- Hawkins, Inc. recently reported its first quarter 2025 results, showing increased sales to US$293.27 million and a 6% dividend boost, and also announced CEO and CFO participation at Seaport Research Partners' investor conference this August.

- The company additionally ratified Deloitte & Touche LLP as its independent auditor for the fiscal year, signaling ongoing focus on governance and transparency.

- We'll now explore how Hawkins' strong quarterly earnings and dividend growth shape its current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Hawkins' Investment Narrative?

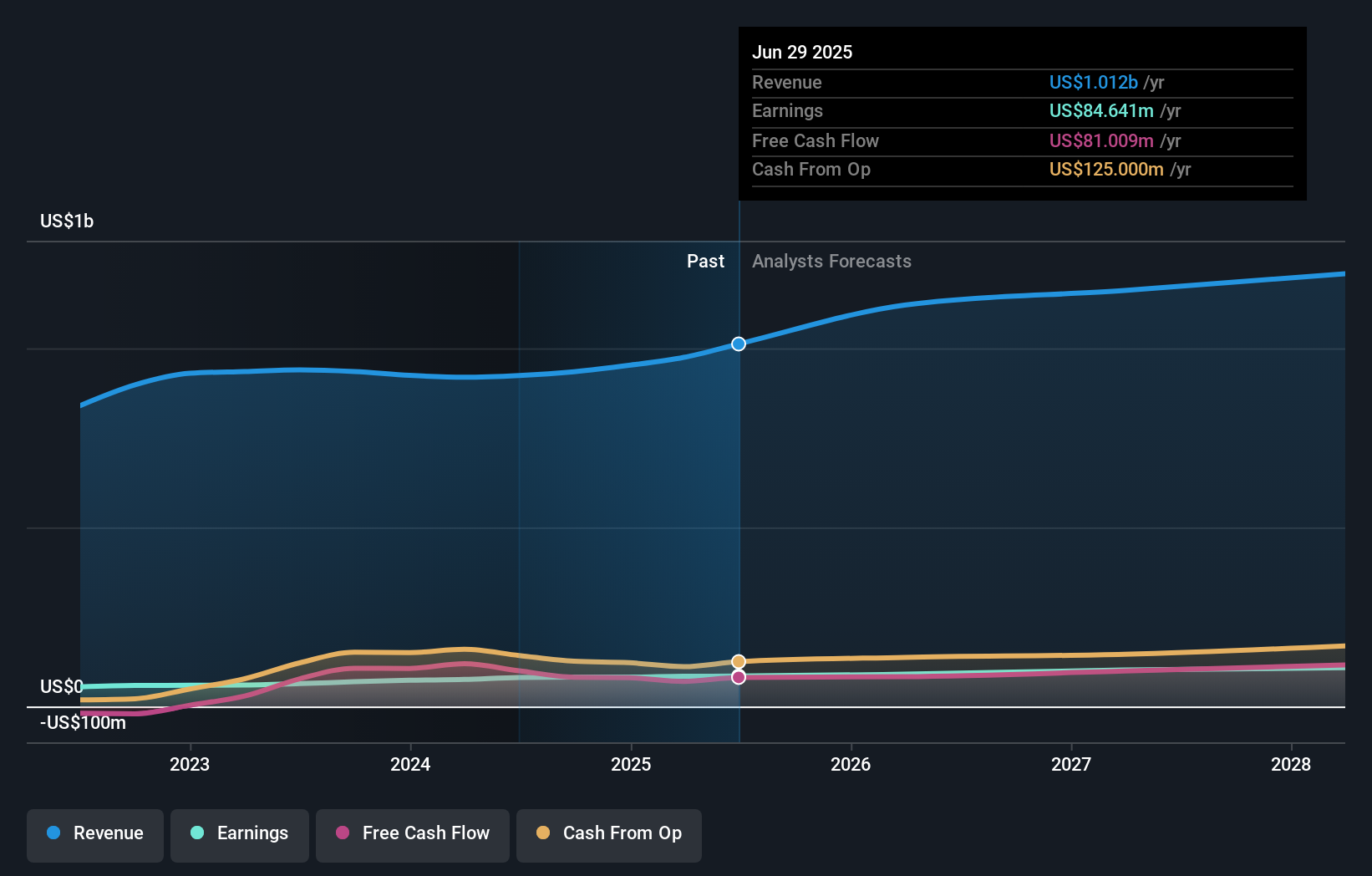

For shareholders, believing in Hawkins means trusting steady growth, operational consistency, and ongoing reinvestment in its core chemicals business. The recent first-quarter results, with record sales of US$293.27 million and incremental earnings growth, combined with a 6% dividend increase, reinforce the narrative of Hawkins as a reliable performer that rewards its investors. Participation by senior leadership at a major investor conference and the ratification of Deloitte & Touche as auditor signal a transparent, investor-focused approach, though these events are unlikely to rapidly shift immediate catalysts. Short-term drivers remain closely tied to stable demand in its markets and execution on acquisition opportunities rather than governance headlines. However, the business’s premium valuation compared to sector averages brings risks of heightened sensitivity to any unexpected slowdown in sales or profit margins, meaning investors need to keep a close watch for any change in the strong, but currently modest, pace of earnings growth.

But with Hawkins trading well above most analyst and community fair value estimates, valuation risk is worth noting for any investor. Hawkins' shares are on the way up, but they could be overextended by 21%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Hawkins - why the stock might be worth 17% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com