- Novanta Inc. recently released its second quarter and first half 2025 earnings, reporting year-over-year sales growth to US$241.05 million but a decline in net income to US$4.5 million from US$13.76 million in the same quarter last year.

- Management signaled a strong push for acquisitions in medical, consumable-based, and embedded software segments, highlighting attractive valuations and an active deal pipeline supported by a solid balance sheet and improved credit facility.

- We'll explore how management's renewed focus on acquisitions and updated revenue guidance may influence Novanta's long-term investment narrative.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

Novanta Investment Narrative Recap

Novanta appeals to investors who believe in the ongoing transformation of healthcare and advanced manufacturing technology, driven by rising demand for precision automation and intelligent medical solutions. The company’s latest results, while showing continued sales growth, highlight that the most important near-term catalyst, successful execution and integration of acquisitions, remains both an opportunity and a risk. The recent update does not fundamentally change this dynamic, but underscores the reliance on deal execution amid softer organic growth.

Among recent announcements, Novanta’s expanded credit facility directly supports management’s active acquisition push, which is important given that their updated 2025 revenue guidance relies on supplementing current organic results. This access to additional capital should enable the company to aggressively pursue targets in medical and embedded software segments, in line with its broader growth strategy and addressable market expansion goals.

Yet, in contrast to the optimism around acquisitions, investors should be aware of the ongoing exposure to US-China trade risks and related export headwinds...

Read the full narrative on Novanta (it's free!)

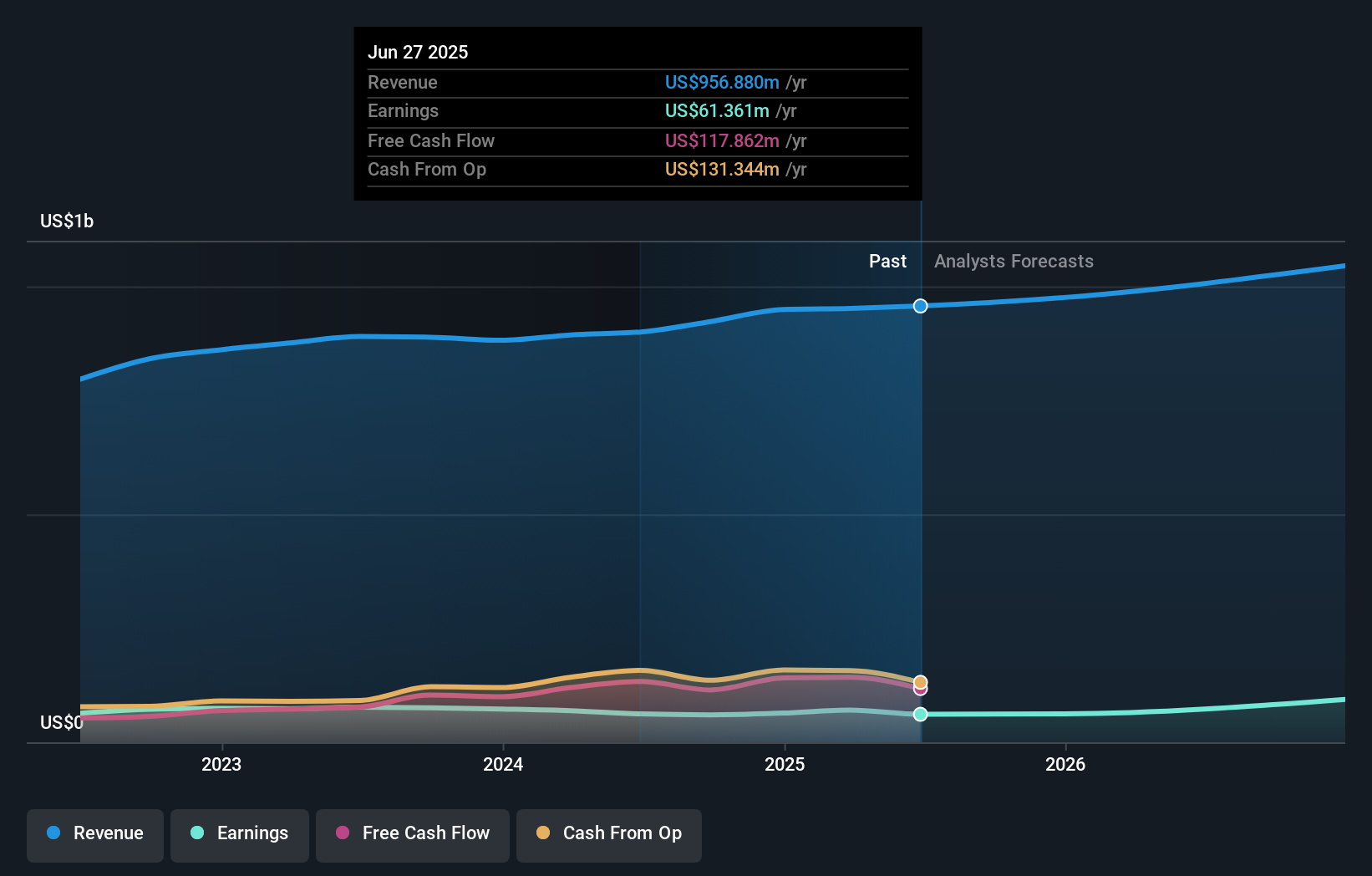

Novanta's narrative projects $1.1 billion revenue and $135.3 million earnings by 2028. This requires 6.0% yearly revenue growth and a $73.9 million earnings increase from $61.4 million.

Uncover how Novanta's forecasts yield a $144.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members placed fair value estimates for Novanta between US$37.81 and US$144.50, a wide range indicating varied convictions. With such diversity of opinion, ongoing reliance on acquisitions remains a pivotal factor that could shape near-term and longer-term performance, explore several viewpoints before forming your own perspective.

Explore 2 other fair value estimates on Novanta - why the stock might be worth less than half the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com