- Quince Therapeutics announced that it has entered a partnership with Option Care Health to support the commercial development and potential launch of its lead therapy, encapsulated dexamethasone sodium phosphate (eDSP), across the U.S. using Option Care Health’s specialty pharmacy and infusion suite network.

- This collaboration could enhance patient access to innovative treatments for rare conditions, highlighting Option Care Health’s ability to serve as a national partner for new therapies targeting complex diseases.

- We’ll review how this expanding role in therapy launches could strengthen Option Care Health’s investment narrative as a leader in infusion services.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Option Care Health Investment Narrative Recap

To be a shareholder in Option Care Health, you need to believe that the company’s growing national presence, deepening payer partnerships, and capability to deliver complex infusion therapies will support sustainable revenue growth despite shifts in therapy mix and potential payer pressure on reimbursement rates. The recent partnership with Quince Therapeutics reflects Option Care Health’s expanding role in rare disease launches, but this announcement may not materially impact the most important short-term catalyst: margin stabilization amid therapy mix changes. Short-term risks such as gross margin compression from therapy mix remain front of mind.

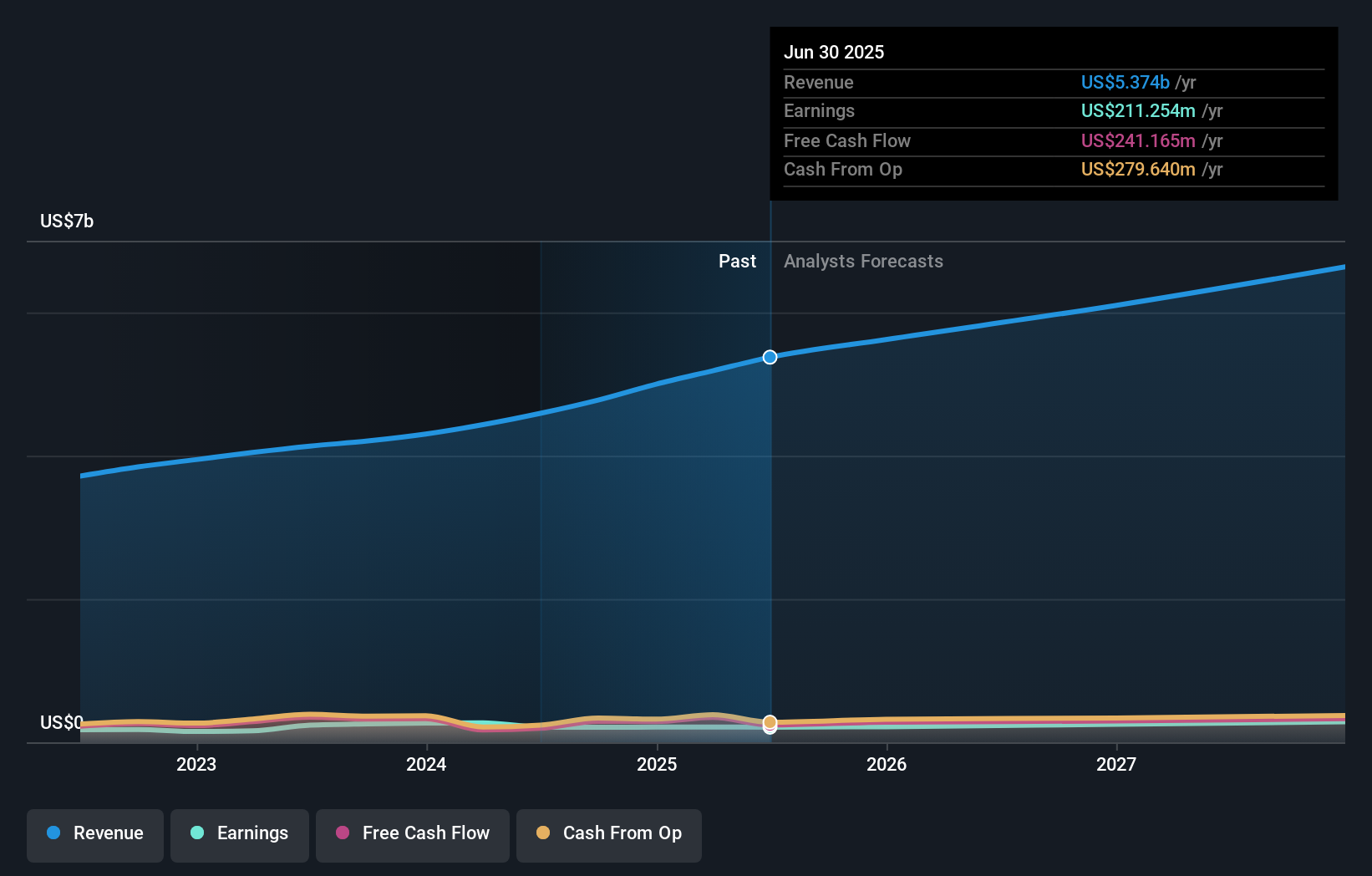

Among recent developments, Option Care Health’s updated 2025 revenue guidance, now projected between US$5.50 billion and US$5.65 billion, is most relevant. This outlook underscores management’s confidence in growth prospects tied to new therapy launches, such as the Quince collaboration, which has the potential to broaden future revenue streams, though investors should watch for any persistent margin pressures as therapy mix evolves.

By contrast, investors should be especially aware that margin compression risks related to shifts in therapy mix do not always become clear until the quarterly results season...

Read the full narrative on Option Care Health (it's free!)

Option Care Health's outlook anticipates revenues reaching $6.9 billion and earnings rising to $301.4 million by 2028. This scenario implies annual revenue growth of 8.7% and an earnings increase of $90.1 million from current earnings of $211.3 million.

Uncover how Option Care Health's forecasts yield a $38.78 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Two unique fair value estimates from the Simply Wall St Community place Option Care Health between US$29.19 and US$38.78 per share. Even as these private investors see opportunity, the evolving therapy mix risk continues to shape the company’s future revenues and profitability, so consider a range of market viewpoints.

Explore 2 other fair value estimates on Option Care Health - why the stock might be worth as much as 38% more than the current price!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com