- Arrow Electronics recently reported stronger second quarter results, posting sales of US$7.58 billion and net income of US$187.75 million, and provided earnings guidance for the upcoming quarter alongside an update on ongoing share repurchases.

- A remarkable increase in both sales and profitability over the year-ago period, combined with management's active buyback program, highlights Arrow's commitment to operational improvements and shareholder returns.

- We'll examine how Arrow's robust quarterly earnings and new outlook could reshape the company's investment appeal and future growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Arrow Electronics Investment Narrative Recap

For investors considering Arrow Electronics, the core belief centers on the company's ability to convert ongoing demand recovery in electronics markets into sustainable revenue and earnings growth, despite industry cyclicality and changing customer procurement trends. The company's latest quarterly earnings, the strongest in over a year, reflect improved operational efficiency and robust sales; however, the short-term outlook remains influenced by ongoing inventory normalization and the uncertain pace of end-market recovery. These results are encouraging, yet the fundamental risk tied to customer destocking and unpredictable demand cycles is largely unchanged for now.

Among the recent updates, Arrow's Q3 2025 guidance stands out: management projects consolidated sales between US$7.30 billion and US$7.90 billion, with diluted EPS guidance of US$1.49 to US$1.69. This guidance will be especially important for investors focused on sales momentum and sequential performance, as it directly relates to Arrow's ability to sustain recovery and operational gains through potential near-term headwinds.

In contrast, investors should not overlook how quickly inventory normalization cycles can shift...

Read the full narrative on Arrow Electronics (it's free!)

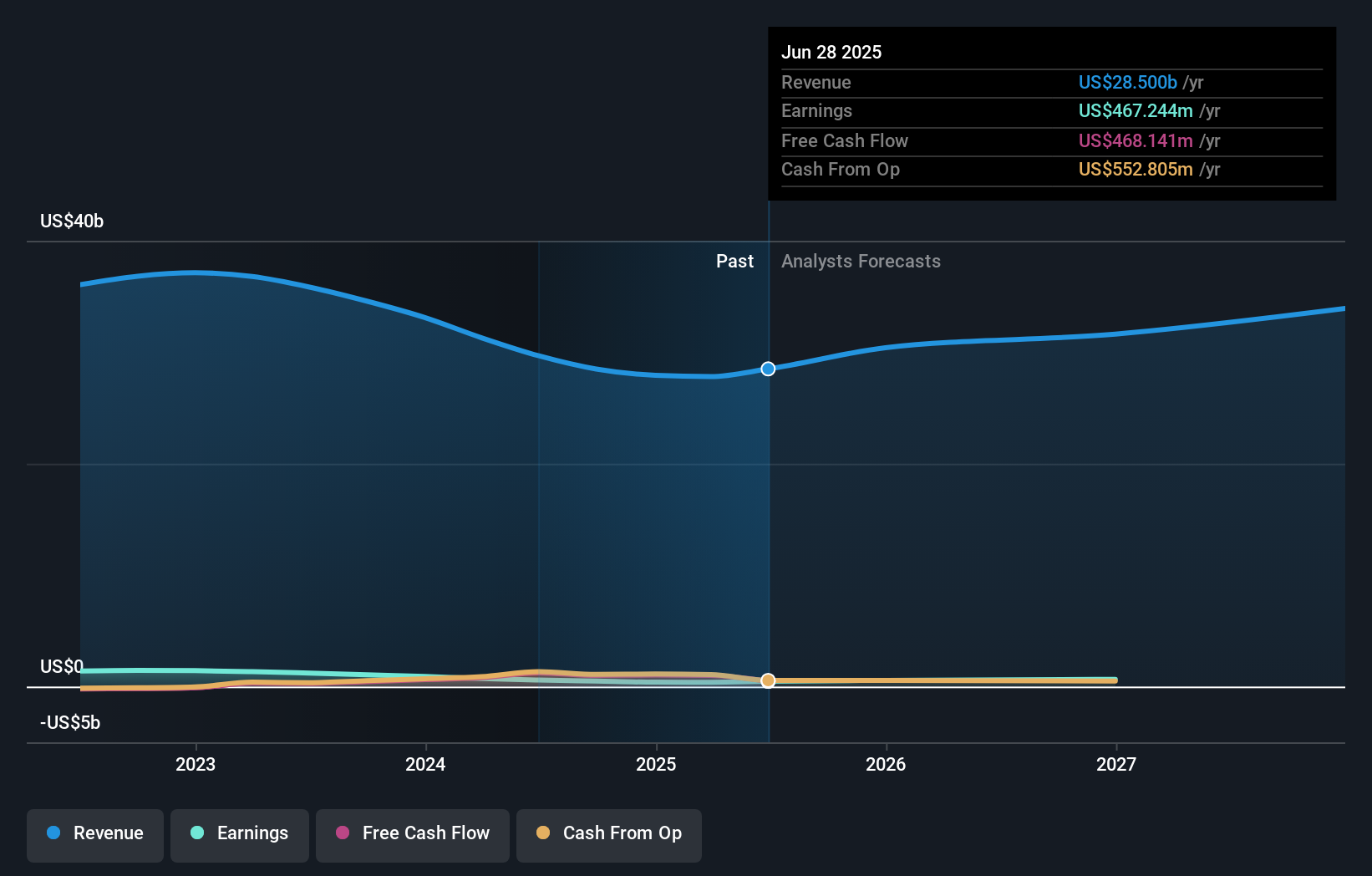

Arrow Electronics' outlook forecasts $34.9 billion in revenue and $880.8 million in earnings by 2028. This assumes a 6.9% annual revenue growth rate and an increase in earnings of $413.6 million from the current $467.2 million.

Uncover how Arrow Electronics' forecasts yield a $116.75 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range widely from US$19.53 to US$116.75. While these perspectives vary, keep in mind that Arrow's earnings remain exposed to volatility in demand cycles, which could impact future returns, explore the full spectrum of community views for a more complete picture.

Explore 2 other fair value estimates on Arrow Electronics - why the stock might be worth as much as $116.75!

Build Your Own Arrow Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arrow Electronics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arrow Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arrow Electronics' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com