- Raymond James Financial reported consistent earnings per share growth of 14% per year over the past three years, with revenue rising 12% to US$14 billion and stable EBIT margins.

- Significant insider ownership highlights strong alignment with shareholder interests, reinforcing confidence in the company's management and operational outlook.

- We'll explore how solid earnings growth and insider alignment further support Raymond James Financial's investment narrative and business momentum.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Raymond James Financial Investment Narrative Recap

To be a shareholder in Raymond James Financial, you need to believe in the company’s capacity to deliver steady, long-term earnings growth through careful cost control, expanding client assets, and disciplined strategy. The recent update of consistent EPS growth and rising revenue mostly reinforces confidence, but it does not materially shift the short-term catalyst, which remains the firm’s ability to attract and keep high-performing advisors; the biggest risk continues to center on market and interest rate uncertainty potentially disrupting revenue streams.

Among the latest announcements, the company’s recently completed US$751 million share buyback program stands out because it directly supports earnings per share growth and signals ongoing commitment to shareholder value. This move is particularly relevant given the updates about steady revenue and margin expansion, as it bolsters confidence in management’s discipline and may help offset short-term earnings variability, which is still influenced by external market conditions.

However, investors should also be aware that despite these strengths, increased client caution in uncertain macroeconomic environments could still ...

Read the full narrative on Raymond James Financial (it's free!)

Raymond James Financial's narrative projects $17.3 billion revenue and $2.7 billion earnings by 2028. This requires 8.0% yearly revenue growth and a $0.6 billion earnings increase from $2.1 billion today.

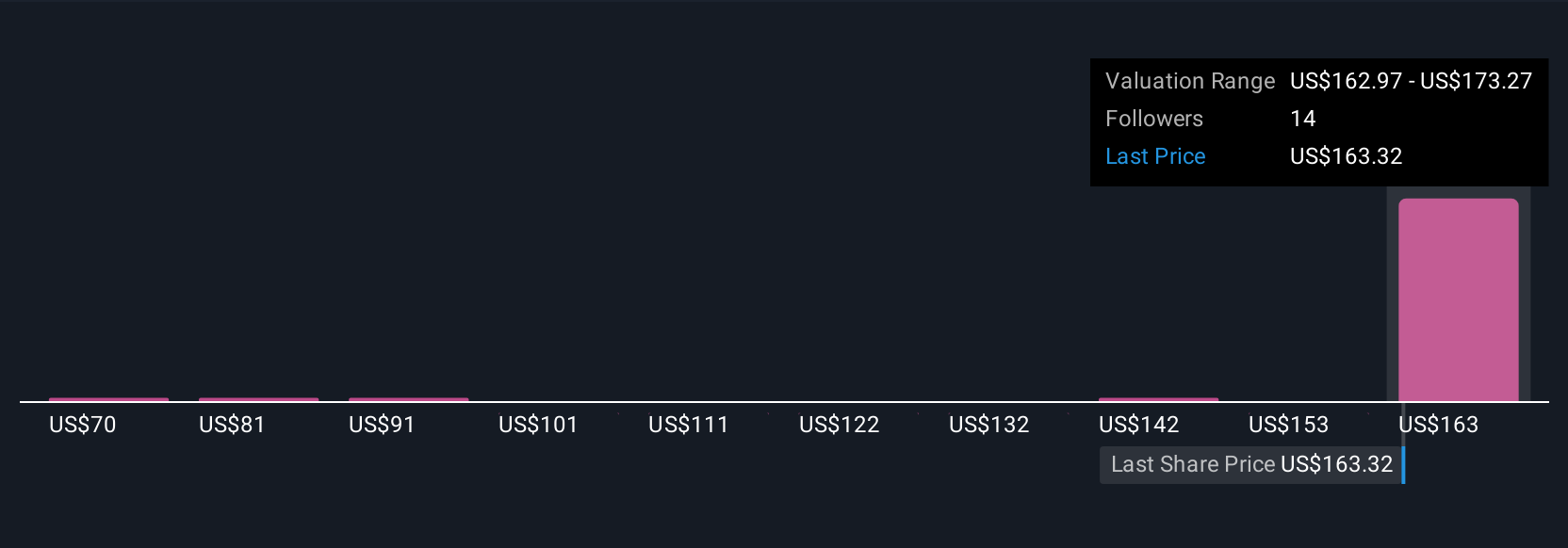

Uncover how Raymond James Financial's forecasts yield a $173.27 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community set fair value estimates for Raymond James Financial between US$70.20 and US$173.27. While the company’s recent buyback activity supports its long-term case, varied fair value opinions remind you that perspectives on potential risks and business quality can differ widely, see more viewpoints inside.

Explore 6 other fair value estimates on Raymond James Financial - why the stock might be worth less than half the current price!

Build Your Own Raymond James Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Raymond James Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Raymond James Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Raymond James Financial's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com