- Super Group (SGHC) reported its highest ever quarterly revenue and Adjusted EBITDA for Q2 2025, attributing the achievement to strong performances across key global markets and the impact of major sporting events.

- The company also announced its exit from the U.S. market to enhance capital efficiency, while raising its full-year Adjusted EBITDA guidance amid ongoing positive analyst sentiment.

- We'll examine how Super Group's record quarterly results and revised outlook could influence its operational efficiency and long-term profitability narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Super Group (SGHC) Investment Narrative Recap

Being a Super Group (SGHC) shareholder requires confidence in its ability to drive revenue and profit growth by focusing on its core global markets and optimizing efficiency. The recent record quarterly results and raised guidance reinforce this growth outlook, while the exit from the U.S. reduces exposure to a previously uncertain segment, a change that lessens but does not eliminate the risk posed by shifting regulatory or tax regimes abroad. In the short term, the company’s operational focus and execution remain the central catalyst, while regulatory risks in key markets like the U.K. and Oceania are still important variables for future performance.

Of the recent corporate moves, Super Group’s decision to withdraw from the U.S. market after evaluating its prospects stands out as the most relevant announcement. This action aligns with the company's efforts to redirect capital and resources toward its more profitable, established regions, a consideration that connects directly to present catalysts around operational efficiency, profit margin improvement, and the maximization of shareholder value.

Yet, despite this refocused direction, the ongoing potential for regulatory changes in core markets remains a factor investors should be aware of, especially if...

Read the full narrative on Super Group (SGHC) (it's free!)

Super Group (SGHC)'s outlook anticipates $2.4 billion in revenue and $394.8 million in earnings by 2028. Achieving this would require 8.1% annual revenue growth and an increase in earnings of $258.6 million from the current $136.2 million.

Uncover how Super Group (SGHC)'s forecasts yield a $15.00 fair value, a 40% upside to its current price.

Exploring Other Perspectives

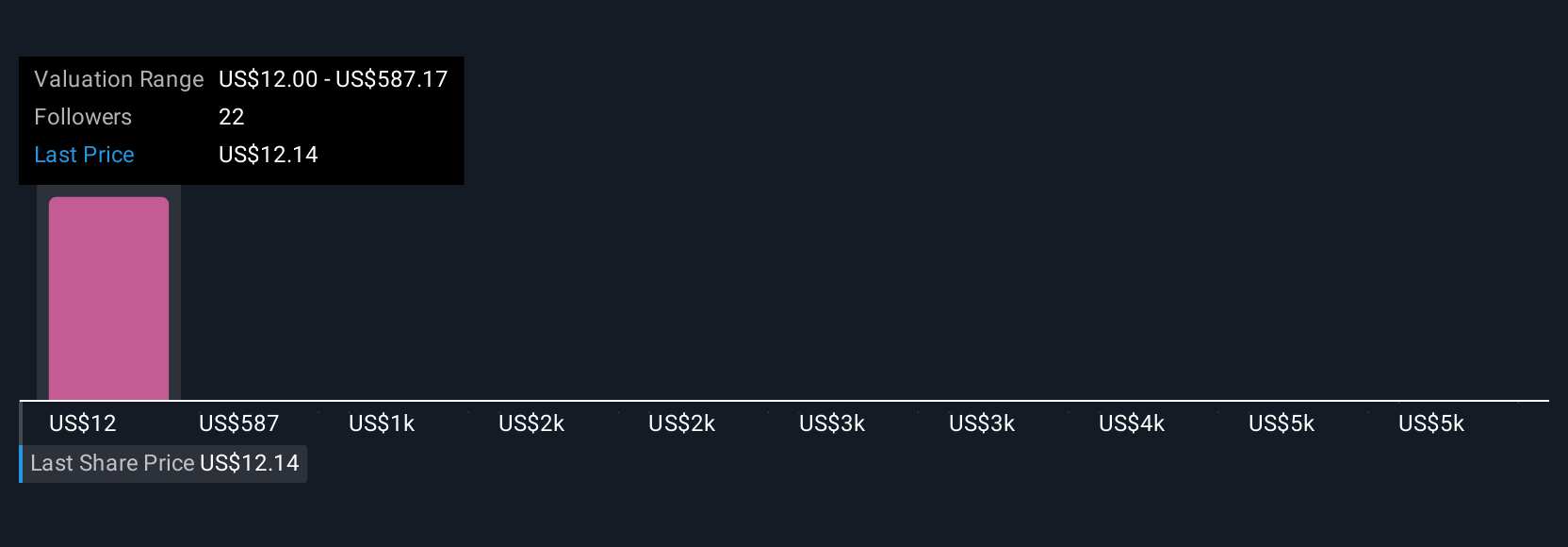

Four members of the Simply Wall St Community set fair value estimates for SGHC that range widely from US$12 to US$5,763.67 per share. Amid this diversity, many see operational efficiencies from the U.S. exit as a positive turning point, but regulatory shifts abroad could still impact future profitability, explore other viewpoints for a fuller picture.

Explore 4 other fair value estimates on Super Group (SGHC) - why the stock might be worth just $12.00!

Build Your Own Super Group (SGHC) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Group (SGHC) research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Super Group (SGHC) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Group (SGHC)'s overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com