- Graham Holdings Company announced past second quarter 2025 results, reporting revenue of US$1.22 billion and a net income of US$36.75 million, marking a return to profitability from a net loss a year earlier.

- This turnaround follows a period where the company had experienced a net loss, highlighting improved performance in continuing operations compared to the previous year.

- We'll examine how Graham Holdings' shift to profitability from a prior-year loss shapes the company's broader investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Graham Holdings' Investment Narrative?

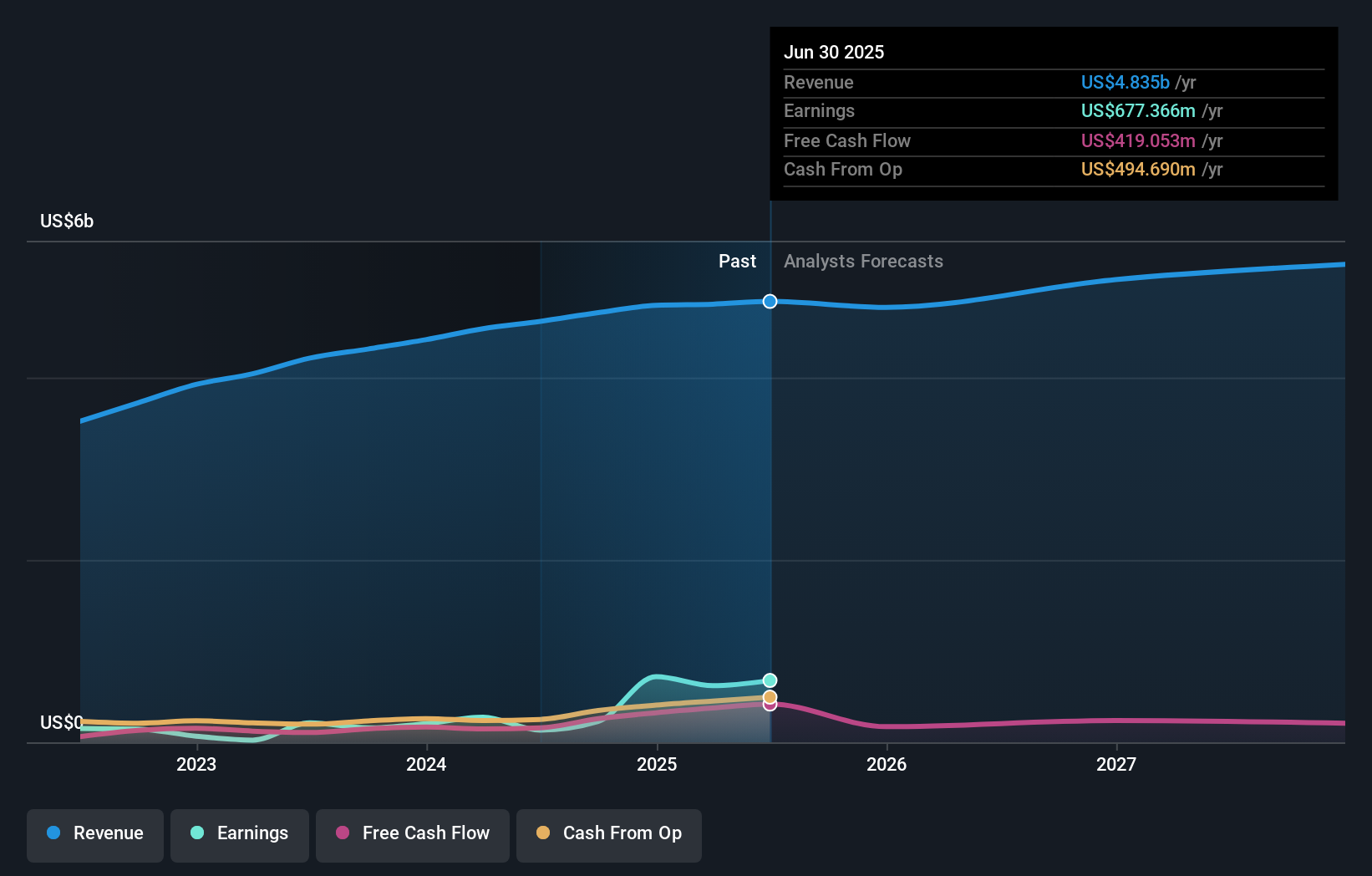

For investors considering Graham Holdings, the big picture has revolved around a company with stable leadership, historically strong earnings growth, and a record of reliable dividends, but also with slower expected revenue growth than the broader market. The latest quarterly results showing a return to profitability, net income of US$36.75 million versus a prior-year loss, may shift short-term catalysts, easing concerns over operational performance and supporting confidence in ongoing dividend payments. This jump in earnings is reflected in recent price gains, but it does not fully resolve the slower revenue growth that has anchored risk discussions. With no share repurchases last quarter and management focused on steady, rather than aggressive, expansion, the biggest ongoing risk is that Graham’s growth continues to lag industry averages. The recent earnings rebound offers a positive signal, yet the long-term investment case still depends on how the company addresses this underlying growth challenge. In contrast, slower anticipated sales growth remains something investors should keep a close eye on.

Graham Holdings' shares are on the way up, but they could be overextended by 29%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Graham Holdings - why the stock might be worth as much as $785.00!

Build Your Own Graham Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graham Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Graham Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graham Holdings' overall financial health at a glance.

No Opportunity In Graham Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com