- Littelfuse, Inc. recently reported second quarter 2025 results showing year-on-year growth in sales and net income, announced a quarterly dividend increase, and provided guidance for continued strong sales in the third quarter.

- The company also named Dr. Karim Hamed as Senior Vice President and General Manager of its Semiconductor Business, signaling a focus on experienced semiconductor leadership after he most recently served at Analog Devices.

- In light of robust Q2 earnings and the upcoming leadership change, we’ll examine how these developments impact Littelfuse’s long-term margin and market outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Littelfuse Investment Narrative Recap

To be a Littelfuse shareholder today, you need confidence in the company's ability to capture growth from electrification tailwinds in automotive, industrial, and data center markets while managing margin improvement in its power semiconductor business. The recent appointment of Dr. Karim Hamed as Senior Vice President brings significant semiconductor experience but is unlikely to immediately shift the primary business catalyst, returning the power semiconductor segment to stronger growth, or to materially affect the current key risk: prolonged challenges in segment execution or a faster-than-expected shift in protection technologies.

The most relevant announcement for investors is Littelfuse’s second quarter 2025 earnings report, which showed continued year-on-year sales and net income growth. Solid sales momentum, along with management’s guidance of US$610 million to US$630 million in expected Q3 revenue, aligns with core long-term catalysts like electrification demand but does not eliminate concerns about ongoing margin pressures and sector cyclicality.

By contrast, one issue investors should be keenly aware of is how quickly technology trends in circuit protection could change, especially if...

Read the full narrative on Littelfuse (it's free!)

Littelfuse's narrative projects $2.9 billion revenue and $400.8 million earnings by 2028. This requires 8.6% yearly revenue growth and a $293.6 million earnings increase from $107.2 million today.

Uncover how Littelfuse's forecasts yield a $300.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

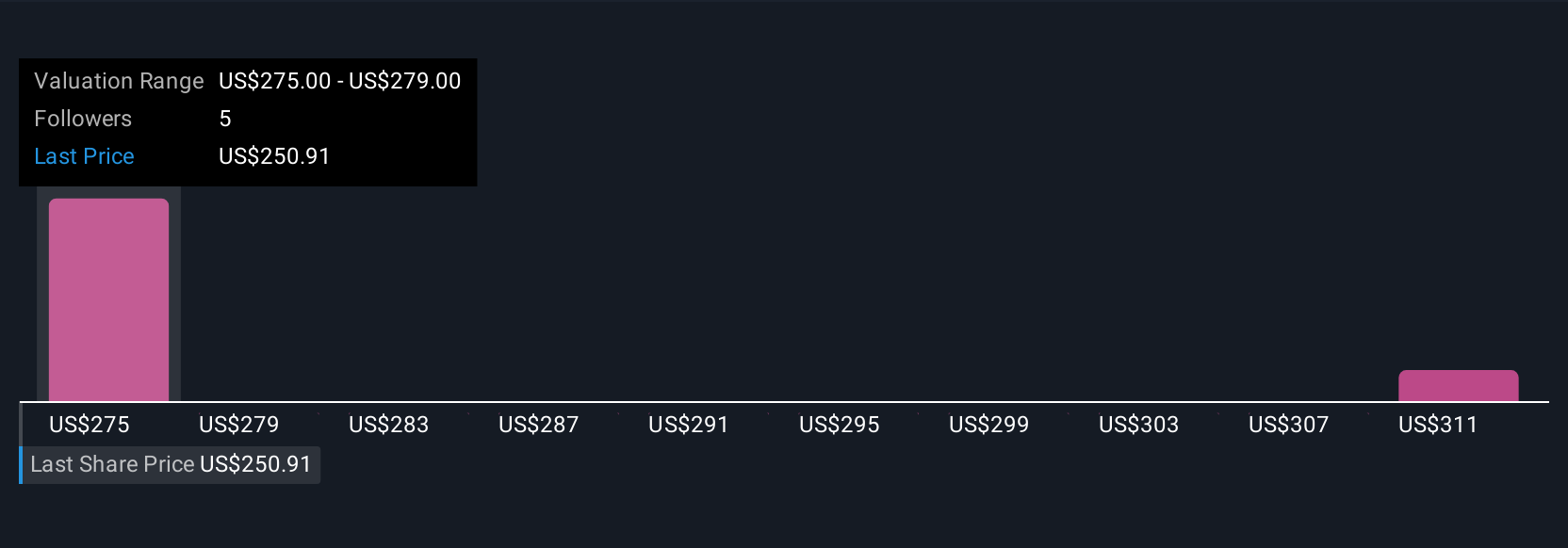

Fair value estimates from two members of the Simply Wall St Community range tightly from US$293.09 to US$300 per share. With ongoing margin pressures and sector cyclicality as central risks, consider how your outlook aligns as you compare these independent perspectives.

Explore 2 other fair value estimates on Littelfuse - why the stock might be worth just $293.09!

Build Your Own Littelfuse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Littelfuse research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Littelfuse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Littelfuse's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com