- In August 2025, Insperity reported a US$5 million net loss for the second quarter, lowered its full-year financial outlook due to rising healthcare costs, and became the subject of an investor investigation related to possible securities law violations.

- An important recent development is Insperity's updated HR solutions portfolio, including a forthcoming collaboration with Workday aimed at capturing more mid-market clients and addressing evolving HR needs for SMBs.

- We'll examine how Insperity's higher benefits costs and earnings guidance revision could influence its investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Insperity Investment Narrative Recap

To be an Insperity shareholder, you have to believe the company’s ability to control benefits and healthcare costs will eventually offset recent margin pressure, unlocking renewed earnings growth from new HR solutions and a broader mid-market reach. The surprise second-quarter loss and sharply lowered outlook increase focus on the near-term impact of rising claims, making cost management the key catalyst, and the biggest risk, for the stock right now.

Among the latest company moves, Insperity’s freshly rebranded HR360, HRCore, and the forthcoming Workday-powered HRScale suite highlight an active push to win more lucrative mid-market clients. However, until benefits cost trends stabilize, these launches may not immediately relieve earnings pressure or restore investor confidence.

By contrast, the recent volatility in margins and healthcare claims is a risk investors should be fully aware of if considering...

Read the full narrative on Insperity (it's free!)

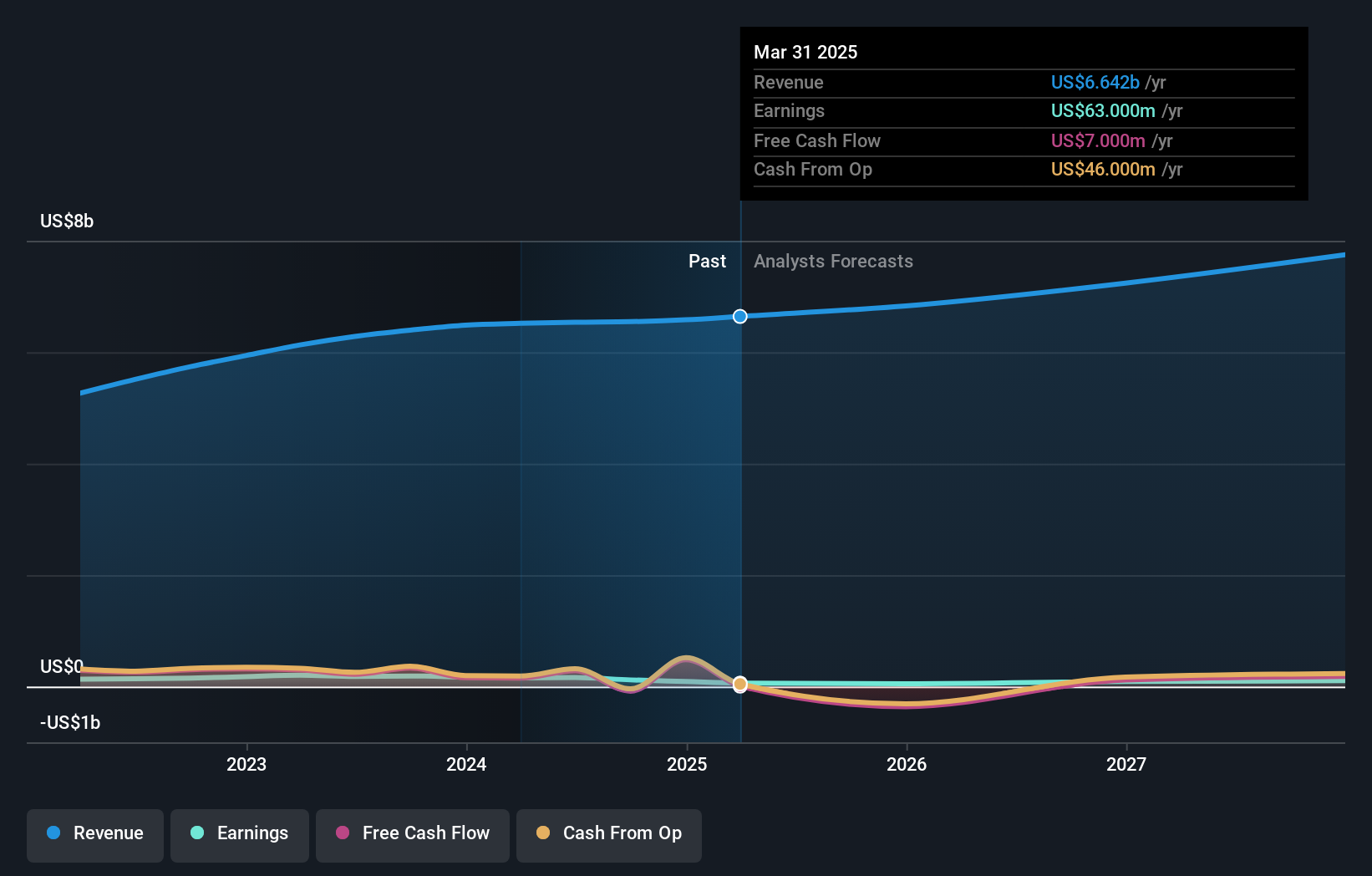

Insperity's outlook anticipates $7.7 billion in revenue and $109.6 million in earnings by 2028. This scenario requires 5.0% annual revenue growth and a $69.6 million increase in earnings from the current $40.0 million.

Uncover how Insperity's forecasts yield a $57.75 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two fair value estimates for Insperity ranging from US$57.75 to US$258.17. With cost escalation now compressing net margins, individual views reflect a wide spectrum of expectations for future company performance.

Explore 2 other fair value estimates on Insperity - why the stock might be worth over 4x more than the current price!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com