- Belden Inc. recently reported its second quarter 2025 results, delivering sales of US$671.99 million and net income of US$61.01 million, with the company also providing third quarter revenue guidance of US$670 million to US$685 million and GAAP EPS between US$1.33 and US$1.43.

- This marks a continuation of improved year-over-year financial performance for Belden, coupled with clear forward visibility through updated guidance for the upcoming quarter.

- With Belden issuing both strong Q2 results and revenue guidance, we'll examine how this enhanced outlook influences its long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Belden Investment Narrative Recap

To be a Belden shareholder, you need to believe in sustained digital infrastructure growth and the company's ability to deliver robust, solutions-oriented offerings amid evolving industrial automation demands. The latest earnings and guidance reinforce revenue stability, but the crucial short-term catalyst remains ongoing demand from new digital transformation projects, while the largest current risk is continued input cost volatility and competitive pressures, neither of which appear meaningfully different following this latest report.

Among recent developments, Belden's Q3 2025 revenue and earnings guidance is especially pertinent, as it reflects management’s confidence in near-term order visibility and margin stability, directly supporting positive second quarter trends. This announcement connects with key performance drivers, notably the rise in high-value, multi-year customer engagements that underpin Belden’s growth narrative.

In contrast, investors should also be aware of the ongoing risk that rapid cost inflation or supply chain disruption could challenge margin recovery, especially if volume leverage fades...

Read the full narrative on Belden (it's free!)

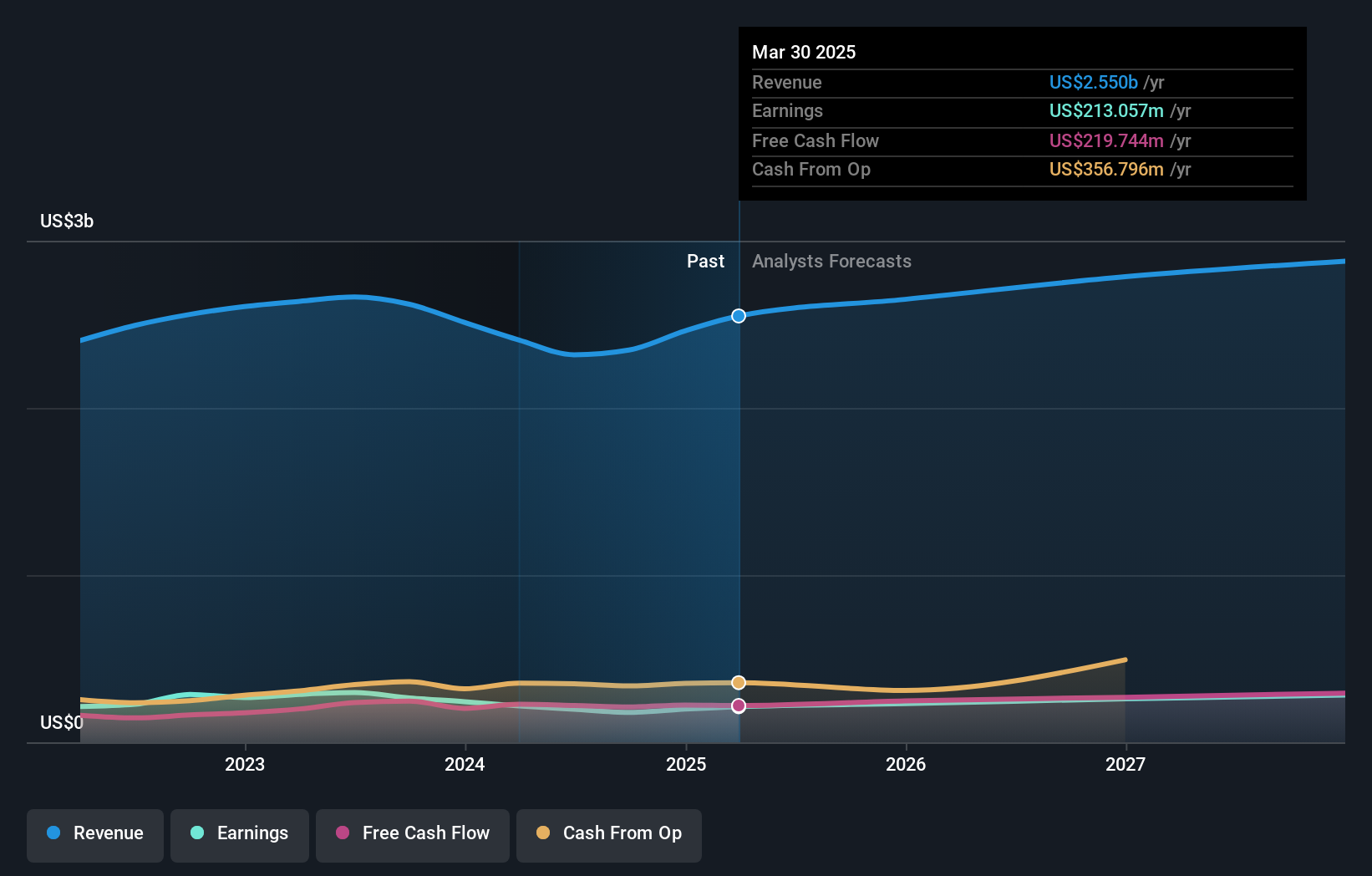

Belden's outlook anticipates $3.0 billion in revenue and $293.6 million in earnings by 2028. This scenario implies a 4.3% yearly revenue growth and a $68.6 million increase in earnings from the current $225.0 million level.

Uncover how Belden's forecasts yield a $139.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three recent fair value analyses from the Simply Wall St Community show estimates spanning US$80.69 to US$139.67 per share. With views so far apart, don't miss how active investment in high-margin solutions could ultimately shape Belden’s earnings performance in ways that might surprise even well-informed investors.

Explore 3 other fair value estimates on Belden - why the stock might be worth 32% less than the current price!

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com