- Chesapeake Utilities Corporation recently reported second-quarter 2025 earnings, with sales rising to US$199.7 million and net income increasing to US$23.9 million compared to the same period last year.

- The company reaffirmed its earnings guidance through 2028, announced new capital investments including a US$200 million private placement of unsecured senior notes, and maintained its long-standing track record of uninterrupted dividend payments and annual increases since 2004.

- We'll explore how the company's strong earnings growth and increased capital spending could impact its long-term investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Chesapeake Utilities Investment Narrative Recap

Investors who see long-term value in Chesapeake Utilities often focus on stable earnings growth, steady dividends, and the ability to capitalize on expanding energy infrastructure in high-growth regions such as Florida. The second-quarter 2025 results, while solid, do not materially alter the near-term catalyst of population-driven demand growth, and higher interest expense related to new debt remains a key risk as it could weigh on net margins if financing costs continue to climb.

Among recent announcements, Chesapeake Utilities' US$200 million private placement of unsecured senior notes stands out, as it increases available capital for infrastructure expansion and regulatory initiatives, the same drivers reflected in the company’s reaffirmed earnings guidance. This financing move is relevant for investors tracking developments around project funding, regulatory success, and whether these can offset the pressure from a higher cost of capital.

However, investors should be aware that, in contrast to the company’s growth story, higher interest expenses tied to new financing may pose a growing risk to profitability if...

Read the full narrative on Chesapeake Utilities (it's free!)

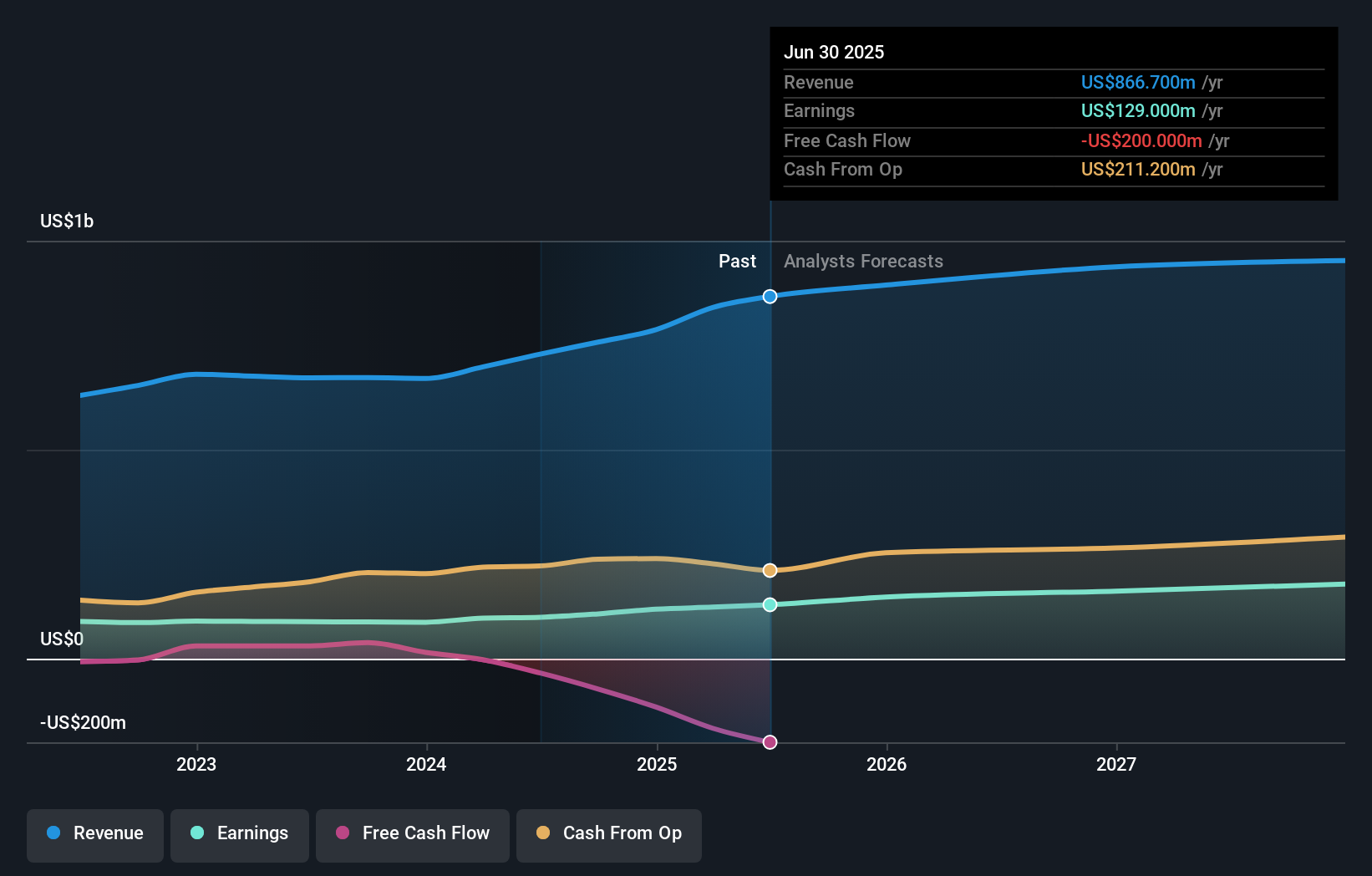

Chesapeake Utilities' outlook anticipates $961.6 million in revenue and $177.5 million in earnings by 2028. This is based on a 4.6% annual revenue growth rate and a $54.2 million increase in earnings from the current level of $123.3 million.

Uncover how Chesapeake Utilities' forecasts yield a $136.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

One estimate from the Simply Wall St Community values Chesapeake Utilities at US$85.72, below current trading levels. Analysts highlight that earnings growth could be limited by rising interest costs, reminding you to consider a wide range of viewpoints before making decisions.

Explore another fair value estimate on Chesapeake Utilities - why the stock might be worth 31% less than the current price!

Build Your Own Chesapeake Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chesapeake Utilities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Chesapeake Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chesapeake Utilities' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com