- Piper Sandler reaffirmed its positive outlook on Valero Energy Corporation after second quarter results, highlighting strengths in the company’s core refining operations while noting caution in the renewable diesel segment due to regulatory uncertainty and margin headwinds.

- This reinforces the market’s focus on Valero’s ability to balance its traditional refining business with the challenges of transitioning toward lower-carbon fuels amid evolving policy landscapes.

- We’ll assess how renewed analyst confidence in Valero’s refining operations could influence the company’s broader investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Valero Energy Investment Narrative Recap

To own shares of Valero Energy today, one mainly has to believe in the company's continued resilience in its core refining business amid ongoing industry headwinds, especially as it balances traditional fuels with the gradual move toward renewables. Piper Sandler’s reaffirmed confidence, reflected in a raised price target, underscores near-term optimism about Valero’s refining operations; however, it does not materially alter the current short-term catalyst or the primary risk, which centers on ongoing challenges in renewable diesel margins due to regulatory uncertainty.

Among recent developments, Valero’s decision to maintain its quarterly cash dividend at US$1.13 per share stands out, especially given the analyst attention on financial strength and shareholder returns. This move reinforces the ongoing catalyst for investors: stable and shareholder-friendly capital allocation, even as other segments of the business remain under pressure.

Yet, on the other hand, investors should not overlook the impact that more stringent regulatory measures could have on…

Read the full narrative on Valero Energy (it's free!)

Valero Energy's outlook anticipates $116.7 billion in revenue and $3.9 billion in earnings by 2028. This reflects a 0.2% annual revenue decline and a $3.14 billion increase in earnings from the current $760 million.

Uncover how Valero Energy's forecasts yield a $155.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

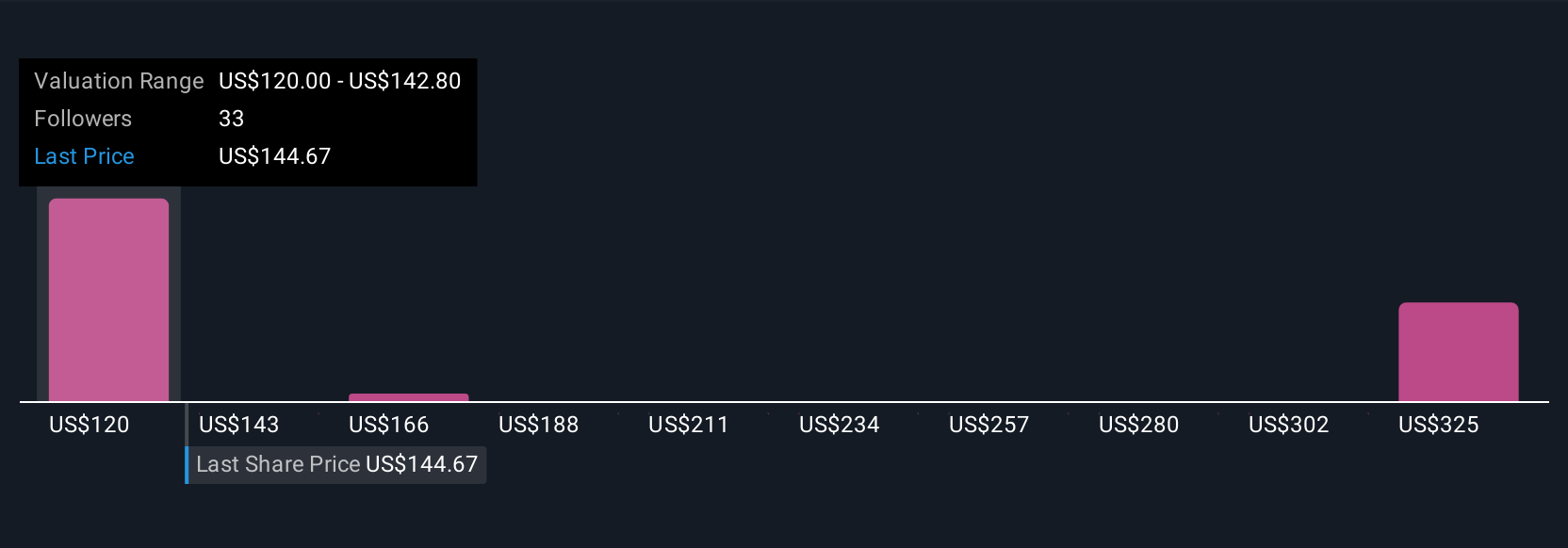

Five members of the Simply Wall St Community estimate Valero’s fair value from US$115.01 up to US$305.39 per share. While many see financial resilience as a key strength, close attention is warranted on policy risks that could impact renewable diesel profitability.

Explore 5 other fair value estimates on Valero Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com