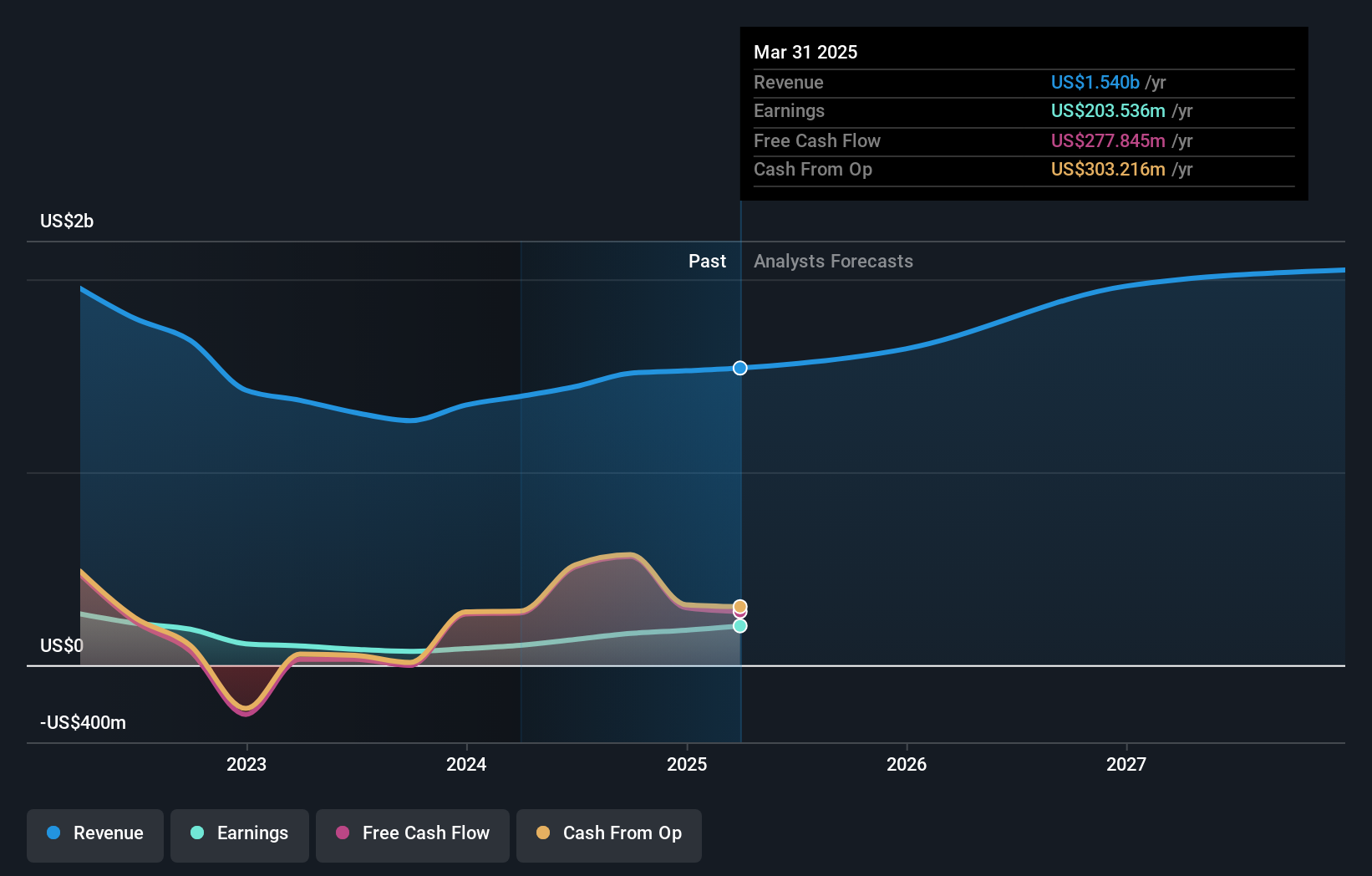

- Piper Sandler Companies has announced that its Board of Directors declared a quarterly cash dividend of $0.70 per share, an increase of $0.05, to be paid on September 12, 2025, alongside the completion of a share repurchase program totaling 850,000 shares for $20.9 million and the release of strong second quarter earnings showing growth in both revenue and net income compared to a year ago.

- This combination of increased shareholder returns and improved financial performance highlights the company’s focus on both rewarding investors and maintaining growth momentum.

- With the dividend boost signaling confidence in future cash flows, we'll examine the implications for Piper Sandler’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Piper Sandler Companies' Investment Narrative?

Being a shareholder in Piper Sandler Companies means believing in the firm’s ability to balance shareholder rewards with solid business execution, amid increased competition and cyclical market pressures. The latest news, a dividend hike, robust second quarter earnings, and completion of a significant buyback, signals management’s confidence in maintaining both growth and capital returns, reinforcing positive sentiment around short-term catalysts such as higher cash flows and improved margins. With recent share price gains and upbeat earnings, these moves could help counter worries about valuation, especially as Piper Sandler’s price-to-earnings ratio remains higher than peers and industry averages, marking it as an expensive stock. The bottom line: while the new developments underline financial momentum, investors should weigh their optimism against persistent risks, particularly the company’s rich valuation and sensitivity to market shifts. Still, the premium price compared to peers remains a significant consideration for investors.

Piper Sandler Companies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be worth less than half the current price!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com