- Bread Financial Holdings announced that, as of August 6, 2025, it had received early tenders totaling US$28.40 million for its 9.750% Senior Notes due 2029 and US$121,000 for its 8.375% Subordinated Notes due 2035, with settlement anticipated on August 11, 2025.

- This early participation in the cash tender offers highlights investor confidence in the company's debt management strategy and progress in strengthening its balance sheet.

- We'll explore how Bread Financial Holdings' successful early note repurchases could influence its investment narrative, particularly regarding funding cost optimization.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bread Financial Holdings Investment Narrative Recap

To be a shareholder in Bread Financial Holdings, you need to believe in its ability to enhance operational efficiency and drive earnings through technology investments and cost optimization, even as it faces headwinds such as flat to declining average loan growth and rising competition. The recent early tenders for its senior and subordinated notes demonstrate Bread Financial’s push to optimize funding costs, but this action does not materially impact the primary short-term catalyst, which remains improvements in credit metrics and prudent balance sheet management. The biggest immediate risk still centers on pressures from structurally lower average loan yields due to the company’s shift toward higher-quality customers, the early note repurchases do little to offset the broader risk of shrinking net interest margins.

Bread Financial’s most relevant recent announcement was its revised guidance for a flat revenue outlook and adjusted net loss rate for 2025. This guidance highlights management’s ongoing focus on credit risk controls and careful expense management, which complements the debt reduction efforts by signaling a measured approach to sustaining earnings and weathering credit quality normalization. Yet, as the company continues to tighten credit standards and encounters an evolving customer mix, these efforts reinforce the importance of balancing growth and risk.

However, investors should also be aware that, despite these positive funding actions, the potential impact of rising competition on future partnership economics remains a meaningful risk…

Read the full narrative on Bread Financial Holdings (it's free!)

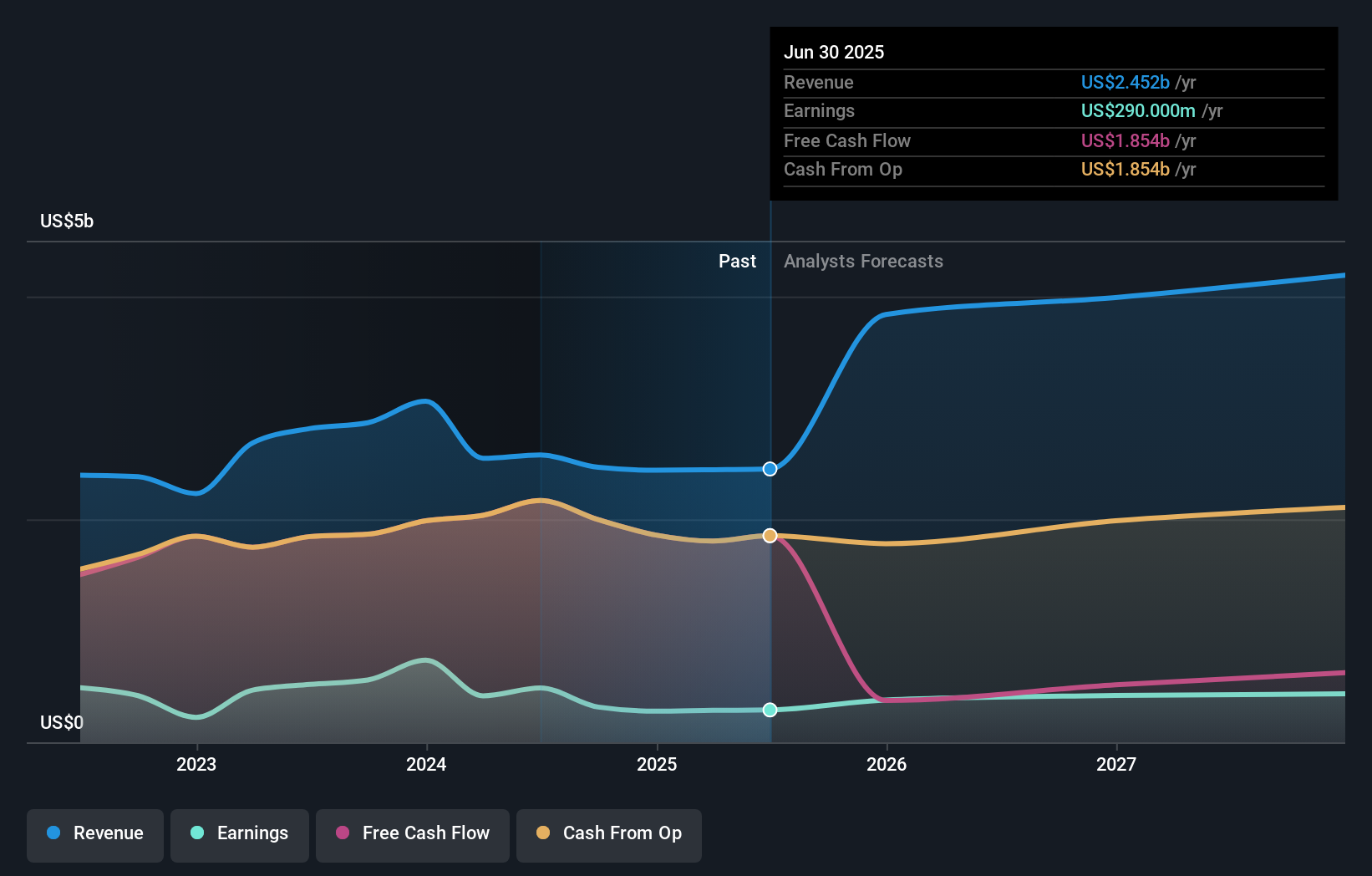

Bread Financial Holdings' narrative projects $4.3 billion in revenue and $379.5 million in earnings by 2028. This requires 20.3% annual revenue growth and an $89.5 million earnings increase from current earnings of $290.0 million.

Uncover how Bread Financial Holdings' forecasts yield a $68.73 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Bread Financial ranging from US$59 to US$68.73 per share. While these perspectives vary, remember, evolving credit yields and margin pressures could influence earnings and invite even broader outlooks, browse alternative takes to inform your view.

Explore 2 other fair value estimates on Bread Financial Holdings - why the stock might be worth just $59.00!

Build Your Own Bread Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bread Financial Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bread Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bread Financial Holdings' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com