- Westinghouse Air Brake Technologies has recently attracted investor attention as shares moved in response to ongoing discussions about the company's valuation and earnings outlook.

- Market participants are increasingly interested in the potential for future earnings growth, especially given the perception that the current share price does not fully reflect these expectations.

- We’ll explore how the growing optimism over undervaluation and future earnings shapes Westinghouse Air Brake Technologies’ investment narrative.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Westinghouse Air Brake Technologies Investment Narrative Recap

To be a shareholder in Westinghouse Air Brake Technologies, you need to believe in the company's role in the modernization and decarbonization of rail transport, as well as its ability to execute growth globally through technology and acquisitions. The recent move in the share price, spurred by renewed attention to potential undervaluation and future earnings, does not materially change the most immediate catalyst: ongoing adoption of high-margin digital and automation solutions. However, the biggest risk remains the weakened North American railcar build outlook, which could pressure future equipment sales. Of the company’s recent announcements, the second quarter results released in late July stand out, showing revenue and net income growth year-on-year, and an increase in revenue guidance, partly due to the acquisition of Evident Inspection Technologies. This progress highlights management’s confidence in harnessing acquisitions as a growth lever, important given that expansion via M&A is also a risk factor, mainly due to financial and execution uncertainties if integration falters. Yet, on the other side of this optimism, investors should keep in mind the soft North American railcar market and how sustained weakness could...

Read the full narrative on Westinghouse Air Brake Technologies (it's free!)

Westinghouse Air Brake Technologies is projected to reach $13.0 billion in revenue and $1.8 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 7.1% and an earnings increase of $0.6 billion from current earnings of $1.2 billion.

Uncover how Westinghouse Air Brake Technologies' forecasts yield a $230.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

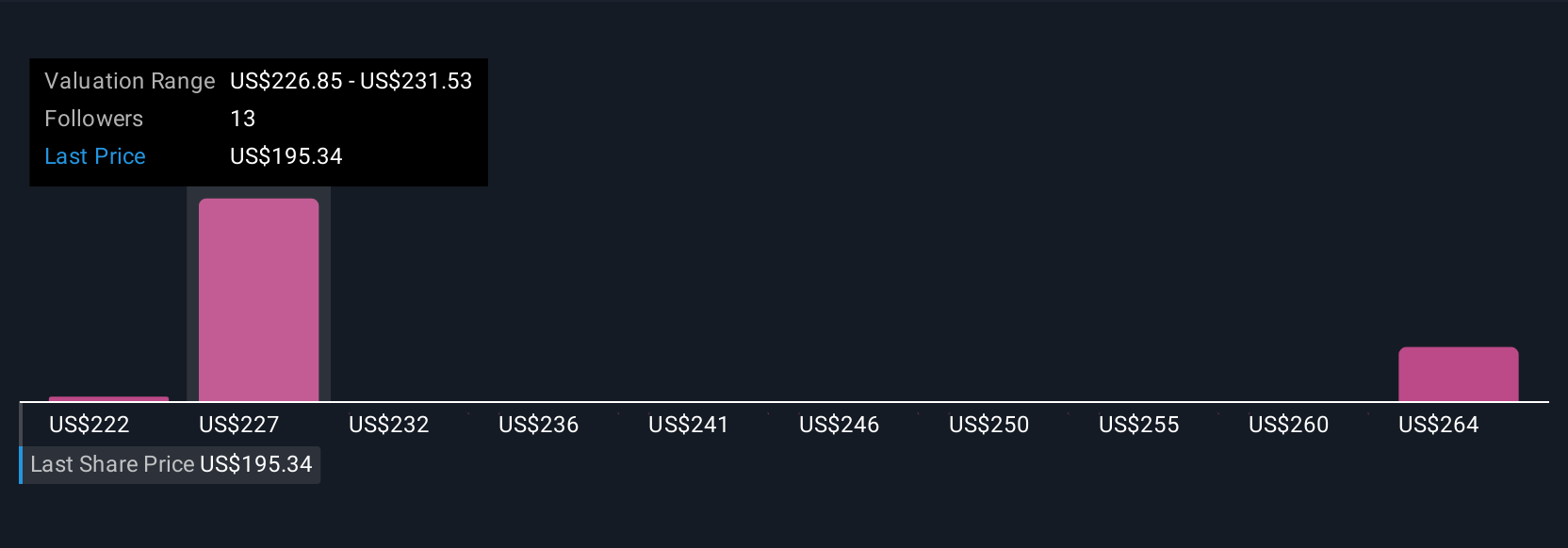

Private investors in the Simply Wall St Community have placed Westinghouse Air Brake Technologies’ fair value between US$222.16 and US$268.60, across three estimates. While many see long-term opportunities in technology-fueled earnings growth, uncertainty in key North American equipment demand could make outcomes differ materially.

Explore 3 other fair value estimates on Westinghouse Air Brake Technologies - why the stock might be worth as much as 40% more than the current price!

Build Your Own Westinghouse Air Brake Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westinghouse Air Brake Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westinghouse Air Brake Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com