- Recently, Reinsurance Group of America reported its second quarter 2025 results, disclosing revenue of US$5.60 billion and net income of US$180 million, alongside declaring a regular quarterly dividend of US$0.93 per share payable August 26, 2025.

- The company also highlighted that US all-cause excess mortality for 2024 had declined to 0.4%, nearing pre-pandemic levels and easing industry risks associated with higher mortality rates.

- We'll examine how improved mortality trends and recent financial results may influence Reinsurance Group of America's long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Reinsurance Group of America Investment Narrative Recap

To be a shareholder in Reinsurance Group of America, you need to believe in the company's ability to manage mortality risks while capitalizing on life insurance demand and expanding globally. The latest update on excess mortality nearing pre-pandemic levels is reassuring, but recent fluctuations in earnings and modest net margin pressures suggest that short-term catalysts may be tempered and the most immediate risk, earnings variability from U.S. life claims, remains. The news does not appear to materially shift this risk in the near term.

The most relevant recent announcement is RGA’s declaration of a US$0.93 quarterly dividend, underscoring its commitment to reliable shareholder returns despite some earnings volatility. This focus on consistent dividends aligns with the company’s history of capital discipline and illustrates how management aims to balance return of capital against the backdrop of industry-wide uncertainty.

Yet, in contrast, investors should be aware that persistently high variability in life claims could still...

Read the full narrative on Reinsurance Group of America (it's free!)

Reinsurance Group of America's narrative projects $29.0 billion revenue and $1.9 billion earnings by 2028. This requires 10.1% yearly revenue growth and a $1.13 billion earnings increase from $770.0 million.

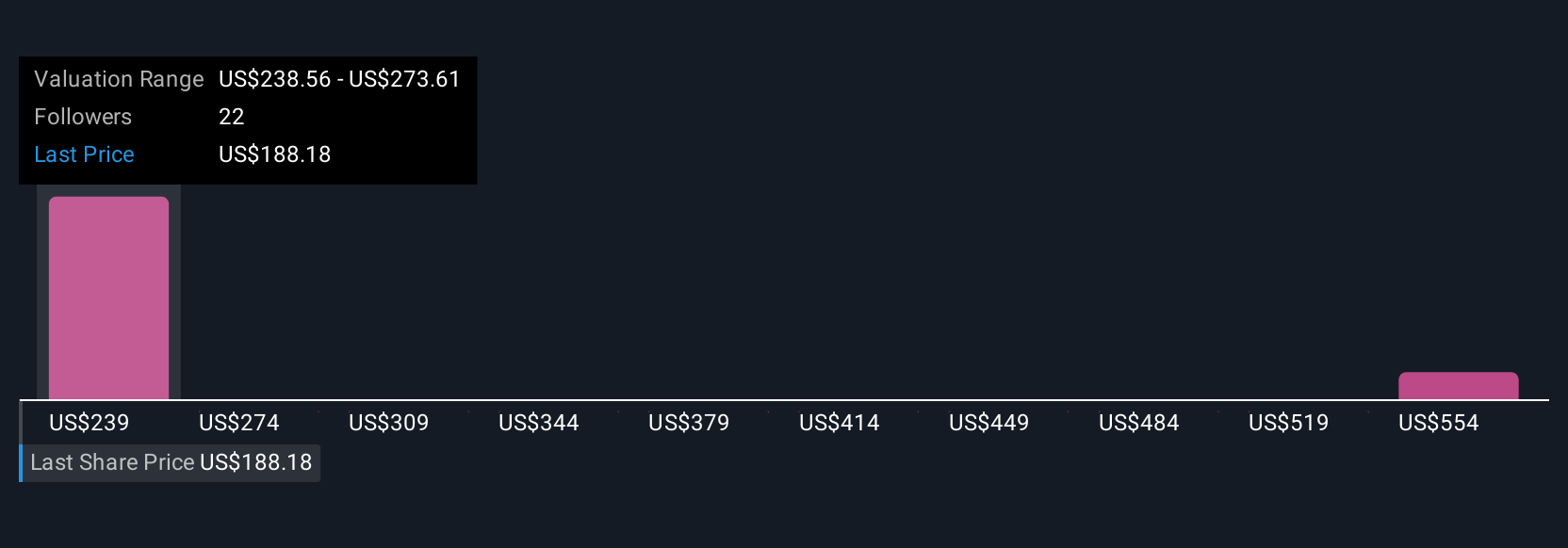

Uncover how Reinsurance Group of America's forecasts yield a $238.56 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates ranging from US$238.56 to US$589.05 per share. With excess mortality rates now almost at pre-pandemic levels, broad differences in outlook remain and highlight the range of possible future outcomes for RGA’s earnings and performance.

Explore 2 other fair value estimates on Reinsurance Group of America - why the stock might be worth over 3x more than the current price!

Build Your Own Reinsurance Group of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reinsurance Group of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Reinsurance Group of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reinsurance Group of America's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com