- Aristotle Capital Management recently announced its selection of Northern Trust to provide middle office outsourcing services across institutional equity portfolios, covering approximately US$40 billion in assets as of June 30, 2025.

- This mandate, alongside Northern Trust's expanded US$2.5 billion share repurchase program, highlights the company’s active role in both strengthening client relationships and reinforcing its shareholder value proposition.

- We'll now explore how Northern Trust's new outsourcing partnership may reshape investor views on its growth and operational flexibility.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Northern Trust Investment Narrative Recap

Northern Trust’s appeal as an investment often rests on belief in its ability to deepen client relationships, maintain capital discipline, and adapt to evolving asset servicing demands. The Aristotle Capital Management outsourcing mandate, covering US$40 billion in assets, showcases Northern Trust’s expanding operational reach; however, its effect on near-term catalysts, such as further margin expansion from technology investments, and exposure to industry-wide fee compression does not appear material to short-term forecasts or key risks at this point.

Among Northern Trust’s recent updates, the board authorizing a new US$2.5 billion share buyback program stands out. This move reinforces financial flexibility at a time when investors are closely monitoring ongoing cost control and balance sheet optimization as potential drivers for further earnings resilience and shareholder returns.

Yet, against these positive signals, investors should be aware that rapid growth in private markets and alternatives could change the picture if...

Read the full narrative on Northern Trust (it's free!)

Northern Trust is projected to have $8.2 billion in revenue and $1.4 billion in earnings by 2028. This reflects a 1.6% annual decline in revenue and a decrease in earnings of $0.7 billion from the current $2.1 billion.

Uncover how Northern Trust's forecasts yield a $117.79 fair value, a 6% downside to its current price.

Exploring Other Perspectives

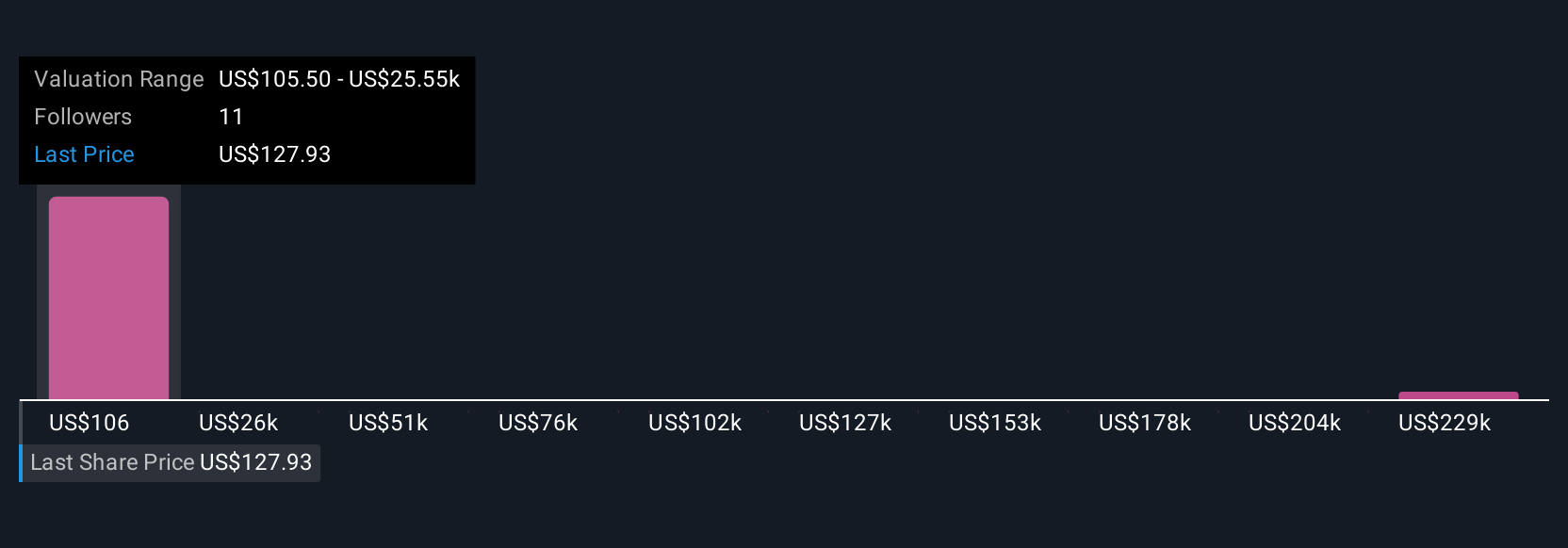

Fair value estimates from the Simply Wall St Community range from US$104.92 to an outlier above US$254,000 across four analyses. While many expect margin gains from operational efficiencies, fee pressure from the rise of passive investing remains a concern for future earnings. Explore the full spectrum of market perspectives and see how your view compares.

Explore 4 other fair value estimates on Northern Trust - why the stock might be worth 17% less than the current price!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com