- Skyworks Solutions recently reported third-quarter earnings, with sales rising to US$965 million and delivering revenue and earnings per share that surpassed previous expectations, while also announcing a 1% increase in its quarterly dividend.

- Alongside this, the company implemented operational improvements, including facility consolidation to boost efficiency, and provided strong forward revenue guidance for the fourth quarter, suggesting ongoing momentum in core business lines.

- With the new fourth-quarter guidance exceeding previous market expectations, we'll examine how this influences the company's overall investment narrative and diversification efforts.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Skyworks Solutions Investment Narrative Recap

To be a Skyworks Solutions shareholder, you need to believe that robust demand for advanced wireless technologies and ongoing diversification beyond mobile will drive long-term growth, despite the company’s high reliance on a single customer. The recent stronger-than-expected revenue guidance for the fourth quarter reflects renewed short-term momentum but does not materially change the core risks, especially customer concentration and pricing pressures, which still weigh on the business.

The company’s announcement of a 1% dividend increase is a relevant update for income-focused investors, reinforcing Skyworks’ commitment to returning capital to shareholders. However, dividend sustainability could face scrutiny if earnings remain under pressure from persistent margin compression or if mobile segment headwinds persist, highlighting the balance between capital returns and longer-term growth prospects.

Yet, despite these positive signals, investors should be acutely aware that reliance on a single major customer still represents a risk if orders unexpectedly fall...

Read the full narrative on Skyworks Solutions (it's free!)

Skyworks Solutions is projected to reach $4.0 billion in revenue and $508.1 million in earnings by 2028. This outlook assumes a yearly revenue decline of 0.7% and an earnings increase of $96 million from current earnings of $412.1 million.

Uncover how Skyworks Solutions' forecasts yield a $71.16 fair value, in line with its current price.

Exploring Other Perspectives

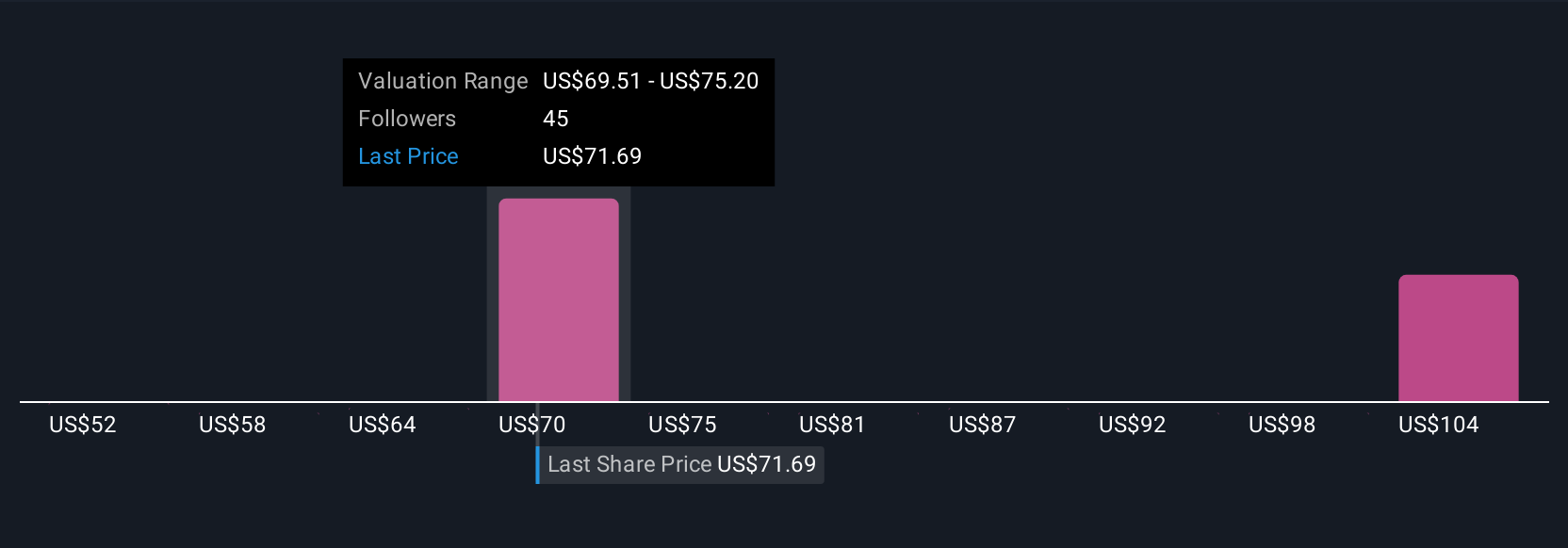

Five Simply Wall St Community valuations for Skyworks Solutions set fair value between US$52.43 and US$109.39 per share, reflecting significant variation in outlooks. Amid this diversity, high customer concentration remains a common concern that could shape the company’s earnings stability and future share performance.

Explore 5 other fair value estimates on Skyworks Solutions - why the stock might be worth as much as 54% more than the current price!

Build Your Own Skyworks Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Skyworks Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyworks Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com