- PACCAR recently completed a share buyback tranche, repurchasing 205,592 shares over the April to June 2025 period for US$18.42 million, as part of a program announced in December 2018.

- This brings total shares repurchased under the program to nearly 2 million, highlighting the company’s ongoing efforts to actively manage its capital structure and return value to shareholders.

- We will explore how this completed buyback tranche could reinforce confidence in PACCAR’s financial position and shape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PACCAR Investment Narrative Recap

To be a PACCAR shareholder, you typically need to believe in the resilience of global truck demand, the company's disciplined capital management, and its ongoing investments in next-gen transport technologies. The recently completed share buyback tranche is consistent with this focus on returning value to shareholders; however, it does not materially alter the biggest short-term catalyst, pre-buy activity ahead of 2027 emissions regulations, or address the immediate risk of declining truck orders and market overcapacity, which could pressure near-term revenue and earnings.

Among recent company announcements, the second-quarter 2025 earnings release is most relevant in context. PACCAR reported lower sales and net income year-over-year, reflecting the macroeconomic and industry challenges that underpin concerns about weak truck orders and softening market demand, even as the company continues its buyback initiatives to support shareholder value.

Yet while the buyback may instill some confidence, investors should also be mindful that, in contrast, ongoing weakness in truck orders could...

Read the full narrative on PACCAR (it's free!)

PACCAR's outlook anticipates $32.8 billion in revenue and $4.0 billion in earnings by 2028. This requires 1.8% annual revenue growth and a $0.9 billion earnings increase from $3.1 billion today.

Uncover how PACCAR's forecasts yield a $104.45 fair value, a 7% upside to its current price.

Exploring Other Perspectives

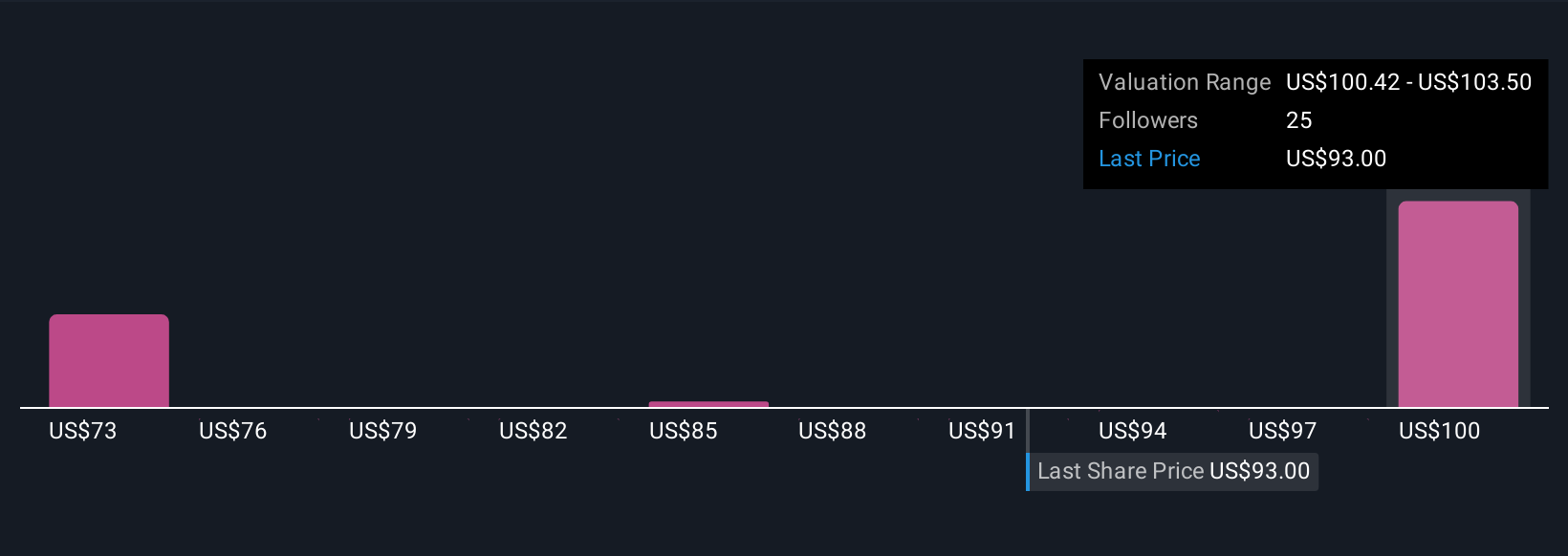

Three individual fair value estimates from the Simply Wall St Community range widely, from US$74.33 to US$104.45 per share. While opinions differ, keep in mind that persistent softness in truck orders remains a key concern with implications for PACCAR’s revenue and profit outlook.

Explore 3 other fair value estimates on PACCAR - why the stock might be worth 24% less than the current price!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com