- In recent days, NXP Semiconductors introduced its i.MX 95 series processors, designed for advanced automotive, industrial, and AI-driven applications, featuring cutting-edge machine learning and 3D graphics capabilities.

- An interesting insight is that NXP's operational efficiencies have enabled it to significantly increase its return on capital while keeping its capital base steady, highlighting improved profitability from existing resources.

- We'll now examine how product innovation in AI edge processing may influence NXP's investment narrative and long-term growth outlook.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NXP Semiconductors Investment Narrative Recap

To be a shareholder in NXP Semiconductors, an investor must have confidence in the company’s ability to unlock growth from the ongoing shift toward automotive electrification, edge AI, and industrial automation despite near-term revenue softness and macro uncertainty. The recent launch of the i.MX 95 series for advanced automotive and AI-driven industrial applications supports the company’s innovation story, but it does not materially shift the main near-term catalyst: a sustained recovery in automotive end demand. The biggest risk remains tepid revenue momentum and persistent pricing pressure, especially from aggressive competitors in China.

Among recent developments, NXP’s collaborations to power next-generation software-defined vehicles, such as the alliance with Rimac Technology to integrate S32E2 processors, align directly with the core themes of automotive digitalization and AI edge processing. These initiatives may reinforce the longer-term growth outlook, but their immediate impact is limited compared to the need for clear signs of consistent end-market recovery and earnings visibility.

By contrast, investors should not overlook how sustained pricing pressure from local competitors in China could...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' outlook anticipates $15.6 billion in revenue and $3.5 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 8.7% and a $1.4 billion increase in earnings from the current $2.1 billion.

Uncover how NXP Semiconductors' forecasts yield a $258.06 fair value, a 25% upside to its current price.

Exploring Other Perspectives

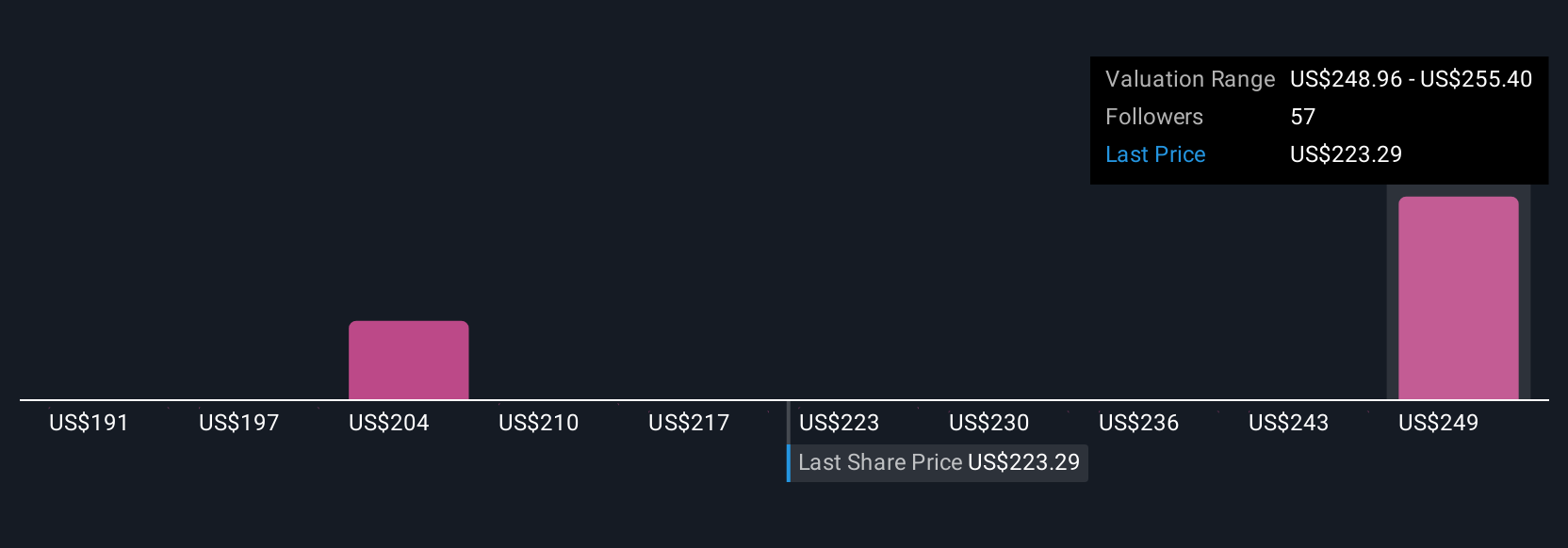

Eight fair value estimates from the Simply Wall St Community range from US$191 to US$258 per share. While you can find wide disagreement, many participants are weighing the importance of lagging revenue growth when projecting where NXP’s performance could head next.

Explore 8 other fair value estimates on NXP Semiconductors - why the stock might be worth 8% less than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com