- Linde plc recently reported its financial results for the second quarter and six months ended June 30, 2025, highlighted by record earnings per share, continued share buybacks totaling over US$1.1 billion for the quarter, and the commissioning of a major helium storage cavern in Texas.

- At its July 29, 2025 annual meeting, a shareholder proposal seeking greater transparency on climate-related lobbying was withdrawn, underscoring management’s control over the company's sustainability agenda and alignment efforts.

- We will explore how Linde's robust quarterly earnings and enhanced helium infrastructure could shape its long-term investment outlook.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Linde Investment Narrative Recap

To be a shareholder in Linde, you need to believe in the company’s ability to drive long-term earnings from global industrial gas demand, bolster growth through project backlogs, and maintain pricing power despite cyclical headwinds. The recent second-quarter results, marked by record earnings per share and ongoing share buybacks, reinforce Linde’s position as a leader, but the biggest risk remains the threat of persistent industrial weakness in Europe; for now, these earnings do not materially shift the balance of short-term catalysts or risks.

Among the latest company announcements, the commissioning of Linde’s major helium storage cavern in Texas stands out for its relevance. This unique facility is designed to support supply reliability in the helium market, a segment associated with both strong demand in sectors like electronics and aerospace and price volatility in certain regions. It aligns with one of Linde's key growth catalysts: expanding infrastructure to underpin long-term, high-margin contracts across expanding markets.

Yet in contrast to these positive developments, investors should remain mindful of the longer-term risk linked to European industrial decline and how it could affect core revenue streams...

Read the full narrative on Linde (it's free!)

Linde's outlook anticipates $38.7 billion in revenue and $9.0 billion in earnings by 2028. This projection hinges on a 5.2% annual revenue growth rate and an increase in earnings of $2.3 billion from the current $6.7 billion.

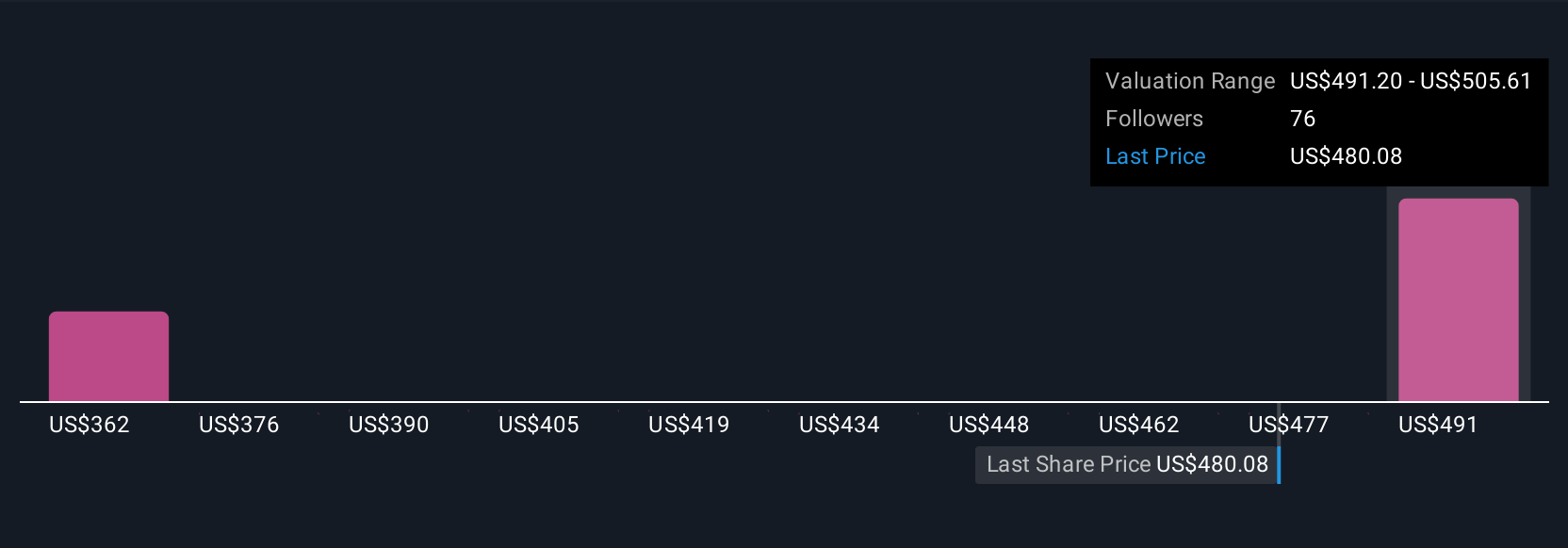

Uncover how Linde's forecasts yield a $505.61 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Linde range from US$339 to US$506 per share. While project backlog growth remains a core positive, your peers see many ways forward, explore their reasoning for a full picture.

Explore 5 other fair value estimates on Linde - why the stock might be worth as much as 7% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com