- Federal Agricultural Mortgage Corporation recently reported strong second-quarter results, with net income rising to US$54.84 million and basic earnings per share increasing to US$4.50 from continuing operations compared to the prior year.

- Unique in this update, the company expanded its share repurchase authorization to US$50 million and highlighted potential benefits from new federal legislation affecting agricultural lending and insurance.

- Next, we will explore how record core earnings growth and the expanded share repurchase plan might influence the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Federal Agricultural Mortgage Investment Narrative Recap

To be a shareholder in Federal Agricultural Mortgage Corporation, you need to believe in the resilience of the agricultural finance sector and the company’s ability to deliver consistent earnings while managing exposure to interest rates and credit risk. The strong second-quarter results reinforce short-term momentum, but the biggest near-term catalyst, further business volume growth, will continue to depend on healthy agricultural credit demand, while the greatest risk remains a potential slowdown tied to rising rates or sector-specific downturns. The latest results do not materially change these drivers but confirm recent progress on growth.

The most relevant recent announcement is the expansion of the share repurchase program to US$50 million and its extension to August 2027. This update signals that the company has flexibility to return capital to shareholders when conditions allow, which could support shareholder value over time as the company continues to monitor the impacts of federal legislation and market conditions on its core lending segments.

However, investors should also stay alert to the way tighter credit spreads in key products could suddenly limit volume growth and impact revenue more than expected, especially if...

Read the full narrative on Federal Agricultural Mortgage (it's free!)

Federal Agricultural Mortgage's outlook anticipates $480.3 million in revenue and $234.4 million in earnings by 2028. This projection is based on a 10.3% annual revenue growth rate and a $56.9 million increase in earnings from the current level of $177.5 million.

Uncover how Federal Agricultural Mortgage's forecasts yield a $222.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

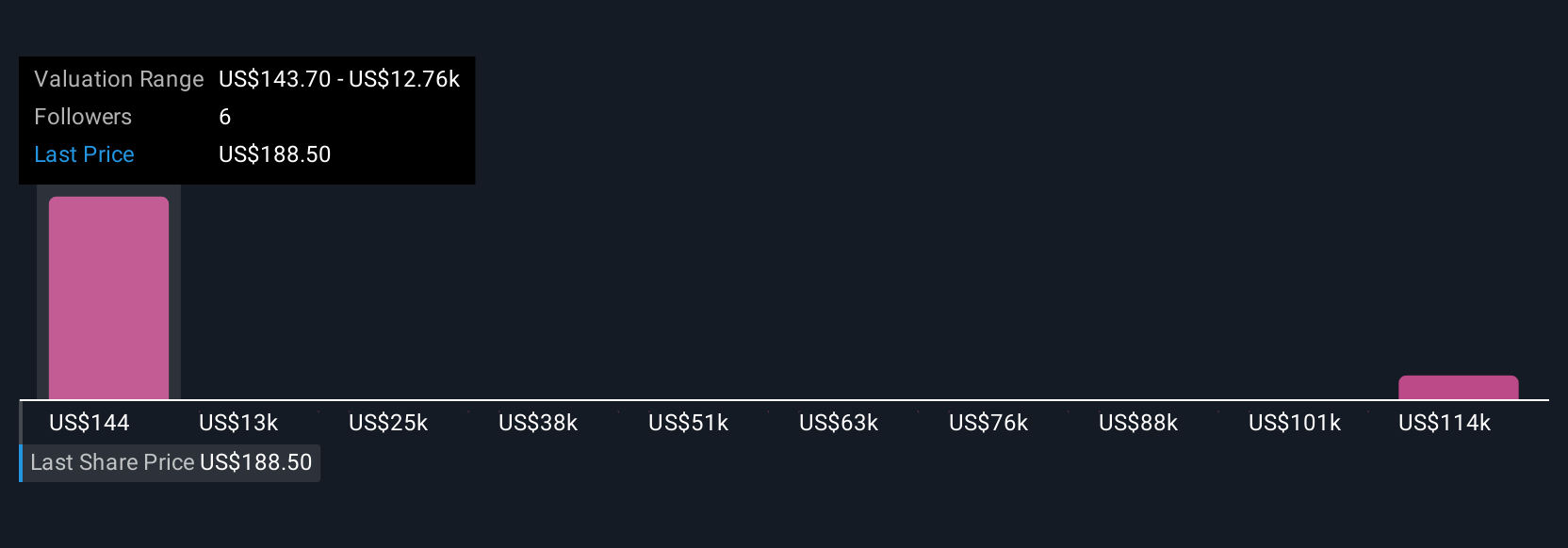

Simply Wall St Community members offered four distinct fair value estimates ranging from US$143,323 to US$126,259. The recent buyback expansion could shift some of these views, so be sure to consider how much opinions can differ, and compare several perspectives before making your judgment.

Explore 4 other fair value estimates on Federal Agricultural Mortgage - why the stock might be a potential multi-bagger!

Build Your Own Federal Agricultural Mortgage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Federal Agricultural Mortgage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Agricultural Mortgage's overall financial health at a glance.

No Opportunity In Federal Agricultural Mortgage?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com