- Harley-Davidson recently announced that Artie Starrs will be appointed President and CEO effective October 1, 2025, following the transition from current CEO Jochen Zeitz, who will remain as a senior advisor until February 2026.

- Starrs brings extensive experience in global brand expansion and operational leadership, having most recently served as CEO of Topgolf International, where he oversaw significant international growth and revenue increases.

- We'll explore how the CEO transition might influence Harley-Davidson's future direction and its response to ongoing financial challenges.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Harley-Davidson Investment Narrative Recap

To be a Harley-Davidson shareholder today, you need conviction in the company’s ability to revitalize its iconic brand, capitalize on new products, and address headwinds like declining motorcycle sales and margin pressure. The news of Artie Starrs stepping in as CEO is not expected to materially shift Harley-Davidson’s most important short-term catalyst, which remains the company’s efforts to unlock cash and reduce debt through a potential stake sale in its financing unit. The biggest near-term risk continues to be declining global motorcycle demand, especially in North America.

One of the most relevant recent developments is Harley-Davidson’s reported negotiations to sell a stake in its financing arm for US$5 billion. This move could provide immediate cash, ease leverage concerns, and enable the company to invest in product innovation and share buybacks, key levers in responding to market shifts and bolstering earnings during this transition period. Still, while fresh leadership may inspire confidence, investors should track whether the company can sustain revenue momentum as market conditions remain challenging.

But with all eyes on the CEO transition, it’s important not to overlook how ongoing weakness in motorcycle sales could challenge even the best-laid plans...

Read the full narrative on Harley-Davidson (it's free!)

Harley-Davidson's narrative projects $3.9 billion revenue and $441.1 million earnings by 2028. This assumes a 4.3% annual revenue decline and a $198.3 million increase in earnings from the current $242.8 million.

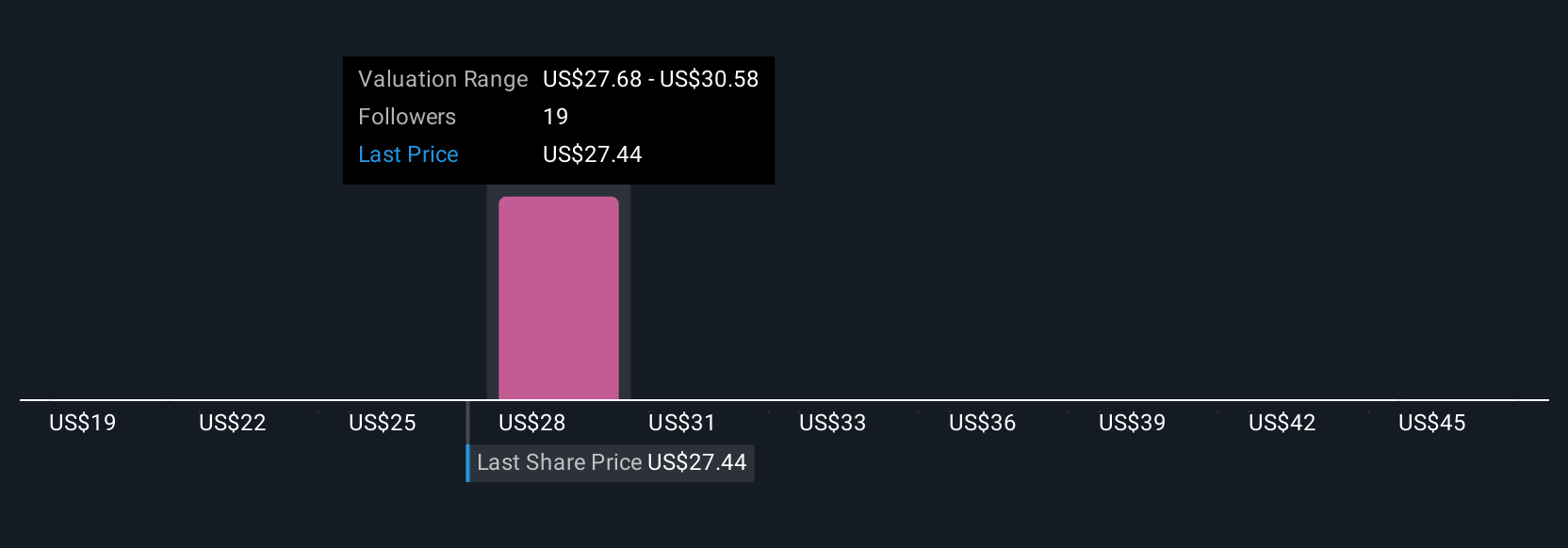

Uncover how Harley-Davidson's forecasts yield a $29.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community forecast Harley-Davidson’s fair value anywhere from US$19 to US$47.94 per share. With motorcycle sales still under pressure, these sharply different perspectives highlight just how much your view of the risks could shape your expectations for the company’s performance.

Explore 4 other fair value estimates on Harley-Davidson - why the stock might be worth 22% less than the current price!

Build Your Own Harley-Davidson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Harley-Davidson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harley-Davidson's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com