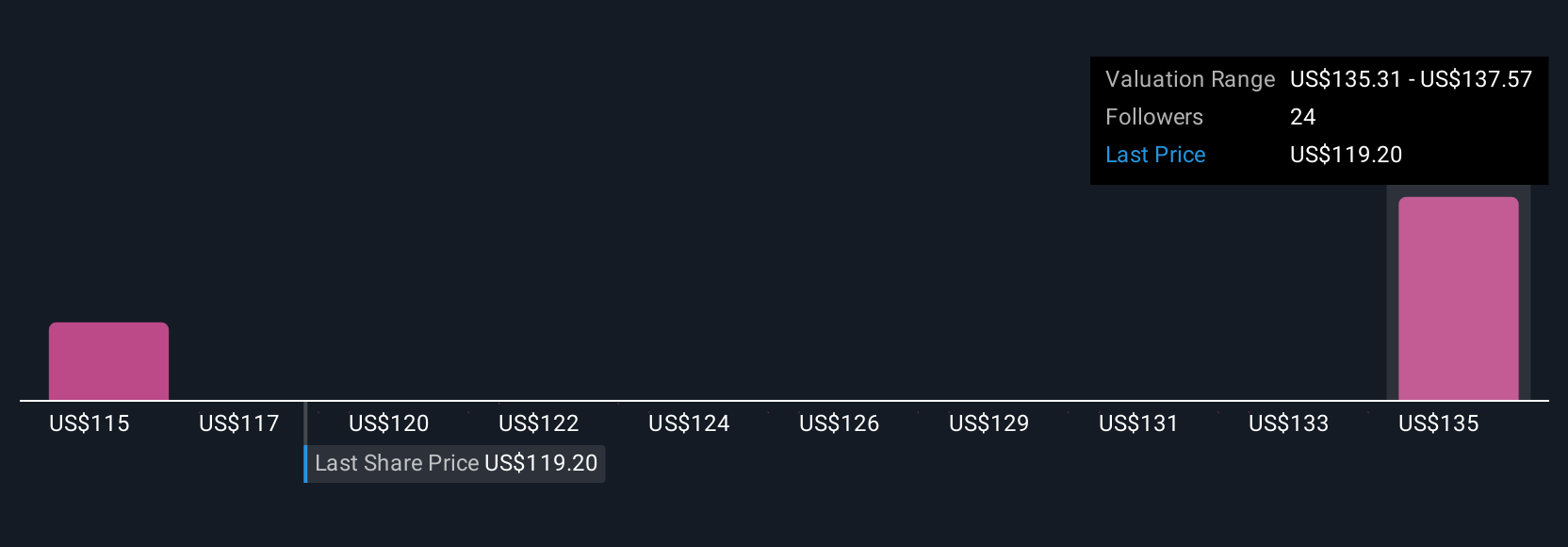

Uncover how Agilent Technologies' forecasts yield a $136.95 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community set Agilent’s fair value between US$108.54 and US$136.95. While you weigh these perspectives, remember currency headwinds remain a challenge and can affect near-term profitability.

Explore 4 other fair value estimates on Agilent Technologies - why the stock might be worth 5% less than the current price!

Build Your Own Agilent Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilent Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Agilent Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilent Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com