- Dolby Laboratories reported third quarter results with revenue of US$315.55 million and net income of US$46.07 million, reflecting year-over-year growth, while affirming a US$0.33 per share dividend and providing updated guidance for the fourth quarter and full year 2025.

- An interesting highlight is that Dolby has increased its annual dividend by about 13% per year over the last decade, and continues active share repurchases under its buyback plan, both indicating a sustained shareholder return focus.

- We'll examine how Dolby's continued dividend growth and buyback activity shape the company's investment narrative amid evolving industry drivers.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dolby Laboratories Investment Narrative Recap

To invest in Dolby Laboratories, an investor needs confidence in the enduring demand for immersive audio and video technologies despite a backdrop of shifting device markets. The latest quarterly results and updated guidance reinforce existing expectations, providing little to materially alter the company's most important short-term catalyst, new partnerships and content integrations, while the biggest risk remains accelerating commoditization in key consumer electronics segments, which was not alleviated by recent announcements.

Among the recent updates, Dolby's affirmation of both its quarterly dividend and continued share repurchases is particularly relevant. These actions underscore management's emphasis on shareholder returns even as the company faces competitive pressure and slower revenue growth relative to technology peers, aligning with the catalyst of ongoing adoption in new application areas such as automotive and streaming devices.

However, investors should be mindful that despite steady dividends and buybacks, the risk of shrinking addressable markets in core segments remains an area that…

Read the full narrative on Dolby Laboratories (it's free!)

Dolby Laboratories' outlook anticipates $1.5 billion in revenue and $327.9 million in earnings by 2028. This is based on a 4.3% annual revenue growth rate and a $63.6 million earnings increase from the current earnings of $264.3 million.

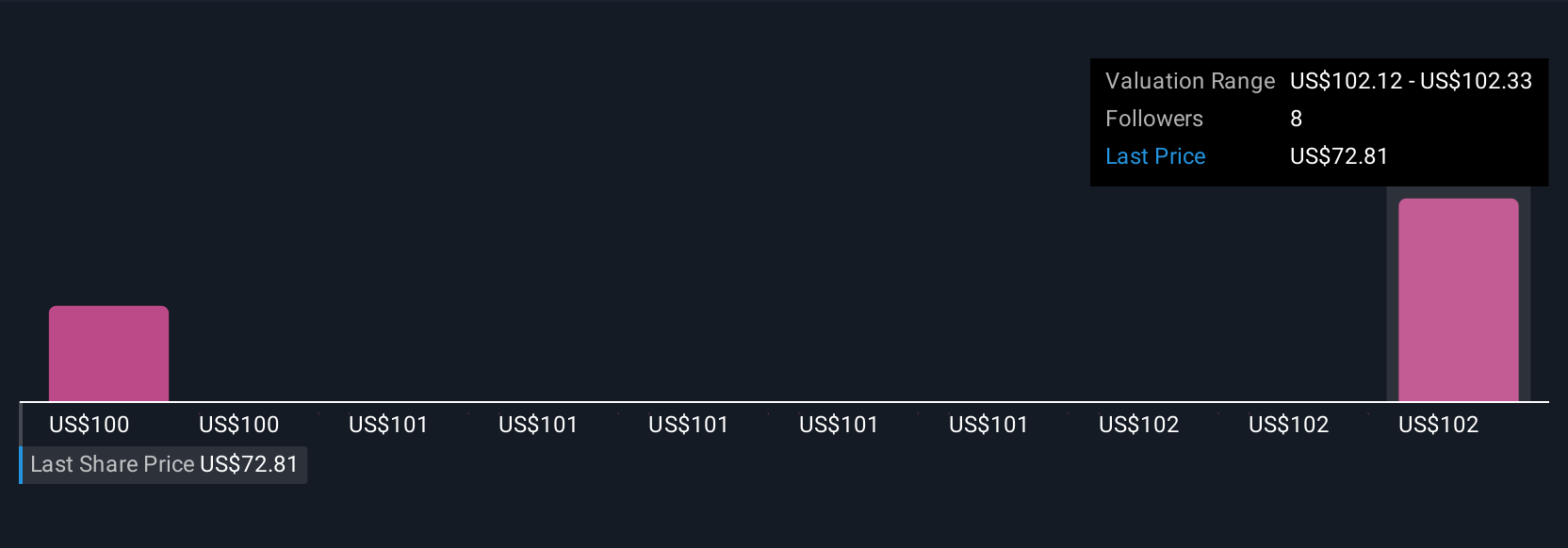

Uncover how Dolby Laboratories' forecasts yield a $102.33 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community investors estimate Dolby's fair value between US$99.85 and US$102.33 based on two unique perspectives. While new partnerships offer growth potential, the challenge of commoditization in consumer electronics could shape how these valuations play out, explore other viewpoints for a fuller picture.

Explore 2 other fair value estimates on Dolby Laboratories - why the stock might be worth just $99.85!

Build Your Own Dolby Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dolby Laboratories research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free Dolby Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dolby Laboratories' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com