- Eastman Chemical Company reported second-quarter 2025 results, showing a decrease in sales to US$2.29 billion and net income to US$140 million compared to the same period a year earlier, alongside an affirmed quarterly cash dividend of US$0.83 per share payable on October 7, 2025.

- In addition, the company completed a buyback tranche, having repurchased over 32.17 million shares since 2018, suggesting ongoing commitment to shareholder returns even as financial results showed year-over-year declines.

- With earnings and net income both declining over the prior year, let's examine how these results affect Eastman Chemical's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Eastman Chemical Investment Narrative Recap

To be a shareholder in Eastman Chemical, you need to believe in the company’s ability to strengthen its position in specialty and sustainable materials while navigating cyclical earnings and challenging end-market demand. The recent quarterly results, announcing declining sales and net income, have not materially changed the top short term catalyst, adoption of advanced recycling and sustainable products, but do highlight a continued risk of margin pressure from weak demand in sectors like automotive and construction.

Of the latest announcements, the earnings update is the most relevant, as it illustrates ongoing earnings volatility and the pressure Eastman faces amid shifting customer demand and tariffs. While the company’s focus on cost control and innovation remains, these results reinforce how sensitive Eastman's short-term outlook is to broader market trends and sector-specific risks. Despite this, investors should be aware that...

Read the full narrative on Eastman Chemical (it's free!)

Eastman Chemical's outlook anticipates $9.7 billion in revenue and $904.5 million in earnings by 2028. This scenario requires 1.4% annual revenue growth and an increase in earnings of $72.5 million from the current $832.0 million.

Uncover how Eastman Chemical's forecasts yield a $78.82 fair value, a 28% upside to its current price.

Exploring Other Perspectives

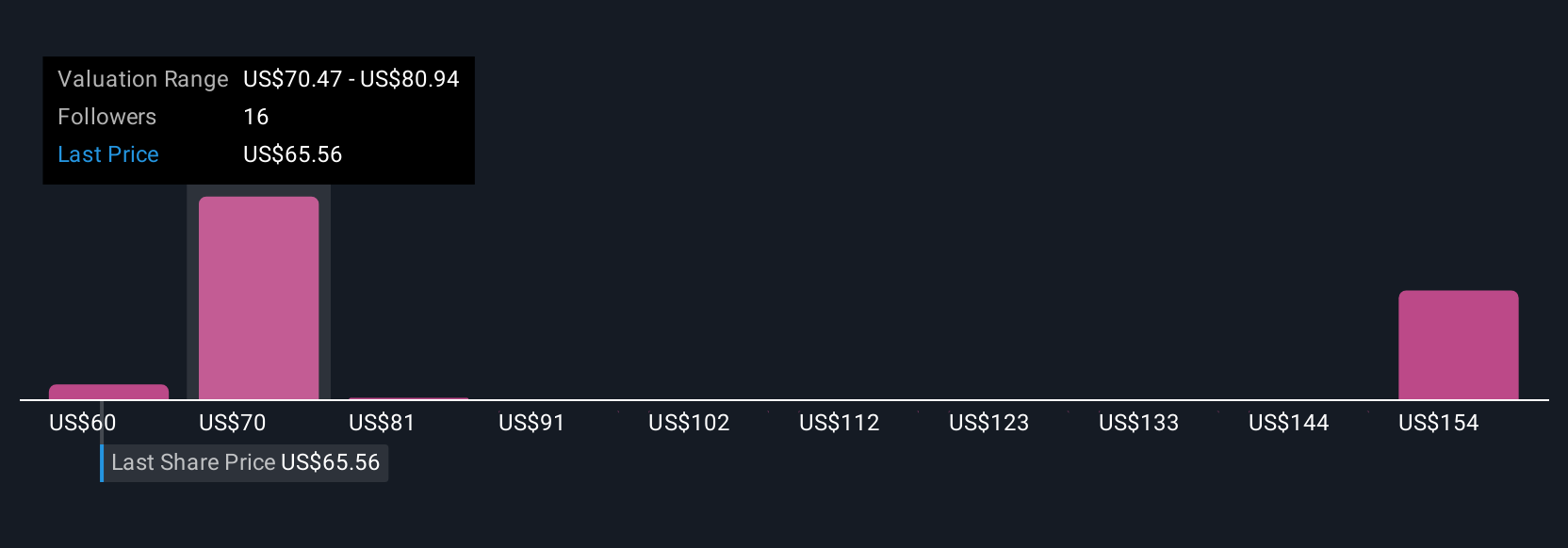

Six Simply Wall St Community members provided fair value estimates for Eastman Chemical stock, ranging widely from US$60 to just over US$91 per share. While opinions differ, weak customer demand and volatile earnings continue to weigh heavily on the company's outlook, reminding you that risks can affect sentiment and price expectations in very different ways.

Explore 6 other fair value estimates on Eastman Chemical - why the stock might be worth as much as 48% more than the current price!

Build Your Own Eastman Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastman Chemical research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eastman Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastman Chemical's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com