- Amkor Technology, Inc. recently reported its second quarter 2025 results, with sales rising to US$1.51 billion from US$1.46 billion a year earlier, while net income fell to US$54.42 million from US$66.9 million and earnings per diluted share decreased to US$0.22 from US$0.27.

- Alongside mixed earnings, the company issued forward guidance for the third quarter, forecasting net sales of US$1.88 billion to US$1.98 billion and net income of US$85 million to US$120 million, attracting significant market attention.

- We'll examine how Amkor's updated earnings outlook, especially its third-quarter guidance, could influence the longer-term investment narrative outlined by analysts.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Amkor Technology Investment Narrative Recap

To be comfortable as a shareholder in Amkor Technology, you need to believe that the company’s investment in advanced semiconductor packaging and geographic diversification can offset pressures from underutilized legacy assets and cyclical demand shifts. The Q2 2025 update, with improved sales but lower earnings, keeps near-term catalysts, such as the upcoming ramp in high-value contracts, intact, though margin volatility from legacy operational challenges remains a top risk and is largely unchanged by this quarter’s result.

Among recent announcements, Amkor’s updated third-quarter 2025 guidance, calling for a notable jump in net sales and net income, stands out, as it directly addresses near-term growth expectations tied to high-performance computing and advanced packaging demand. While this positive outlook aligns with analyst views on technology adoption, it will be important to watch how successfully Amkor manages cost structure and capacity utilization to capture these opportunities.

However, investors should be especially mindful that even as revenue guidance looks strong, ongoing underutilization in legacy Japanese facilities continues to threaten…

Read the full narrative on Amkor Technology (it's free!)

Amkor Technology's outlook anticipates $7.7 billion in revenue and $540.2 million in earnings by 2028. This is based on an annual revenue growth rate of 6.9% and an earnings increase of $236.4 million from the current earnings of $303.8 million.

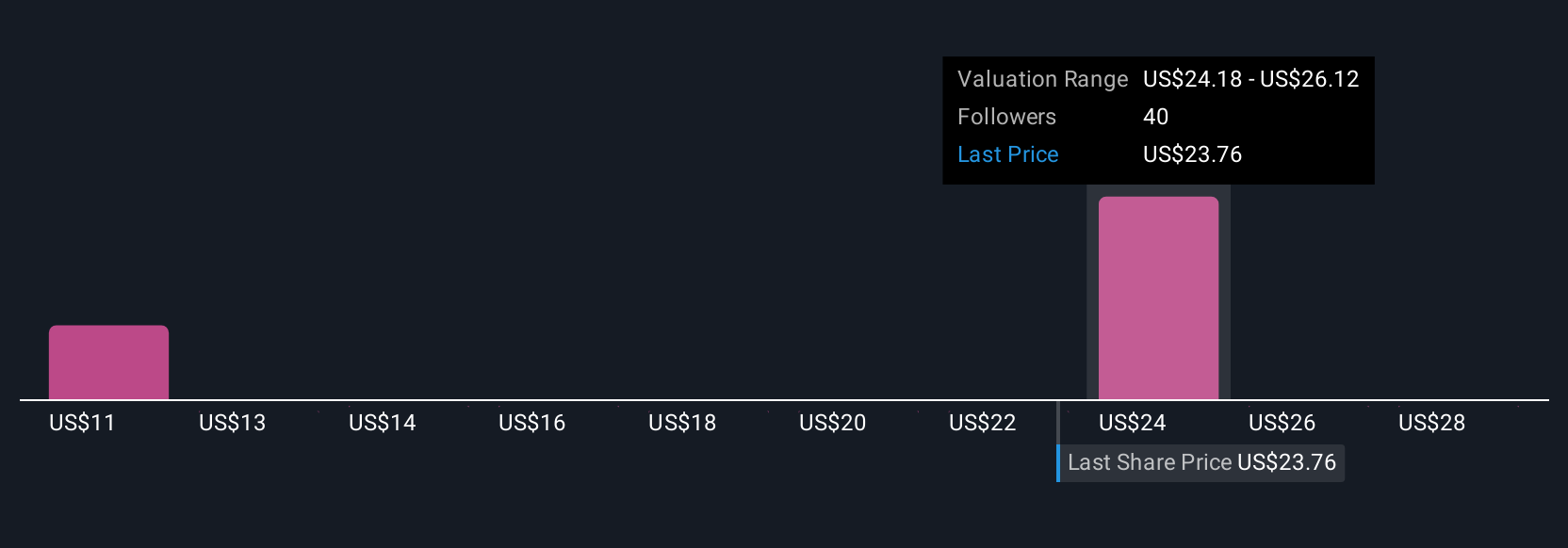

Uncover how Amkor Technology's forecasts yield a $24.38 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Community members’ fair value estimates for Amkor span from US$10.44 to US$27.43, reflecting five distinct viewpoints within the Simply Wall St Community. Amid this variance, remember the risk of continued margin pressure from underused legacy assets could meaningfully shape future company performance, see how others frame these risks and opportunities.

Explore 5 other fair value estimates on Amkor Technology - why the stock might be worth as much as 19% more than the current price!

Build Your Own Amkor Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com