- MarketAxess Holdings Inc. recently reported strong second quarter 2025 results, with year-over-year revenue and net income growth and the announcement of enhancements to its dealer-initiated trading protocols, including the launch of Mid-X in US Credit and improvements to the Dealer RFQ protocol.

- The company also signaled its intent to pursue mergers and acquisitions, highlighting both a robust balance sheet and renewed executive capacity for expansion following leadership changes.

- We'll explore how recent earnings growth alongside new product innovations, like Mid-X for US Credit, influence MarketAxess's investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MarketAxess Holdings Investment Narrative Recap

To be a shareholder in MarketAxess, you have to believe in the continued shift from manual to electronic trading in global fixed income markets, along with the company's ability to innovate and expand its reach. The recent strong quarterly revenue and net income gains, coupled with fresh investments in new trading protocols and a push into M&A, highlight short term growth catalysts, but do not materially change the biggest risk: losing market share in large US high-grade corporate bond trades to competitors or manual channels.

The launch of Mid-X in US Credit stands out among the recent announcements as directly relevant to this catalyst, representing a concrete step to increase platform adoption in dealer-initiated trading. Its rapid expansion, mirroring past successes in emerging markets, aims to boost MarketAxess’s relevance and capture more of the shift from phone and chat to electronic execution, a key driver of future volume and margin growth for the platform.

In contrast, investors should be aware that persistent migration of large block trades away from MarketAxess to offline channels may continue to...

Read the full narrative on MarketAxess Holdings (it's free!)

MarketAxess Holdings' outlook anticipates $1.1 billion in revenue and $382.0 million in earnings by 2028. This implies an annual revenue growth rate of 8.7% and an earnings increase of $159.2 million from the current $222.8 million.

Uncover how MarketAxess Holdings' forecasts yield a $220.58 fair value, a 18% upside to its current price.

Exploring Other Perspectives

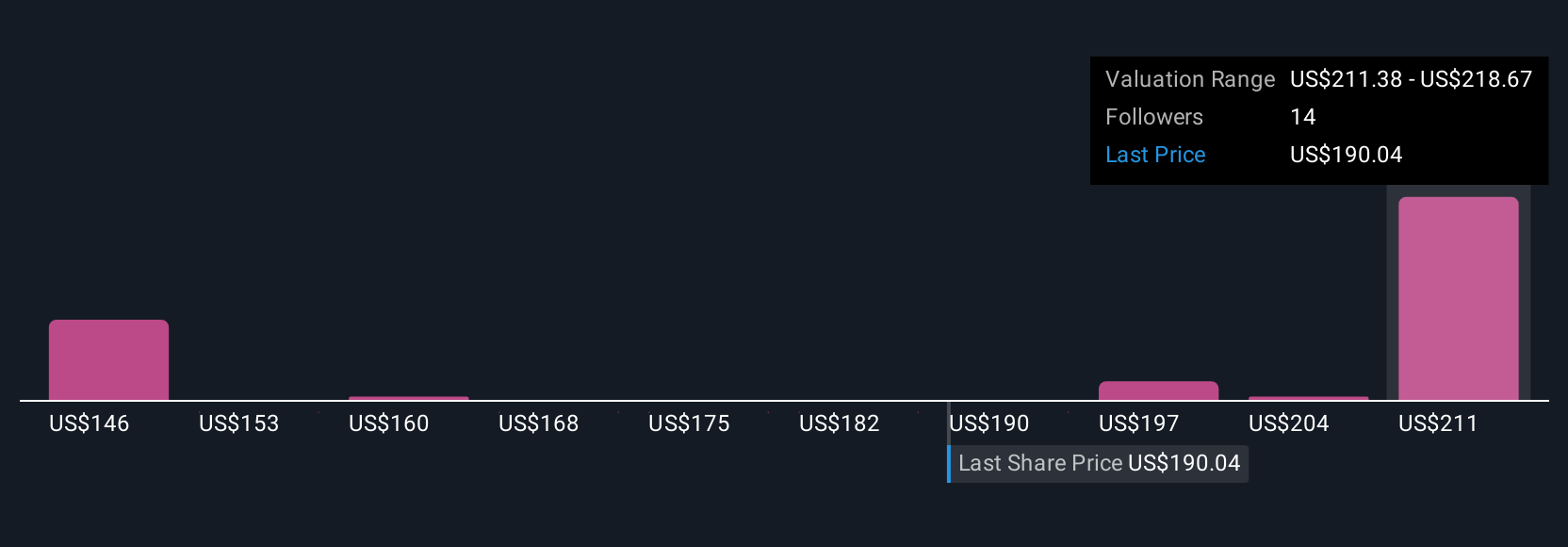

Six fair value estimates from the Simply Wall St Community place MarketAxess between US$149 and US$221 per share. This wide range of opinions comes as some analysts highlight competition and shifting trading methods as core uncertainties for the company's performance going forward. Explore more views and deepen your understanding of the different assessments.

Explore 6 other fair value estimates on MarketAxess Holdings - why the stock might be worth as much as 18% more than the current price!

Build Your Own MarketAxess Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MarketAxess Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MarketAxess Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com