- United Therapeutics Corporation recently reported its second quarter 2025 earnings, posting improved sales of US$798.6 million and net income of US$309.5 million, while also announcing a new US$1 billion share repurchase program authorized through March 2026.

- An additional shelf registration filing for 950,000 shares related to the ESOP underscores ongoing capital management alongside recent moves to return capital to shareholders.

- We’ll now explore how United Therapeutics’ robust quarterly earnings and substantial buyback authorization may affect its investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Therapeutics Investment Narrative Recap

To be a shareholder in United Therapeutics, you have to believe in the company’s ability to deliver innovation-driven growth from its core cardiopulmonary portfolio while actively investing in next-generation therapies. The recent Q2 earnings report highlighted strong sales and stable profitability, but the biggest immediate catalyst remains upcoming clinical trial readouts for Tyvaso in IPF, while the primary risk is the intensifying competition from generic and branded alternatives, a dynamic not materially affected by the latest financial disclosures.

Among recent announcements, the US$1 billion share repurchase program stands out, as it complements disciplined capital management and could support per-share earnings even amid revenue pressure from competitors or regulatory hurdles. This move may provide some near-term confidence, yet for those watching the upcoming TETON and ADVANCE OUTCOMES trial results, the buyback offers limited insulation from event-driven volatility tied to product pipeline success.

However, in contrast, the most important risk investors should be aware of is competition from emerging generics and branded rivals, which could...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics is projected to generate $3.7 billion in revenue and $1.6 billion in earnings by 2028. Achieving this outlook assumes a 6.0% annual revenue growth rate and a $400 million increase in earnings from the current $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $376.82 fair value, a 25% upside to its current price.

Exploring Other Perspectives

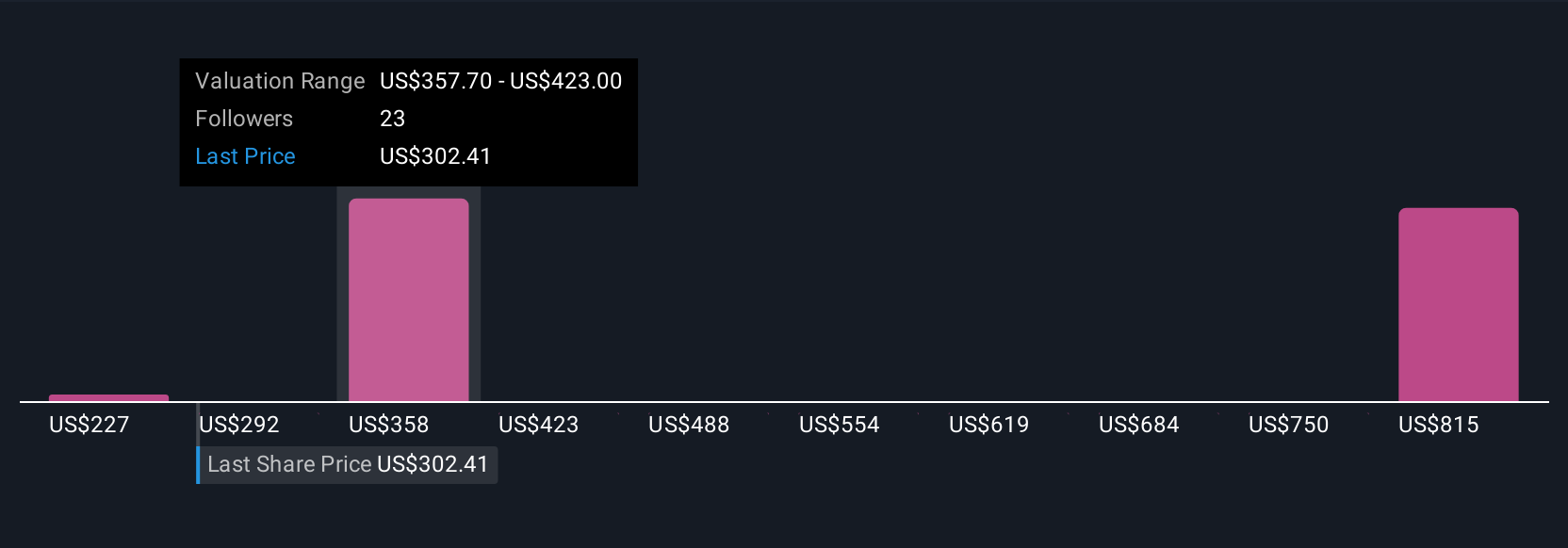

Simply Wall St Community members place United Therapeutics’ fair value from US$227 to US$880, with four perspectives included. Investors should consider how shifting competition and upcoming trial data might impact the company’s long-term potential and explore several contrasting viewpoints.

Explore 4 other fair value estimates on United Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com