- SiriusPoint Ltd. announced second-quarter 2025 results, reporting US$748.2 million in revenue and US$63.2 million in net income, along with a quarterly US$0.50 dividend on its 8.00% Series B Preference Shares.

- Despite a year-over-year drop in net income, the company highlighted 11 consecutive quarters of underwriting profit and ongoing expansion of its MGA partnerships.

- We’ll assess how SiriusPoint’s focus on consistent underwriting profit shapes its broader investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SiriusPoint Investment Narrative Recap

To be a SiriusPoint shareholder, you need to believe in the company's ability to deliver consistent underwriting profits while expanding through new Managing General Agent (MGA) partnerships and navigating specialty markets. The recent Q2 2025 results, with steady revenue but a significant drop in net income, do not materially change the short-term catalyst of further profitable MGA expansion but highlight the ongoing risk that newly onboarded MGAs may underperform and affect margins.

Among the latest announcements, the approval of a US$0.50 quarterly dividend on the 8.00 percent Series B Preference Shares stands out as a signal of ongoing capital management and support for shareholders, even as net income declined year-over-year. This move is particularly relevant when considering the importance the company places on sustaining financial resilience amid evolving market conditions.

By contrast, investors should be mindful that SiriusPoint's premium growth relies heavily on new MGA partnerships, which means that if these partnerships stall, revenue momentum could...

Read the full narrative on SiriusPoint (it's free!)

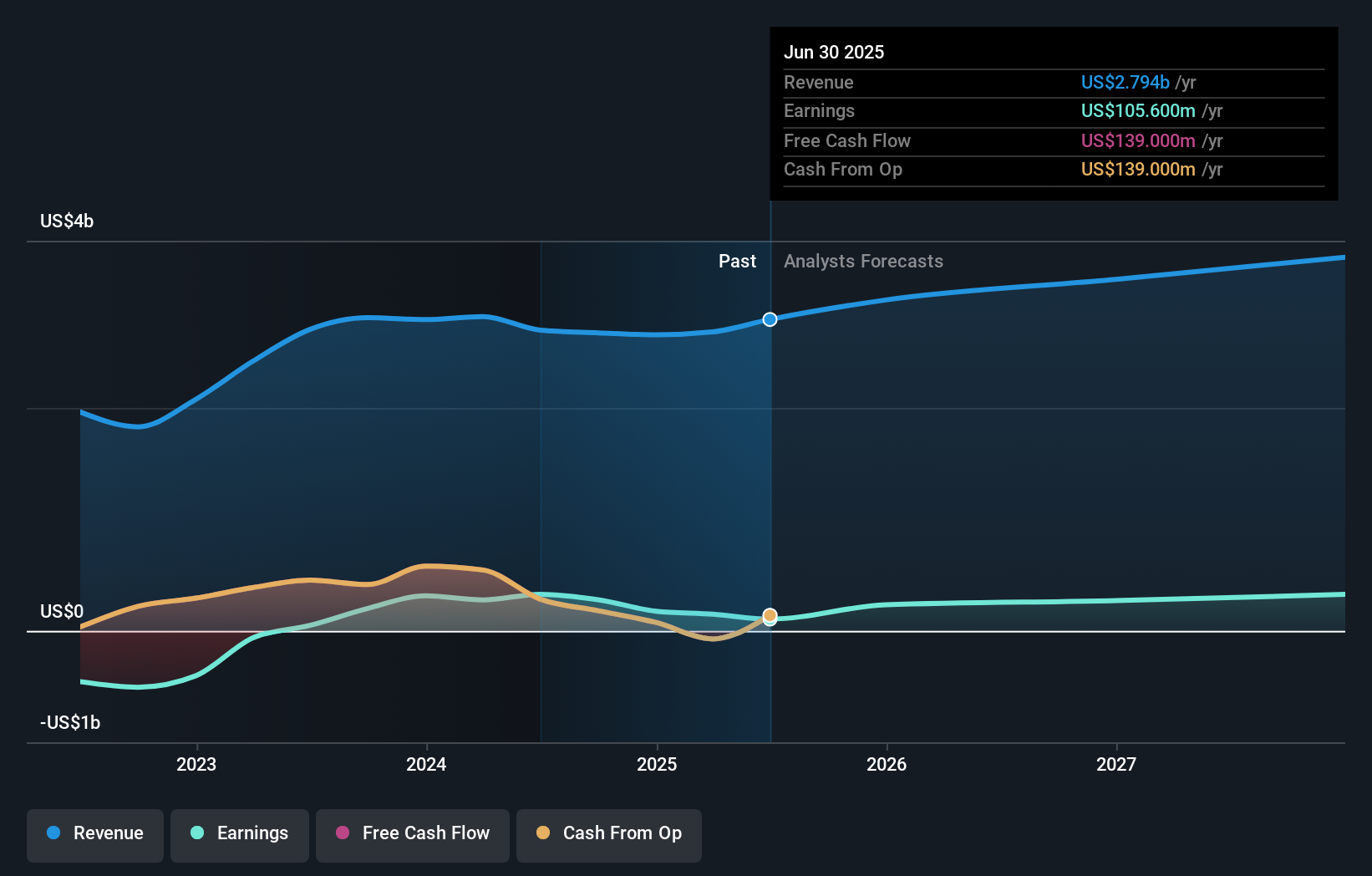

SiriusPoint's narrative projects $3.4 billion in revenue and $410.2 million in earnings by 2028. This requires 7.2% yearly revenue growth and a $304.6 million increase in earnings from the current $105.6 million.

Uncover how SiriusPoint's forecasts yield a $25.33 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member has estimated SiriusPoint’s fair value at US$23.22 per share. While the focus on underwriting profit remains the key current catalyst, broadening your outlook with additional viewpoints can help highlight risks around new MGA partner performance.

Explore another fair value estimate on SiriusPoint - why the stock might be worth as much as 28% more than the current price!

Build Your Own SiriusPoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiriusPoint research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SiriusPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiriusPoint's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com