- Novanta Inc. recently reported its second quarter 2025 financial results, which included a 2% increase in GAAP revenue to US$241.05 million and a GAAP net income of US$4.5 million, along with confirmation of guidance for continued revenue growth and a focus on acquisitions.

- Management emphasized a strong acquisition pipeline, ongoing outperformance of the Kion Technologies acquisition, and plans to further pursue larger, high-growth opportunities in medical and robotics markets as valuations become more attractive.

- We'll examine how Novanta's accelerated acquisition strategy, highlighted in the latest results, could influence its investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Novanta Investment Narrative Recap

To be comfortable owning Novanta stock, you need confidence that acquisitions will offset flat organic revenue growth and segment pressures, especially as the company leans into high-growth medical and robotics markets. The latest acquisition-focused guidance and management’s conviction in deal execution by year-end could meaningfully influence the most important short-term catalyst, filling the organic growth gap, but do not remove the risk that slow or poor acquisition integration could limit earnings recovery.

Of the recent announcements, Novanta’s expanded credit facility of approximately US$1.0 billion stands out, as it directly supports the acquisition pipeline discussed in the Q2 update. This increased financial flexibility aligns closely with management’s emphasis on larger, impactful deals as a key lever to drive future growth and potentially stabilize margins in the quarters ahead.

Yet, in contrast, investors should be aware that ongoing trade disruptions and muted China export orders continue to put at risk ...

Read the full narrative on Novanta (it's free!)

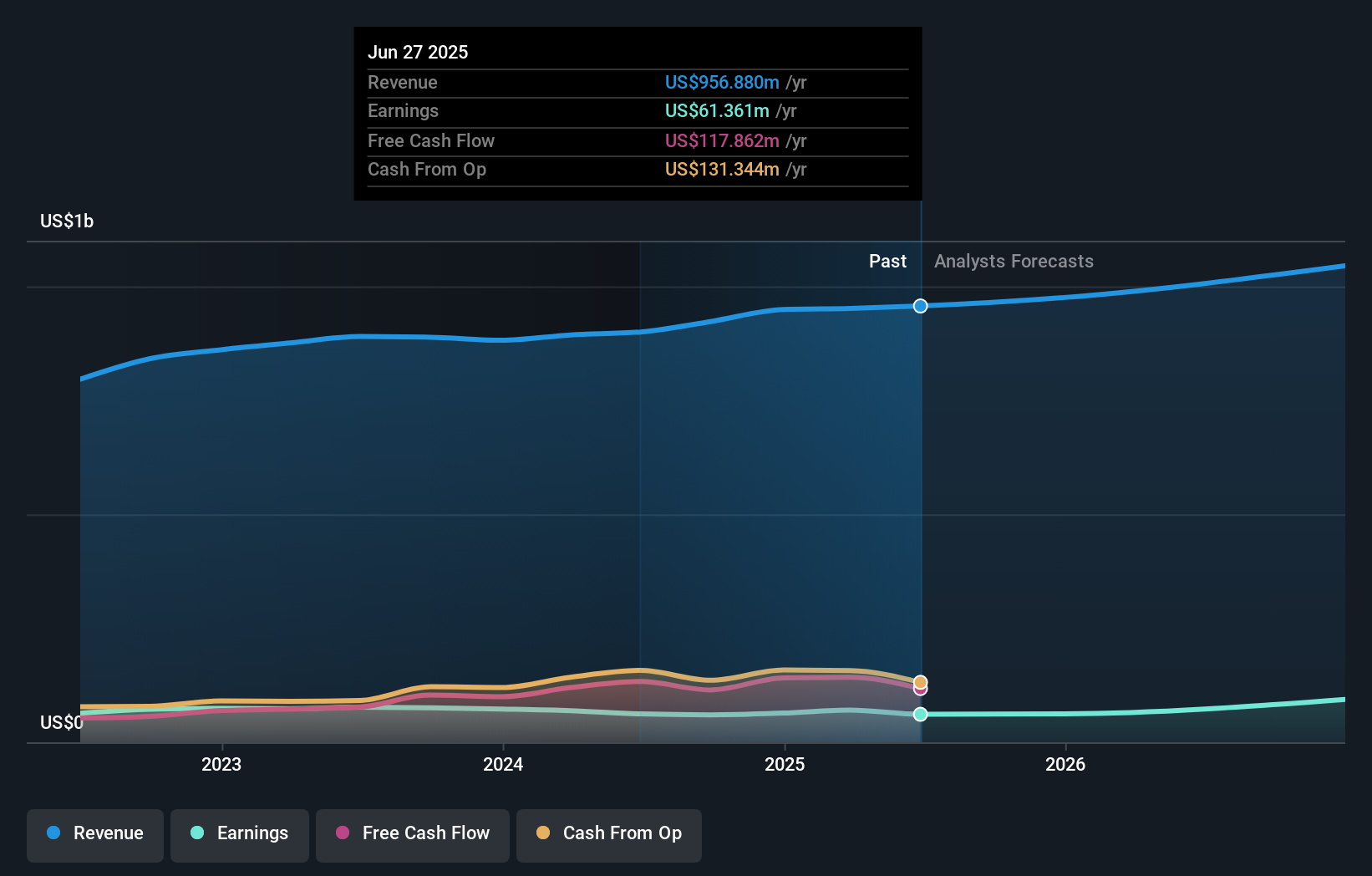

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 6.0% yearly revenue growth and a $73.9 million earnings increase from $61.4 million today.

Uncover how Novanta's forecasts yield a $144.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value for Novanta anywhere from US$37.79 to US$144.50, reflecting a wide divergence in their two estimates. With so much depending on the company’s success with acquisitions, you can see how different views on future growth make a big impact on expectations.

Explore 2 other fair value estimates on Novanta - why the stock might be worth as much as 25% more than the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com