- Eastman Chemical Company recently reported a year-over-year decrease in both sales and net income for the second quarter of 2025, alongside the declaration of a US$0.83 per share quarterly dividend and an update on its share buyback program.

- Although its earnings performance weakened, the company continued to return capital to shareholders, underscoring management’s commitment to dividends and buybacks amid challenging conditions.

- We’ll assess how the recent earnings decline informs Eastman Chemical’s investment outlook and sustainability-driven expansion strategy.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Eastman Chemical Investment Narrative Recap

To be a shareholder in Eastman Chemical right now, you have to believe in its ability to deliver long-term value through sustainable materials and the expansion of molecular recycling, despite recent margin pressures and a slower revenue outlook. The latest drop in quarterly earnings does little to change the immediate importance of demand recovery in key segments like automotive and building materials, while ongoing global trade tensions remain the most significant short-term risk; neither issue is materially altered by the newest dividend and buyback moves.

Of the recent company updates, Eastman’s announcement of a US$0.83 per share quarterly cash dividend is most directly relevant, as it signals the continuation of capital returns to shareholders even as earnings slid. This approach aligns with the company’s track record of consistent dividends and share repurchases, serving as a source of support for current shareholders amid external demand headwinds.

But while the dividend and buybacks offer reassurance, investors should also be aware that persistent trade pressures and lower volumes could limit the company’s financial flexibility if...

Read the full narrative on Eastman Chemical (it's free!)

Eastman Chemical's narrative projects $9.7 billion revenue and $904.5 million earnings by 2028. This requires 1.4% yearly revenue growth and a $72.5 million earnings increase from $832.0 million today.

Uncover how Eastman Chemical's forecasts yield a $78.82 fair value, a 28% upside to its current price.

Exploring Other Perspectives

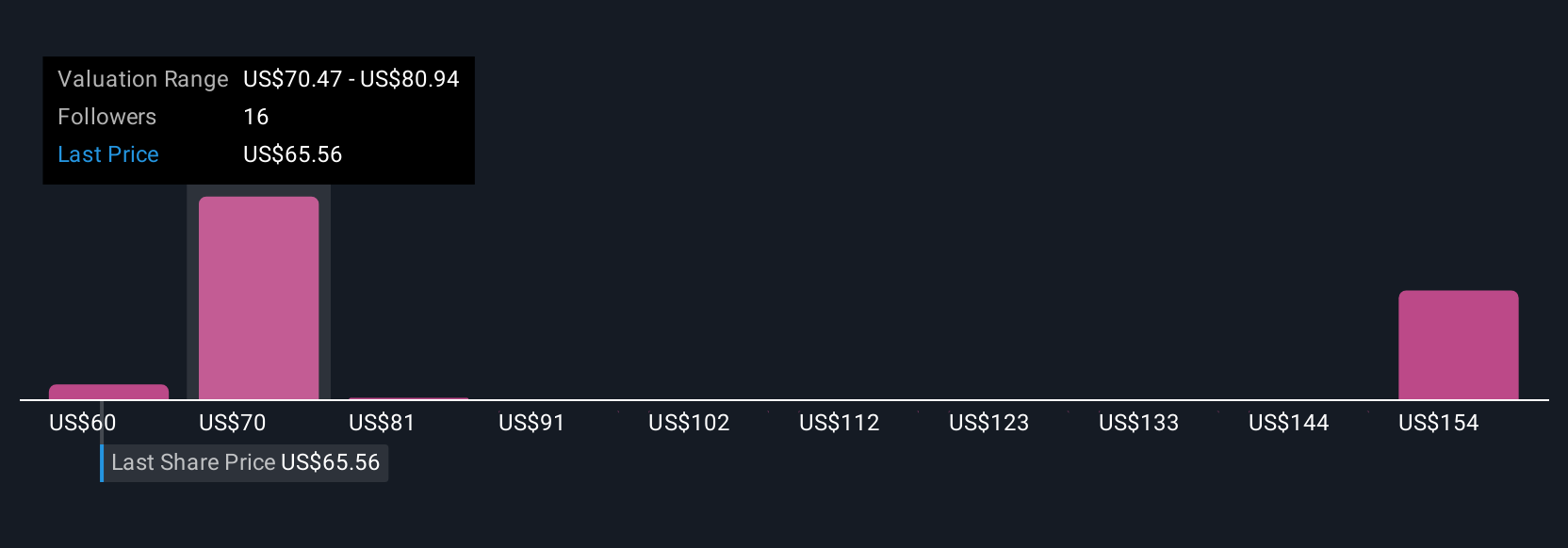

Six fair value estimates from the Simply Wall St Community for Eastman Chemical range from US$60 to US$91 per share, highlighting significant splits in opinion. Many analysts remain cautious about ongoing trade risks and earnings headwinds, reinforcing the need to weigh multiple outlooks when considering the company’s performance.

Explore 6 other fair value estimates on Eastman Chemical - why the stock might be worth just $60.00!

Build Your Own Eastman Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastman Chemical research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eastman Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastman Chemical's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com