- Last week, Select Medical Holdings Corporation announced amendments to its bylaws to clarify procedures for shareholder nominations and proposals, alongside reporting second-quarter financial results that included revenue growth but reduced net income year over year.

- A one-off US$29 million expense and mixed performance in the Rehabilitation Hospital segment featured prominently, despite management reaffirming annual financial guidance and continuing with dividends and share repurchases.

- Next, we will review how the unusual expense and ongoing operational measures could influence Select Medical Holdings' investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Select Medical Holdings Investment Narrative Recap

Investors in Select Medical Holdings focus on the company’s ability to maintain long-term growth through expanding inpatient rehab and outpatient networks, while managing regulatory and reimbursement pressures. The latest bylaw amendments and Q2 results, with a one-off US$29 million expense, do not materially shift the key short-term catalyst: stable occupancy and earnings resilience in core hospital segments. However, the biggest risk remains ongoing regulatory changes that can directly impact revenue and profitability.

Of recent company announcements, the reaffirmation of full-year 2025 earnings and revenue guidance stands out as most relevant. This move signals management’s intent to stay the course despite operational headwinds, supporting their growth narrative while acknowledging continued cost and reimbursement pressures that could affect near-term outcomes.

Yet, before focusing too closely on earnings guidance, investors should not overlook the persistent regulatory risks that may challenge...

Read the full narrative on Select Medical Holdings (it's free!)

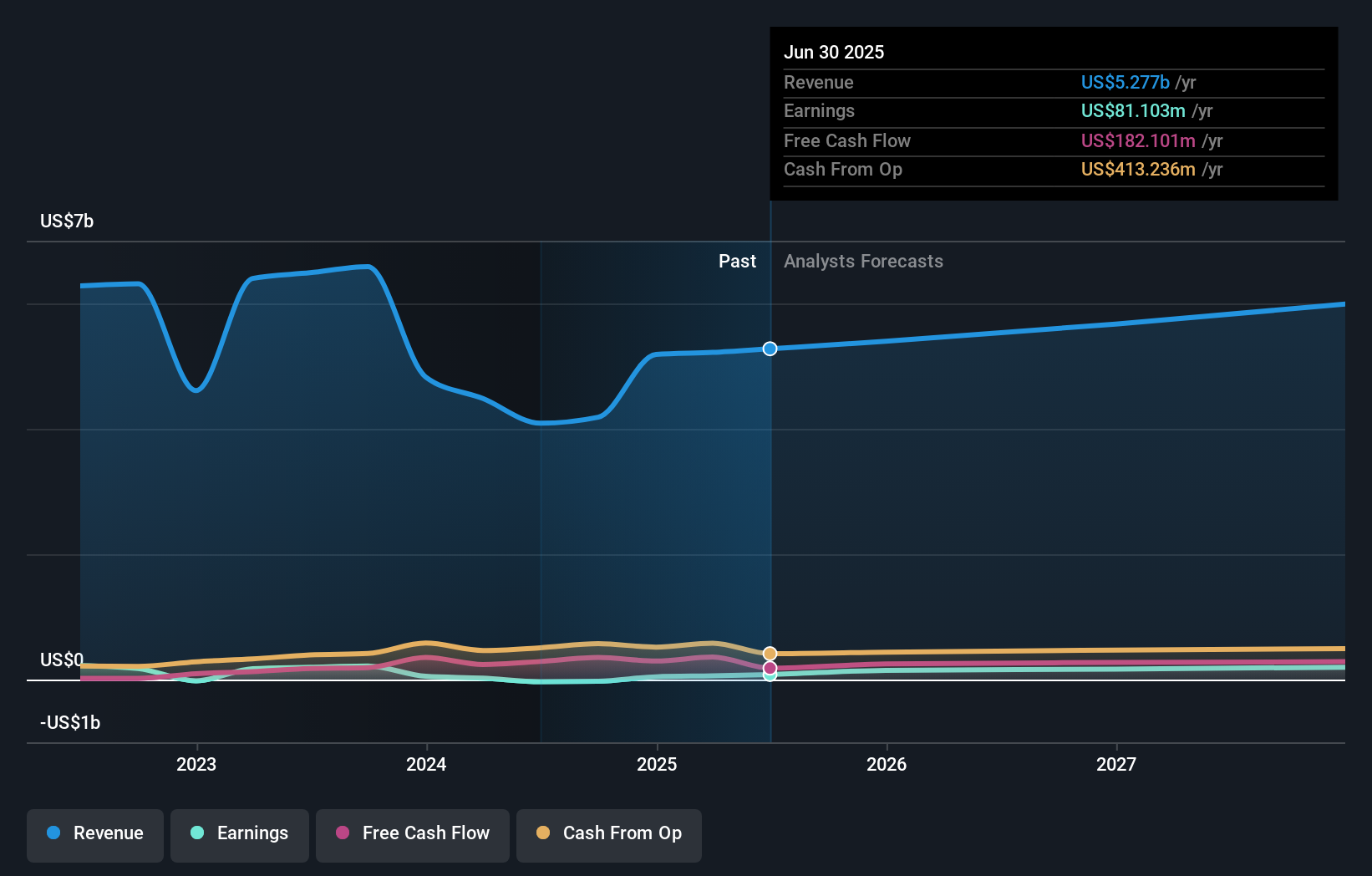

Select Medical Holdings is projected to reach $6.1 billion in revenue and $236.5 million in earnings by 2028. This outlook assumes annual revenue growth of 5.1% and an earnings increase of $155.4 million from current earnings of $81.1 million.

Uncover how Select Medical Holdings' forecasts yield a $18.33 fair value, a 52% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St have estimated fair values for Select Medical Holdings ranging from US$18.33 to US$43.04, based on two separate analyses. With ongoing regulatory pressures threatening earnings stability, you can see how market participants may interpret the company’s prospects quite differently.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth just $18.33!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com