- Integral Ad Science Holding Corp. recently reported second quarter 2025 results, with revenue rising to US$149.2 million and net income reaching US$16.41 million, both up from the previous year, and raised its full-year revenue guidance to a range of US$597 million to US$605 million.

- The company also became the first in its industry to earn the Ethical AI Certification from the Alliance for Audited Media, highlighting its commitment to responsible AI practices across its ad measurement products.

- We will explore how this raised financial outlook, paired with industry-first AI certification, updates IAS's investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Integral Ad Science Holding Investment Narrative Recap

To be a shareholder in Integral Ad Science Holding Corp., you need to believe in the company’s ability to shape and monetize the future of digital advertising through advanced measurement and AI-driven solutions. The recent increase in full-year revenue guidance strengthens the near-term growth catalyst of product adoption, while the core risk, exposure to evolving platforms like CTV and social media, remains a key factor for ongoing performance. The latest results reinforce the growth story but do not fundamentally alter the risk profile just yet.

Among recent announcements, IAS’s achievement as the first in its sector to secure Ethical AI Certification directly ties to confidence in its AI-powered measurement products, a pillar supporting near-term adoption, especially as advertisers push for transparency and responsible practices. This recognition reinforces IAS’s efforts to differentiate its offerings and may help sustain client trust at a critical phase of industry AI integration.

Yet, it’s important for investors to keep in mind that if social media or CTV platforms change their algorithms or competitive dynamics…

Read the full narrative on Integral Ad Science Holding (it's free!)

Integral Ad Science Holding's narrative projects $755.7 million in revenue and $94.5 million in earnings by 2028. This requires 11.2% yearly revenue growth and a $47.5 million earnings increase from current earnings of $47.0 million.

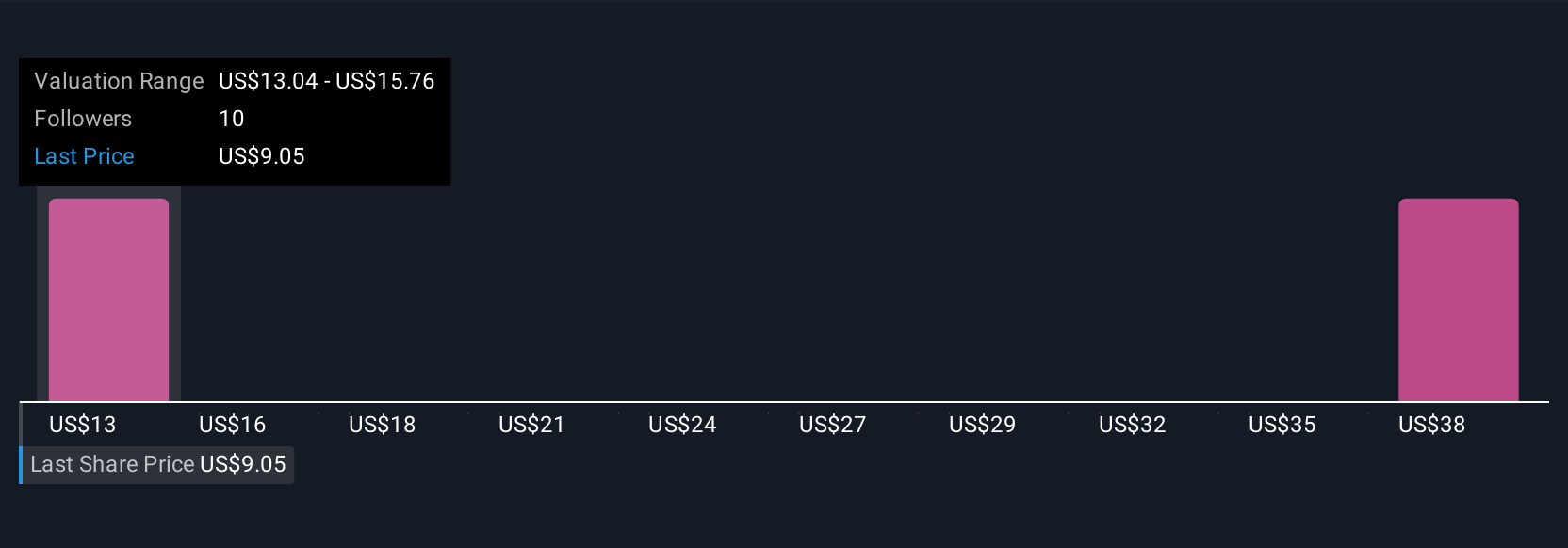

Uncover how Integral Ad Science Holding's forecasts yield a $13.47 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Community members’ fair value estimates for IAS shares range from US$13.47 to US$40.78, with 2 individual viewpoints from the Simply Wall St Community. Amid this range, platform dependency is in focus as a crucial risk with implications for earnings stability and future growth.

Explore 2 other fair value estimates on Integral Ad Science Holding - why the stock might be worth over 4x more than the current price!

Build Your Own Integral Ad Science Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integral Ad Science Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integral Ad Science Holding's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com