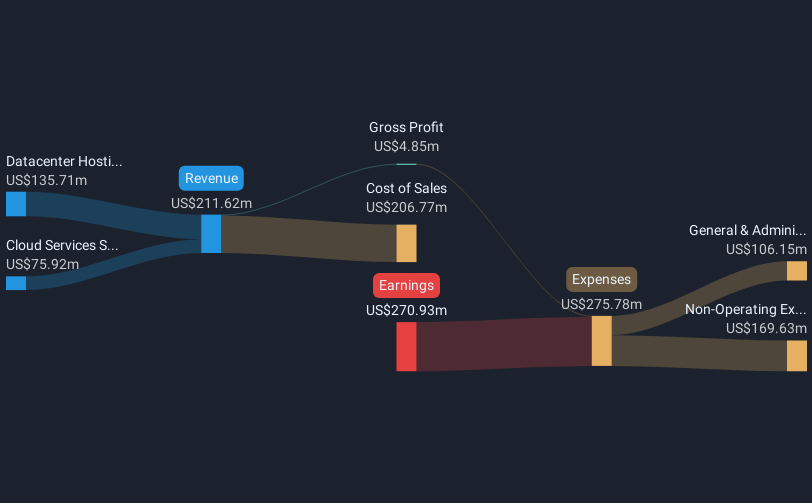

Applied Digital (APLD) recently reported a 163% share price increase over the last quarter, partly coinciding with its financial announcements. On July 30, 2025, it released fourth-quarter results, highlighting a sales increase from USD 26.9 million to USD 38 million and an improved net loss of USD 52.54 million from the previous year's USD 64.76 million. Despite challenges due to increased full-year losses, new partnerships with BASX and ABB and significant lease agreements with CoreWeave present growth opportunities. Coupled with a strong tech sector rally, these developments may have helped the company's stock align with broader market gains, as the Nasdaq reached record highs.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The recent developments surrounding Applied Digital, including the significant share price increase, appear to signify investor confidence in the company's prospects amid its recent partnerships and lease agreements. The 163% rise over the last quarter coincides with a favorable sector performance and the company's sales growth, potentially boosting revenue forecasts. Such improvements signal a strong position within North America's digital infrastructure landscape, leveraging AI and high-performance computing demands to propel growth.

Over the past five years, Applied Digital's total shareholder return exploded by a very large percentage. Contrast this to the past year's performance, where the company outstripped the U.S. IT industry by surpassing its 20.2% return. This long-term appreciation illustrates the pronounced energy surrounding its market activities and future prospects. However, while the short-term highs are impressive, investor caution may center on the sustainability of earnings amid ongoing market dynamics.

The updated revenue from US$26.9 million to US$38 million and controlled net losses could positively influence future earnings projections. Still, the continued dependence on substantial crypto-related revenues and capital expenditures may introduce variability into profit margins forecast at 111.6% today. Given the current share price of $14.20, the consensus analyst price target of $17.22 implies a 17.3% potential gain. Investors are encouraged to assess the underlying assumptions critically in aligning expectations with analyst forecasts, considering the company's expansionary strategies amid prevailing industry trends.

Jump into the full analysis health report here for a deeper understanding of Applied Digital.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com