- Hawkins, Inc. recently reported its first quarter results, with sales rising to US$293.27 million and net income edging up to US$29.18 million; the company also announced a 6% increase in its quarterly cash dividend at its July 30, 2025 board meeting.

- This move highlights the company's ongoing commitment to returning capital to shareholders while signaling management's confidence in the business's financial health and prospects.

- We'll explore how Hawkins' dividend increase could shape the company's investment narrative and support perceptions of long-term stability.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Hawkins' Investment Narrative?

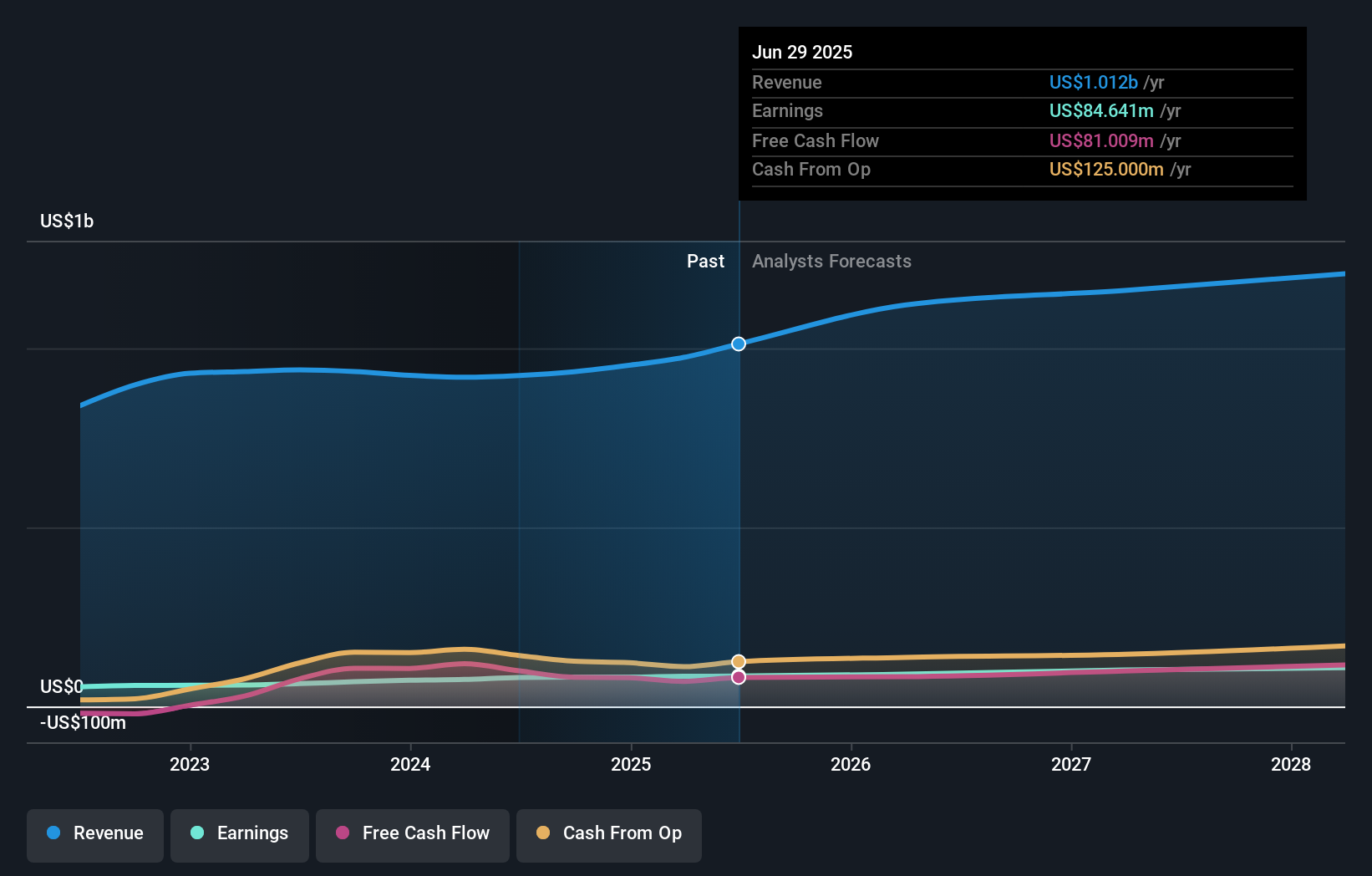

For those considering Hawkins as a long-term holding, the central thesis revolves around its consistent financial performance, steady return of capital through dividends and buybacks, and an experienced leadership team. The recent 6% dividend hike reinforces the board’s view of financial resilience and a focus on shareholder returns, while the newly ratified auditor appointment signals a continued commitment to governance as the company manages substantial debt and pursues acquisitions. While the latest quarterly results showed only modest earnings growth, the news flow hasn’t introduced material new risks or shifted the most important short-term catalysts: maintaining profit margins and integrating recent acquisitions amid a high share price. Given that Hawkins continues to trade at a premium relative to its sector and historical fair value estimates, the dividend increase may support sentiment, but existing valuation concerns and slower forecasted growth remain front of mind.

However, growing debt levels are still a key risk investors should keep in mind.

Hawkins' shares are on the way up, but they could be overextended by 21%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Hawkins - why the stock might be worth 17% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com