- Carlisle Companies’ Board of Directors recently approved a 10% increase in its regular quarterly dividend to US$1.10 per share, with the new payout set for September 2, 2025, payable to shareholders of record as of August 19, 2025.

- This dividend increase follows a period marked by steady revenues, a decline in net income year-over-year, continued share repurchases, and updated guidance that points to modest revenue growth for 2025.

- We'll assess how Carlisle Companies' decision to raise its dividend highlights management's commitment to shareholder returns within its current business outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Carlisle Companies Investment Narrative Recap

To be a Carlisle Companies shareholder, you need confidence in the resilience of the commercial reroofing market and the company's ability to drive earnings through recurring revenues, operational initiatives, and product innovation. The recent 10% dividend increase signals management’s ongoing focus on shareholder returns but does not materially alter the immediate revenue growth outlook or offset risks tied to margin pressures and soft end markets.

Among recent announcements, Carlisle’s second-quarter results show flat sales and a sharp decline in net income year-over-year, underscoring how end-market headwinds and limited pricing traction continue to challenge profitability. This reinforces the importance of focused operational execution as a near-term catalyst and a key factor for mitigating downside risk.

In contrast, persistent softness in new construction and margin headwinds remain information that investors should be aware of...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies' narrative projects $5.8 billion in revenue and $997.0 million in earnings by 2028. This outlook requires 4.9% yearly revenue growth and a $193.1 million increase in earnings from the current $803.9 million.

Uncover how Carlisle Companies' forecasts yield a $425.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

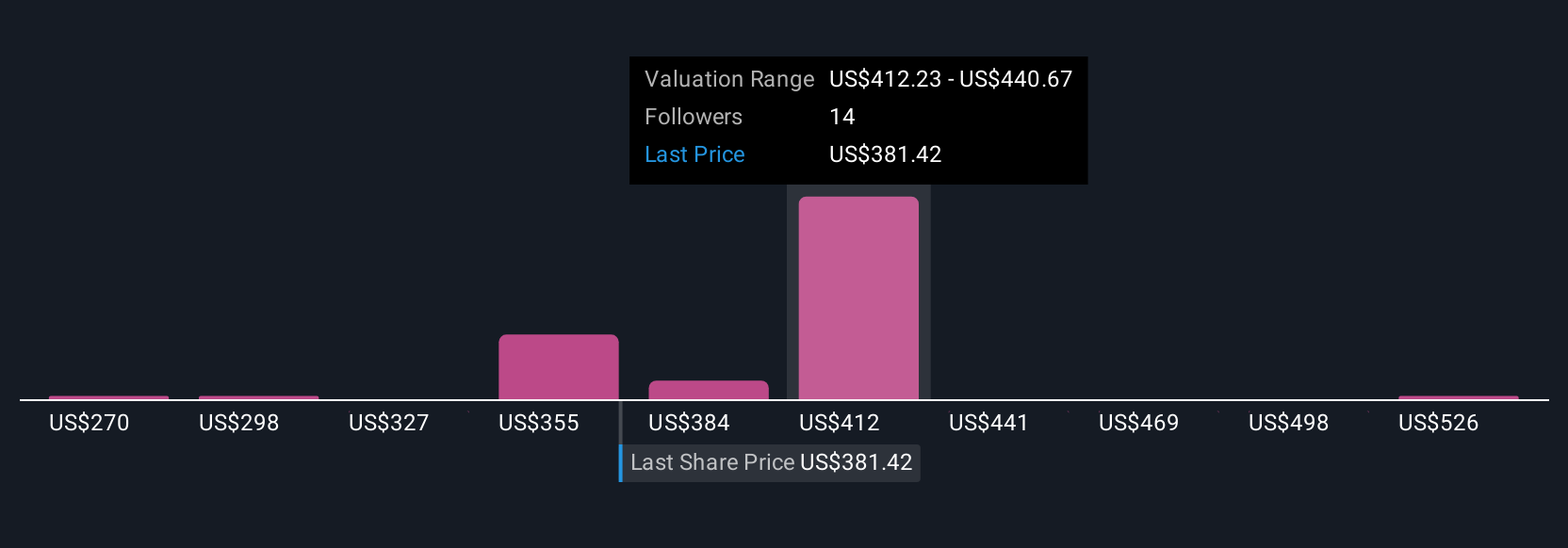

Simply Wall St Community members offered seven fair value estimates for Carlisle Companies ranging from US$270 to US$554.45 per share. With diverse opinions set against current margin and revenue headwinds, you are encouraged to review several viewpoints on Carlisle’s longer-term performance.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth 26% less than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com