- CSW Industrials recently filed a US$514.83 million shelf registration for an ESOP-related offering and reported first quarter sales of US$263.65 million, with net income of US$40.93 million, both rising over the prior year.

- The company's Zacks Rank #2 (Buy) upgrade reflects improving earnings estimates and heightened business momentum, placing it among the top 20% of covered stocks by Zacks.

- We’ll explore how this upgrade, driven by positive earnings momentum, could influence the outlook for CSW Industrials’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

CSW Industrials Investment Narrative Recap

To be a CSW Industrials shareholder today, you'd need confidence in the company's ability to turn regulatory-driven demand in HVAC and construction into lasting organic growth, especially as integration of acquisitions powers results but exposes risks if merger opportunities slow. The recent ESOP-related shelf registration and Zacks Rank upgrade signal business momentum but do not materially change the biggest near-term catalyst, successful cross-selling of acquired brands, or the major ongoing risk of margin pressure from input costs and inflation.

Of the latest announcements, CSW's first quarter results stand out given a continued rise in net income and sales, indicative of ongoing benefits from both acquisitions and efficiency initiatives. However, despite positive revenue and profit trends, persistently tight margins, impacted by input cost inflation and a higher proportion of lower-margin products, remain central to the investment outlook.

Yet, while business momentum is improving, investors should not overlook the risk that persistent cost pressures could narrow profitability if supply chain or tariff conditions worsen...

Read the full narrative on CSW Industrials (it's free!)

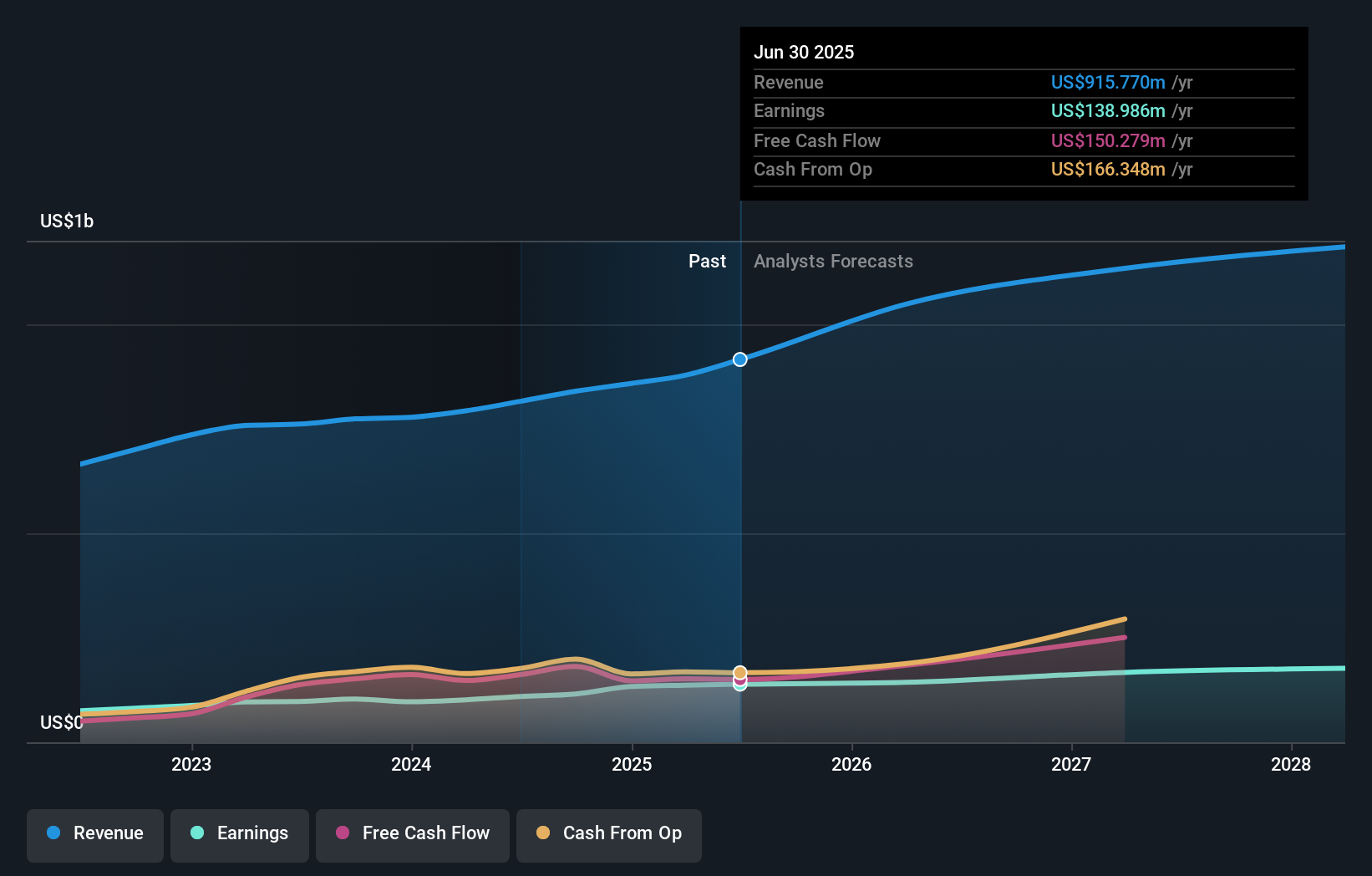

CSW Industrials' narrative projects $1.3 billion in revenue and $190.6 million in earnings by 2028. This requires 11.2% yearly revenue growth and a $51.6 million earnings increase from the current earnings of $139.0 million.

Uncover how CSW Industrials' forecasts yield a $294.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fair value opinions from the Simply Wall St Community range widely, from US$215 to US$313.73, reflecting two varying valuations. With cost inflation squeezing margins across the sector, your view on CSW's margin resilience may shape where you fall in this spectrum of outlooks.

Explore 2 other fair value estimates on CSW Industrials - why the stock might be worth as much as 20% more than the current price!

Build Your Own CSW Industrials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSW Industrials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CSW Industrials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSW Industrials' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com