- Civitas Resources recently announced the appointment of Board Chair Wouter van Kempen as interim CEO following the departure of Chris Doyle, alongside plans to divest non-core D-J Basin assets valued at US$435 million to streamline its operations and reduce debt.

- The leadership transition and asset sale were accompanied by mixed second quarter results, with revenues and net income down year-over-year and the board affirming a US$0.50 quarterly dividend for shareholders.

- We'll assess how the leadership change and asset sales could affect Civitas Resources' investment outlook and financial strategy.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Civitas Resources Investment Narrative Recap

To be a shareholder in Civitas Resources right now, you have to believe in management’s ability to drive value through smarter portfolio choices, disciplined cost control, and debt reduction, even as production and earnings come under short-term pressure. The recent leadership transition, with Wouter van Kempen stepping in as interim CEO, presents more of an operational reset than a dramatic pivot; near-term, the asset sales and new guidance appear primarily focused on stabilizing the balance sheet, with no material shift in major risk or catalyst to the outlook.

Of the recent announcements, the company’s affirmation of its US$0.50 quarterly dividend is particularly relevant. Despite headwinds in quarterly revenue and earnings, Civitas continues to support a shareholder return, reinforcing management’s intent to balance capital return with operational discipline, an important signal for investors focused on near-term catalysts.

On the flip side, investors should be aware that declining production volumes in key regions may put pressure on future cash flows if...

Read the full narrative on Civitas Resources (it's free!)

Civitas Resources is projected to have $4.6 billion in revenue and $693.3 million in earnings by 2028. This outlook reflects a 3.2% annual decline in revenue and a decrease in earnings of $155.4 million from current earnings of $848.7 million.

Uncover how Civitas Resources' forecasts yield a $43.14 fair value, a 43% upside to its current price.

Exploring Other Perspectives

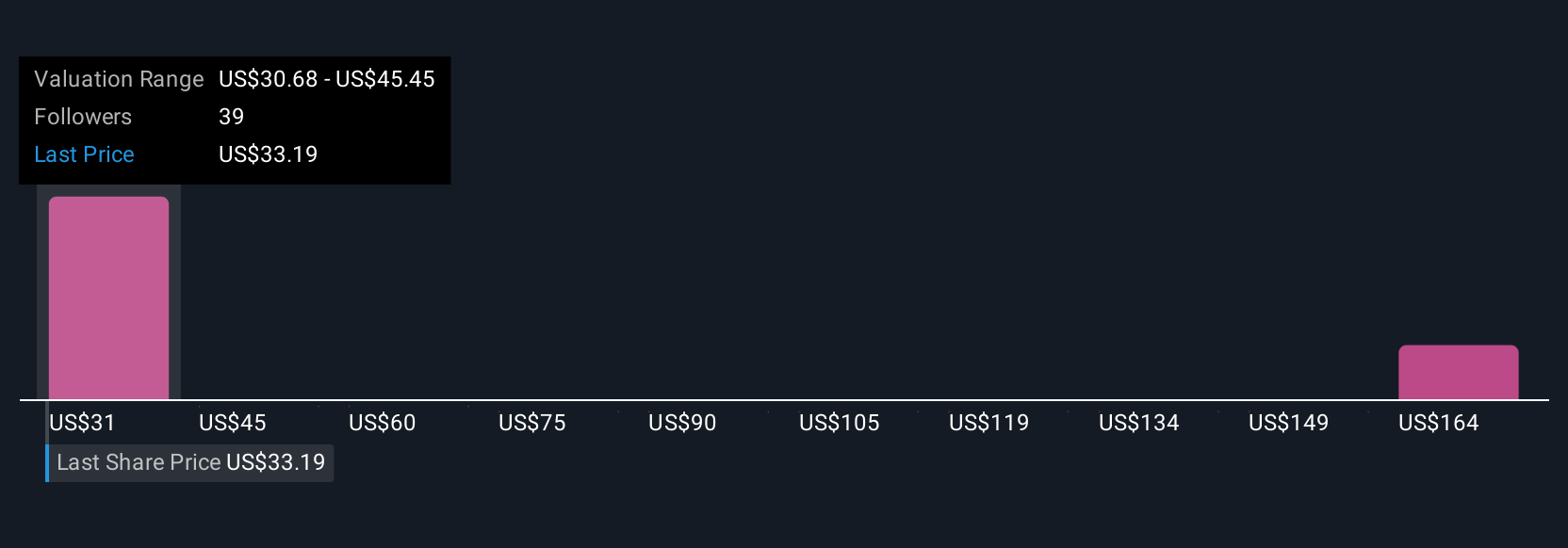

Simply Wall St Community members set fair value for Civitas Resources between US$30.68 and US$111.66, using six independent forecasts. With recent leadership changes and asset divestitures shaping expectations, consider the broad range of community viewpoints before making decisions.

Explore 6 other fair value estimates on Civitas Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Civitas Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Civitas Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Civitas Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Civitas Resources' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com