- In the past quarter, Crown Holdings did not repurchase any shares, but over the course of its current buyback program, it has completed the repurchase of 4,603,107 shares, representing 3.9% of outstanding shares for US$407.15 million.

- A one-off expense of US$315 million impacted the company's profit over the last year, and the absence of further such items is expected to support improved profitability moving forward.

- We'll examine how the resolution of one-time expenses could influence Crown Holdings' future earnings outlook and investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Crown Holdings Investment Narrative Recap

The core investment case for Crown Holdings centers on resilient demand for metal packaging, operational efficiency, and its ability to expand in high-growth international markets. The latest buyback update, showing no shares repurchased in the past quarter, does not materially affect the company’s near-term catalyst, continued earnings recovery following the resolution of one-off expenses, but investors should still watch for any persistent margin pressures, especially in volatile markets.

Among recent developments, the steady stream of cash dividends, most recently declared on July 24, 2025, reinforces Crown Holdings’ commitment to shareholder returns. This financial discipline could bolster confidence as the firm looks to benefit from post-expense earnings normalization, though how well it overcomes geographic and inflationary risks will shape future performance.

However, it is important to keep in mind that if margin pressures resurface, particularly in key international regions, investors should be aware of...

Read the full narrative on Crown Holdings (it's free!)

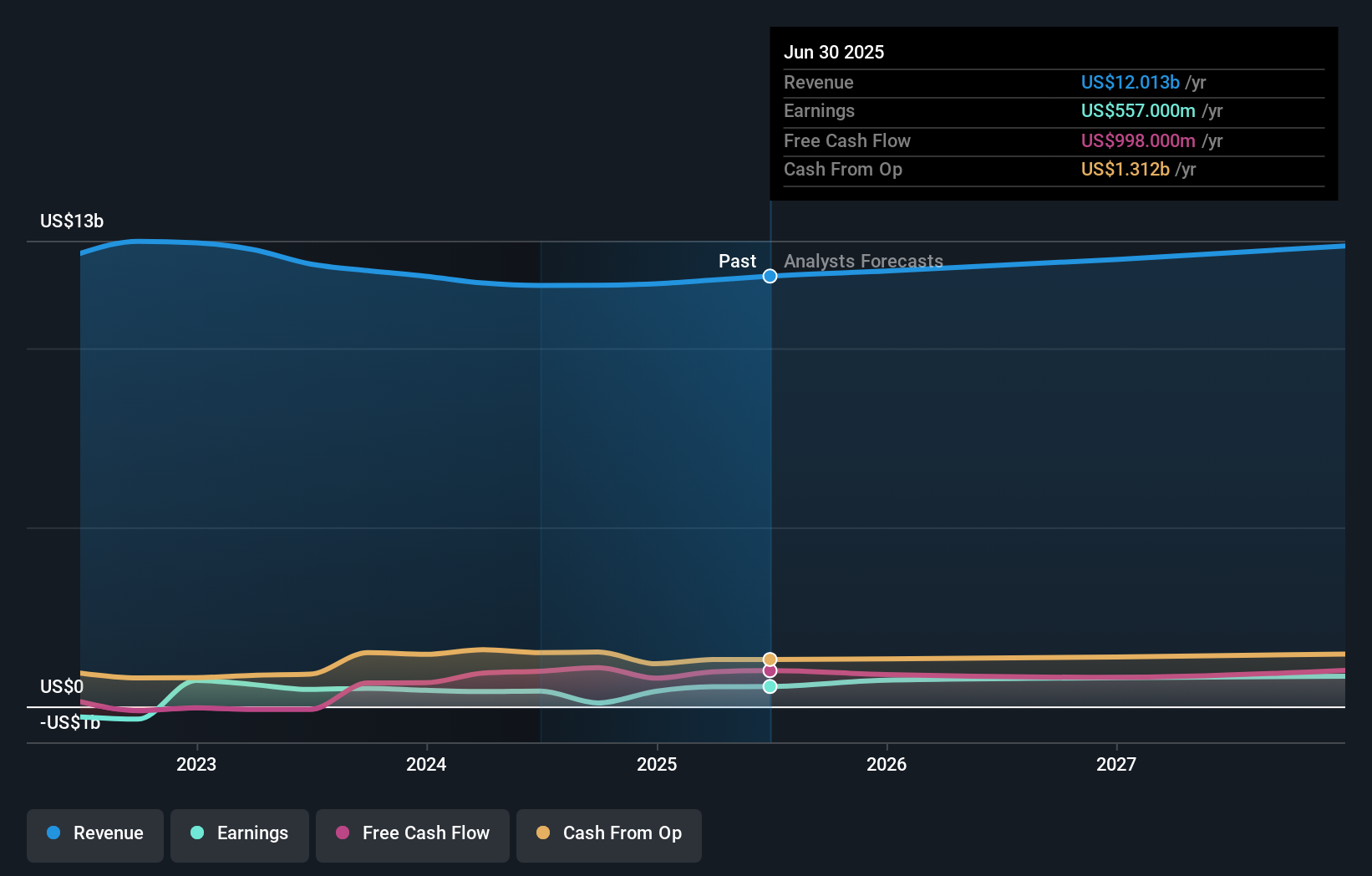

Crown Holdings' outlook foresees $13.3 billion in revenue and $886.4 million in earnings by 2028. This implies a 3.3% annual revenue growth rate and a $329.4 million increase in earnings from the current $557.0 million.

Uncover how Crown Holdings' forecasts yield a $123.36 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two distinct fair value views for Crown Holdings, ranging from US$123.36 up to US$221.35 per share. With input costs and competitive pricing shaping future margins, you can see just how much opinions on the company can vary, explore several viewpoints before making up your mind.

Explore 2 other fair value estimates on Crown Holdings - why the stock might be worth just $123.36!

Build Your Own Crown Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crown Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com